Commercial Property Selling Guide For Karachi

The art of Commercial Property Selling has always been more accessible than buying it. It can be confirmed as potential clients tend to visit or contact the seller rather than sellers visiting the clients and finding interested prospects. Another advantage property sellers have is that they do not have to pay taxes of different kinds. There are perks, but this doesn’t make entrepreneurship quite simple.

Here we’ll discuss real estate in Karachi.

Selling & Transfer Procedure Of Property:

The property selling process in Karachi is somewhat similar to those set by individual developers in housing societies. The question that intrigues most individuals is how one transfers property ownership in Karachi.

The transfer process proceeds in the office of Karachi’s land development authority. If the project is from a private sector and registered developers, the transfer of the property takes place in their respective office place.

What to Keep In Mind When Selling Property:

To start a business in Karachi regarding land sales, one should know a few things to keep in mind. Research beforehand should be done regarding the land and its sales. One should find an agent, set the agent’s commission, and keep in mind the token money, initial deposit, no-demand certificate, taxes, and transfer letter.

Research & Agent Hunt:

One shouldn’t depend entirely on the agent they hire but explore the market rate that the property stands. When one knows the worth of their property, they can put it up on sale at the best suitable price. This process benefits both sellers and buyers; when sellers make their minds up about selling their property, they are to check resources to maintain market rates. This process is quite time-consuming but pays off fruitfully.

The next is to find an agent once you’re aware of the market value of the property. One would question why an agent is to be hired, and the answer to that is to scavenge a profitable deal in a saturated market. The agent will be a helping hand in taking care of the processes.

Commission Of The Agent:

The agents get one percent of the profits as they work on a commission basis. Rarely does an agent adjusts commissions by the deal. The best way to overcome the latter problem and complications regarding this is to finalize the commission beforehand.

Token Money:

Once the seller finds the potential buyer, token money is to be paid by the buyer. Token money shows the intention of purchase of the buyer. In other words, token money reserves the property for the payer. The buyer can ask for a photocopy of the original documents of the property once the token money is paid for verification.

Deposit at Initial:

The buyer pays an amount of money marked as the initial deposit, 25% of the total price. The stamper paper is signed at this stage with terms and conditions.

The No-demand Certificate:

One needs to apply for the no-demand certificate near the date of final payment. The transfer of the property isn’t possible without this certificate. This certificate states that no dues are owed and includes taxes, transfer fees, and stamp duty applicable to buyer and seller. The buyer is to be provided with a copy of the NDC.

Taxes:

The tax payment is to be submitted to the house society or development authority office. The buyer must pay the transfer fee, stamp duty, CVT, and TMA Tax for the property.

Transfer Letter:

Both the buyer and seller are to be present at the time of the documentation of the transfer letter. Once the property is transferred to the buyer, the property no longer belongs to the seller. The payment is transferred into the seller’s account within a few days. The seller is to keep a check on their account when the payment is pending.

Conclusion:

Constant vigilance is required and vital when dealing with real estate. One is to be aware of the scams that are present in the market to stay safe.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

Commercial Property Selling Guide For Karachi

Business Property: Buy for Multipurpose

Buying any Business Property is an important decision, but the universal property is one’s own animal. Rather than dominating one sub-asset class within the real estate with a focus exclusively on renting offices, apartments, warehouses or retail space, a different approach is needed.

Here’s what you need to know to buy and manage a universal building less try.

Thank the Class of Construction and Risk Involved

Commercial buildings come with a classification. The ratings for office buildings usually range from class A to class C property. Other types, such as retail stores or industrial buildings will be designated differently. Understand clearly how universal buildings are classified to assess the level of risk you are taking. While their skill with different uses improves their usefulness, it may increase the risk.

Look at Similar Buildings to Get an Idea About Companies

Look for listings for similar buildings including past sales to have a clearer idea of applicable compilations for purchase prices per foot. Compare what they offer, including not only the various sizes of usable space within a universal structure but also support services. Useful extras like parking and other facilities can save employees or visitors money and time to find a place to park, so they are worth the extra cost.

Consider the Local Market

Let’s say you look at a building that can be used as a meeting place, storage room or as gym, how hot is this in the area? A multi-purpose building will attract some organizations more than others. While the flexibility might appeal to a Scout group, it is less applicable to a company looking for dedicated office facilities. Can you find local examples of fully rented universal buildings? Can you talk to the owners to understand how well this style of real estate works in their city or town?

Get Right Insurance

When it comes to commercial property insurance, you will want to make sure you get the right insurance. There are many types of insurance to cover commercial buildings. A multi-purpose building is unique and not every insurer will feel comfortable covering it if they don’t fully understand it. Find the right insurer who strongly understands how this type of property changes, depending on what the tenant is demanding. As a result, there will be no question marks about coverage due to how the building was used.

Get the Discount on Current Rentals

Will the building be acquired with existing tenants over a long lease? Or will they need to be replaced soon enough? Can you talk to the current tenants to discuss their future plans for staying or moving to another location or another building? While all plans are changeable, it helps to get a basic idea.

Assuming an existing building with happy business tenants on long-term leases is completely different from one that has been partially vacant for months. Although the current owners of buildings may have reasonable sound reasons for a long-term vacancy, it does not change the fact that it will affect cash flow and the ROI going forward.

Develop a Marketing Plan

Kia marketing plan do you have for the building? The effectiveness of it and the cost of securing new tenants after each vacant need must be taken into account. When there is a significant gap between arranging a new commercial property lease, that is lost revenue. If you can find out what marketing has been done before, and how successful it has been, this is useful information. While you may be deciding on another approach, it may at least provide a path for research.

Check Zoning

Any commercial building, it will have zoning that is valid for it. The zoning confirms to what use the building can be used and what is also excluded. Therefore some commercial activities may be allowed while others are not disputed. Depending on the zoning and any restrictions, it could make a building less marketable than it would otherwise be. Examine this carefully to avoid possible roadblocks to getting a reasonable ROI.

Getting a satisfactory investment return from a universal building is somewhat different from other types of commercial property. Its flexibility is either a blessing or a curse, depending on your point of view. However, thank you for changing some considerations as an investor in commercial real estate.

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

Business Property: Buy for Multipurpose

Healthy Real Estate Well-Positioned for Sustainable Growth in a Post-COVID World

The COVID-19 health crisis has had a greater impact on business real estate demand than the Great Recession, as forced quarantines, social distancing, layoffs, supply chain disruptions, unemployment and erosion of consumer confidence put the industry on its knees in 2020 and through the first quarter 2021.

One bright spot in the troubled commercial real estate sector was medical real estate. While office visits for election procedures have fallen, critical care, especially off-campus, has seen an increase as a result of the pandemic, balancing any weaknesses in the sector.

The vacancy rate of the U.S. Medical Office (MOB) was 8.6% since the 4th quarter of 2020, up from 7.8% at the end of 2019. By comparison, the overall vacancy rate for the office sector was 13.2% since the 4th quarter. 2020, sales have resisted extremely well, and real estate investors remain very optimistic in the sector.

“The healthcare sector continues to play a dominant role in the U.S. economy and has shown annual growth for many decades,” notes Martin Freeman, CEO of OrbVest, a global real estate company that invests in U.S. revenues that produce medical commercial real estate. “From an economic and political perspective, Biden’s new management strongly favors expanding health services and benefits and we remain optimistic about the sector going forward.”

Expectations of continued oversupply in the sanitary real estate sector are bolstered by some of the following fundamentals.

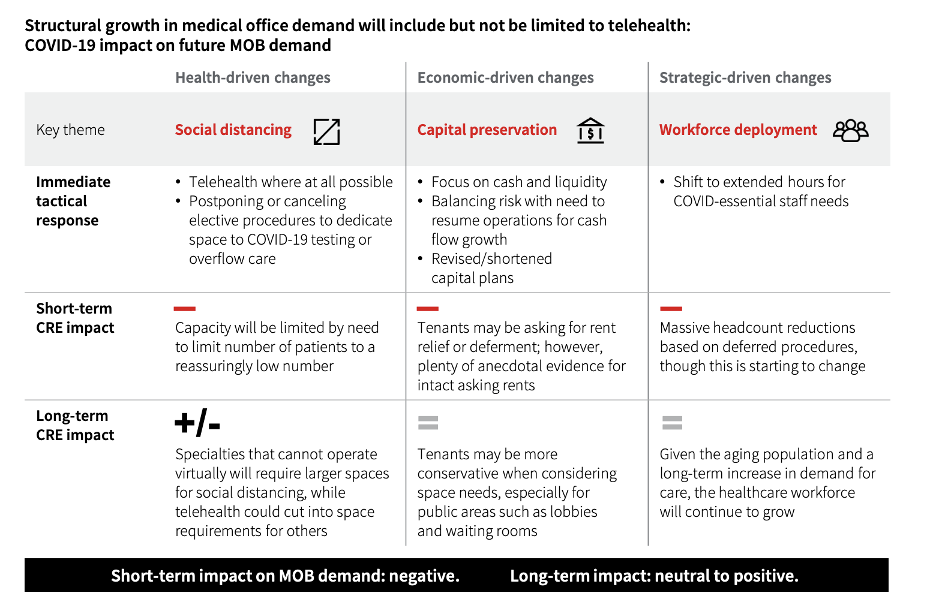

1. Structural growth in medical office demand will include, but will not be limited to telehealth

Investors in medical real estate must consider the impact of healthy, economic and economic and strategic shifts. Telesano will be a great driver for healthcare real estate growth and will be complementary rather than competitive. Take a telescopic giant The merger of Teladoc with a chronic disease manager Livongo, for example.

Social distancing, whether popular or not, will be a growth driver for structural and spatial improvements in medical office buildings, as consumers and staff will require modifications to feel safe. Economically, capital conservation will impact real estate, and strategically, labor deployment could be affected. There could be some short-term disruption as we figure out how to take what worked with the “old normal” and integrate with the “new normal”. Let’s not be surprised to see limited capacity, relief or delays in rentals, reductions in numbers based on delayed procedures and more.

However, in the long run, as the sector inevitably adapts and adapts, and medical real estate needs to have a solid long-term growth potential due to changing consumer needs and evolving demographics.

2. Increased real estate demand from the segmentation of wellness and acute care locations

“We see a measurable shift from the hospital as the center of U.S. healthcare,” Freeman explains, “this trend is likely to continue and accelerate in future years.”

This is another backwind for medical real estate partly driven by demographics. The need for preventive and personalized care among millennials and the elderly has already transformed property treatment long before the pandemic. We have already discussed how the aging U.S. demographics seem to directly correlate with increased real estate demand for health services. Providers also understand that both millennials and the elderly value preventive and personalized care. They know that these cohorts want to focus on a long and healthy life for themselves and their families. In addition, seniors now have access to less expensive and convenient care, while young working millennial parents have access to faster and more special care for their children. This worked too well for it not to increase.

However, this trend is not exclusive to demographic changes. Many of these triggers are due to a growing hospital and how complicated they can navigate. A convenient approach along with lifestyle integration looks like a key driver. Hospitals are likely to focus on longer-term hospital care in the long term, opening up a need for additional buildings dedicated to less harsh and less costly facilities in more convenient and easily accessible locations in population centers.

Moreover, with brighter light shining on pre-existing conditions, well-being and preventive care needs have never been higher.

From a real estate standpoint, a future overlay will likely involve a combination of the following.

Increased efficacy of outpatients.

This can be considered a “medical home” model. This may include group primary care and special care in solid locations accompanying services such as imaging, pharmacy and laboratories. This might also require larger buildings with more giant footprints. The most significant suppliers have already increasingly adopted this model.

The growth of “MedTail”

Retail and health real estate both share many common issues, such as the need for high traffic, visibility, neighborhood proximity and parking. A shopping mall is available and affordability is increasing, and health care providers can jump at the opportunity to increasingly relocate within retail centers.

This gave rise to a new segment of commercial real estate – “MedTail”. Retail locations with integrated medical options, such as pharmacies, are becoming more common.

According to a sanitary real estate company HBRE, townships and suburban areas that once had little access to local medical facilities see more options like the CVS Minute Clinic or the Kroger Small Clinic.

In addition, emergency care centers have emerged in retail malls as another offering to suburban residents.

Tether Advisors also conducted a study and found that “nearly 80 percent of private equity, commercial real estate and retail physicians respond that medium-term investment will increase in the coming year and that COVID-19 has strengthened the sector’s outlook.”

Maximize revenue opportunities on one website

Operators can maximize several revenue streams, such as promoting flexibility for different care delivery types at other times. Providers are also more willing to outsource facilities and project management services in strategic partnerships to ensure they get the highest possible value from their property.

This could also create significant real estate due to adjustments that hospitals will have to make. COVID-19 increased the need for sharper space within hospitals and pushed sharper and administrative uses into alternative locations. This has changed the functional mix of hospitals and increased public perception that hospitals are for very sick people. Many short- and long-term approaches affecting medical real estate must be seen here.

Hospitals will inevitably have to optimize their existing buildings and reduce the possibility of contamination by modifying existing spaces and consolidating. They will also have to accept higher acute care while managing contagious risk – even after the pandemic becomes more manageable. Future success for hospitals will also involve embracing the shift to more acute care and facilitating safety concerns within hospital facilities.

3. Medical office investments are a source of pre-pandemic, mid-pandemic and post-pandemic stability

The numbers don’t lie. Medical office buildings (MOB) are loved by passive investors because of long-term leases, stable employment, consistent income, and rental quality.

This active class has a lot of tailwinds blowing favorably for both the short and long term.

First and foremost, these properties have benefited greatly from all the aid in the multiple incentive packages and the billions dedicated to helping small companies. Think of all the independent doctors and small practices that have benefited from the PPP loans. While many tenants struggled to pay rent, most of these medical tenants were quite good. Loans from the federal government required hospitals to maintain employee levels and continue to pay rent for their buildings, and as a result, relatively few organizations had trouble paying rent. In fact, in the worst part of the pandemic, owners of medical offices have collected rent from tenants in the high 90 percent range.

As a result of the relatively low amount of rental delays, there is a strong long-term outlook for medical real estate.

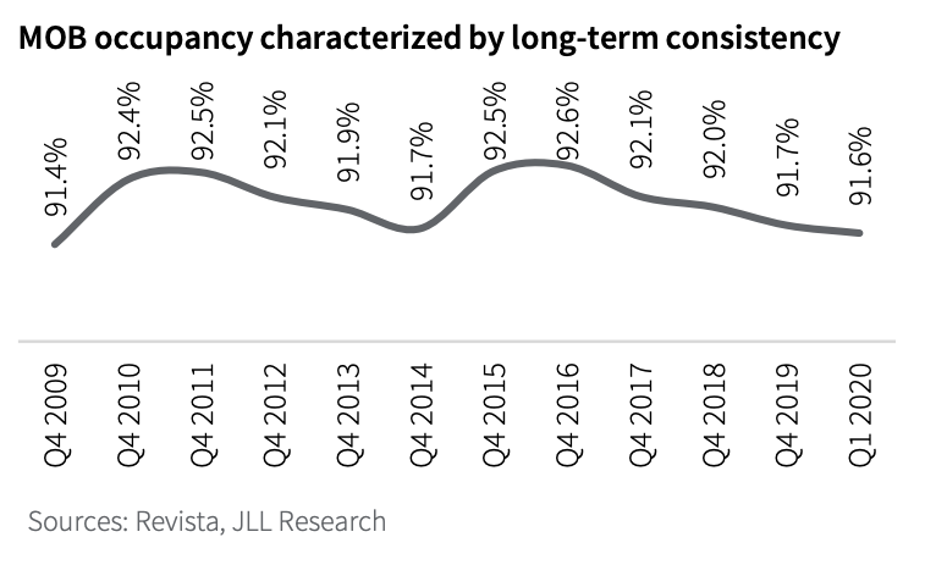

Also, consider MOB fundamentals and occupancy rates. Through approximately 1.5 billion square feet in the United States, MOB occupancy has been remarkably stable. Between the financial crisis and now, MOB employment ranged between 91.4 percent and 92.6 percent. Compare that to the average occupancy rate for offices in the U.S. in that same period – about 82.1 percent to 85.8 percent.

Or maybe you want to consider renting. Due to the high investment in infrastructure required by medical tenants and barriers to entry as rules necessary for surgical centers and imaging, MOBs on average report an average retention rate in the high 80 percent range, significantly exceeding typical commercial office retention.

In addition, despite all the economic headwinds and a downturn in commercial real estate, new outpatient medical construction has remained steadily stable at about 17 to 20 million square feet per year, about 1.8 percent of storage nationally, and well below the national average of 2.1 percent. for a business office.

There is also almost no speculative medical office, as most developers and lenders alike require a 50 percent down payment to launch new construction.

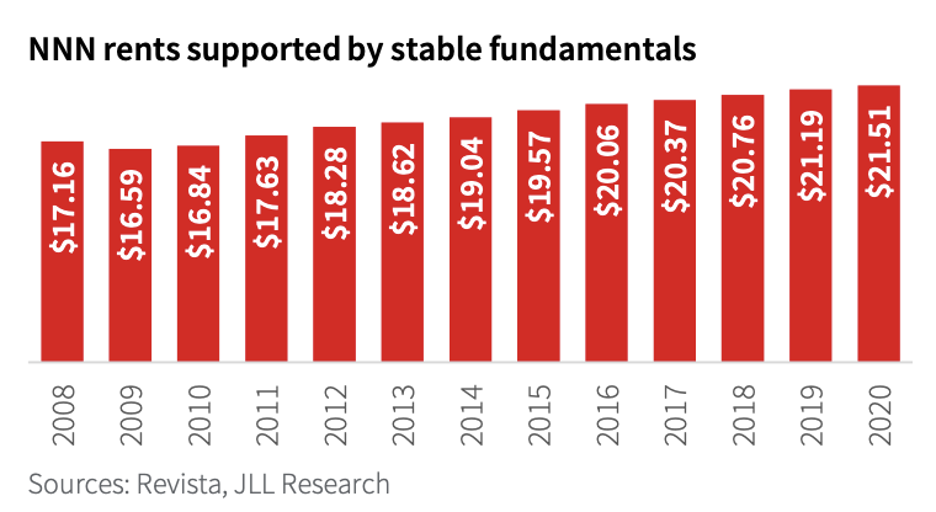

Look at how medical rental growth has also grown. Nationally, average medical office rents have steadily risen from $ 18.28 per square foot in 2012 to $ 21.51 in early 2020. This is a stable 1.5 percent year-over-year gain and a 31.8 percent peak-to-excess return. from a low of $ 16.32 in the fourth quarter of 2008.

Key Withdrawal for Investors

Can medical real estate withstand the downturn in the commercial market? The answer is a resounding yes. “The current challenges facing the global economy, and the potentially aggressive rebound of business sentiment in the U.S., create an ideal opportunity for companies like OrbVest to help investors around the world invest directly in medical real estate in the U.S. and grow their wealth steadily and sustainably,” says Freeman.

Healthcare is changing, our demographics are aging, and if this last year has shown us anything, it is that an adaptable and thoughtful healthcare system is essential for a functioning society. We will see numerous changes in medical real estate and MOBs in the short and long term. But the bottom line is that if you look at the fundamentals, you really can’t find a better long-term investment than medical real estate for stable income streams, quality tenants, long-term rents, and high occupancy rates.

If you look at investment performance after the financial crisis, this supports the fundamentals of the sector. This is an ongoing asset class, changing over time, and a property type that will experience growth a lot in the future.

If you are looking for passive income in real estate, medical commercial real estate offers an extraordinary investment opportunity.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Healthy Real Estate Well-Positioned for Sustainable Growth in a Post-COVID World

Investment In Commercial Property In Pakistan

Commercial real estate in Pakistan has different characteristics that distinguish it from a dwelling house.

It is not a simple job to invest in commercial real estate. Before investing, there are also things to look at. Business investment in Pakistan includes the choice of the site, the number of feet, how many people visit the region per day, price, price for money, and so on.

It is just as difficult to find the right property for your company, whether it is rented or purchased. Property is another aspect that needs to be targeted in the form of the company so that the investment is not lost.

That is why there are some outstanding advantages and handy tips for investing in commercial real estate in Pakistan.

Equality

By building equity in your real estate business, you will use it to further expand your business without jeopardizing your business. This helps you deal with the development of your company more flexibly.

It also gives more options when the retirement period arrives. As a company owner, you can either directly sell the practice and underlying property during the retirement period, or just sell the practice and rent a commercial property that provides a source of income.

Good Thanksgiving

Investments such as stocks do not allow for anything more than buying and selling, however, provided requirements are met and necessary permits from a local authority are secured, commercial homeowners can invest in their real estate.

A commercial property owner in Pakistan can upgrade, restructure the property outside or inside, increase rents or even modify its zoning. Inflation will bring value to current features as well. While new developments may cost more than building older properties, existing sites and the more recent local construction are still growing in value.

Tax Benefits And Maximum Returns

It can be a dynamic place to invest. Unfortunately, it is not only black and white as a profit generation. Taxes and other external conditions can also affect business activities. These elements can be used to your advantage when working with real estate.

The value could rise in terms of market valuation and financial value for you, but over the years the building itself would certainly decline. The direct decline indicates that the physical value of property decreases over 27.6 years. Meanwhile, after more than a decade, other features will fall apart. This loss will offset a market value gain that actually contributes to a better outcome.

A competent accountant would require these considerations. However, in most markets, such resources are not open. Here is another explanation for preferring industrial ownership over other solutions.

Cash Flow Perspectives

You must pay the premium for an additional cash flow of rental income if you own a commercial property with room for tenants. Tenants are willing to use their money to pay for the purchase of their land, offsetting the expense of saving.

It is important to note, however, that tenants include responsibility for property maintenance, which will diminish the presence of the main commercial properties.

Practical Tips For Investing In Commercial Real Estate In Pakistan

- One must understand the state of the market, including tariffs and the value of land, so as not to deceive man. It is extremely important to keep yourself up to date. In relation to residential and commercial property, there is a great distinction, so the characteristics of both forms must be understood.

- You need to prepare yourself so that you know when, why and how to invest in company property because there is only one factor you need to consider when investing.

- You need to remember whether the position would offer you capital growth or not, and whether the site has construction potential or not.

- The land has or does not have the most important lease option. If you do not want to use the feature yourself, you must rent it.

- The land should also include important amenities such as parking lots and electrical supplies.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Investment In Commercial Property In Pakistan

- Published in Business, Buying, Commercial Investment, Commercial Property, Commercial Property in Pakistan, commercial real estate, Economic Zone, ECONOMY, Market Overview, MARKETS, News, News & Updates, News and Update, Property In Pakistan, Real Estate, Real Estate Investments, real estate sector, Real Estate Trends, tax, TAX POLICY, Tax Reforms Commission (TRC), TAXATION, Trends, World Business News

Transfer fee for commercial and residential plots

If you want to know the transfer fee of commercial and residential plots, then this article is for you.

The details of the transfer fee for commercial and residential plots are as follows.

- Housing: Rs.250 per square foot

- Model Villages: Rs.150 per square foot

- Business Delivery on Family: Rs. 10,000