As an investment property owner, you should also know the most common homeowners Insurance Tips when renting or renting property. As these are the most frequently cited reasons for insurance claims by owners, they also relate to the most common causes of damage to wolf property. They give an idea of what dangers pose the most common risk to property investments.

Whether you choose to pay in advance for repairs for damage to your rental property or you pay insurance premiums, you are required to pay expenses anyway. It is best to know more about these dangers and risks so that you can take steps to avoid them. Here are some of the most common causes and reasons for landlord insurance claims. Suggestions on how to minimize or avoid them are also given.

1. General Responsibility

General liability coverage is one of the areas covered by homeowners insurance. General liability is triggered when, for example, a tenant, guest or visitor is damaged or injured on the leased or leased property. The most common events that result in a general compensation claim are slips, trips and falls.

If a person slips due to a pile of ice or snow on your property and breaks a few bones, an owner will most likely reimburse the hospital and medical expenses. General liability can help pay for some of the injured person’s medical expenses and hospital bills.

If you would like to avoid or at least minimize these kinds of incidents and claims, you should take the time to remove any hazards on your property on a regular basis. Examples of hazards include slippery wet surfaces, large tree trunks or branches obstructing paths, or rusting handrails and iron bars protruding into common areas or footpaths.

2. Loss Of Income

Loss of rental income is among the main reasons invoked or used in claims by insurance owners. Observers from the insurance industry say there have been years when it has covered more than half of the claims of insurance holders. This happens when you have lost tenants or when you have had difficulty finding new tenants.

You can avoid losing tenants or having unoccupied rental properties by making sure your rentals are always in good condition and safe. You should check your properties from time to time to eliminate or mitigate the risk of possible damage.

Earn up to 9% APY with your cryptocurrency and receive up to $ 250 in Bitcoin for account financing.

Other common causes of loss are economic recessions and financial crises. Unemployment is inevitable during these times, and this can lead to people losing their homes or relocating to cheaper alternatives.

3. Water Damage

Another common ground for claiming rental insurance is coverage for water damage.

Plumbing is mostly hidden under concrete. Most of what you see are joints under sinks and toilets. When there is a faulty plumbing in your property, it can continue to leak under the concrete and you wouldn’t even notice it. You will only begin to notice it as small mounds or cracks on the concrete slabs. Even when the tap is closed in the bathroom, drops of water may seem to escape between tiles. This can eventually lead to mold or further damage.

Have a plumber inspect your property’s water pipes periodically to avoid water problems. You must also include terms and conditions of the tenant’s liability if the water damage is due to his negligence or negligence.

4. Damage From Hurricanes And Storms

Many of the southern and solar states are vulnerable to hurricanes and storms. Some states, such as Louisiana and Texas, have experienced severe flooding in recent years. Florida has always been hit by hurricanes and storms. Even Ohio and Kentucky were hit by devastating tornadoes.

These natural disasters and disasters can cause severe damage to properties. While some extreme weather disruptions and strong hurricanes can cause unavoidable damage, there are ways you can minimize them.

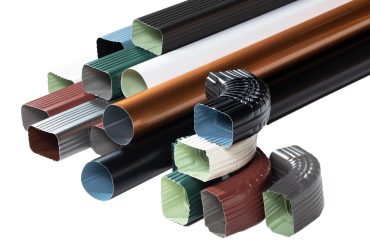

You can check your gutters, downspout and gutters before a big hurricane to make sure they are all good and untidy. This can help the free flow of rainwater on your roof and minimize the damage to it. The average cost to install a new roof will cost you another $ 18,800. Taking these steps can save you a lot of money.

5. Damage Caused by Fire

In addition to the common causes of damage invoked in landlord insurance claims, another type of claim is for fire damage.

The Gemini Exchange makes it easy to explore the crypto market, buy bitcoin and other cryptocurrencies and earn up to 8.05% APY!

There are things inside a home that can ignite a fire and even destroy your rental property to the ground. Some of these are electrical malfunctions and malfunctions of home appliances. Candles left burning near combustible or highly flammable materials can also burn your property. Everything owned by the owner within a property will be covered by owner insurance, but not the personal property of tenants. The building itself should be covered by construction insurance separately.

Conclusion

As a wolf owner, know and understand the most common hazards and risks to your property. If you can minimize or avoid the risk of damage to your property, this will also reduce the out-of-pocket expenses you have to pay for the repairs. If you already require insurance coverage, this would tend to raise your premiums during renewal because you now have a high-risk profile.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.