List of Banks Providing Home Loans in Pakistan

Who does not want the luxury of having their own home?

It is the dream of most of us. Living in a rented house may become frustrating and annoying. Privacy and comfort are usually absent in rented spaces and oh… don’t forget the sky-high utility expenses. A place you can call home is indeed a blessing.

However, building a home in today’s era can be very difficult due to the increasing cost of raw materials, labor, and property tax. Before getting a loan for the home you exactly know about the plot size conversion. Once you know the exact size of your land then it is easy for you to get a loan with a proper plan. Thankfully, some banks are providing home financing for Pakistani people.

All you have to do is pay a certain amount of money every month to the bank. This makes the whole construction process easier and more practical. A person belonging to the middle class and upper-middle class can enjoy the perks of their very own home, all thanks to home financing.

We have outlined a very useful and thorough comparison among different banks so that you can see how the whole loan thing works.

Before starting off with the article, we would like to highlight that the costs and interest rates mentioned in the content are for Islamabad. The interest rates, terms, and conditions may differ in other cities.

Also, these figures are related to an average 5-marla house in Islamabad. The cost of construction is taken as Rs. 26 lac, and the payback period is 15 years.

You can change the cost of construction, income bracket and payback period according to your preference. The primary objective of this article is to educate people about the interest rates, processing fees and basic requirements of every bank.

If you want to know about the breakdown of construction costs of a 5-marla house, then do check out Cost to construct 5 marla house where we have sketched all the costs associated with the grey structure of a 5 marla house for sale. There are many construction companies that provide high-quality construction services at an affordable price.

APR stands for annual percentage rate. It is the annual interest rate that the person has to pay the bank. Secondly, the repayable amount is the total amount (principal amount and interest amount) that the person has to pay back to the bank.

List of Banks Providing Home Loans in Pakistan

1. Bank Alfalah

Alfalah Home Finance is giving home loans on easy terms and conditions. You can apply for a loan amount starting from Rs2 million to Rs. 50 million, payable in 36 to 240 monthly installments.

Requirements:

The minimum salary requirement for the filer is Rs. 70,000, and the age limit is 23-60 years. Documents required for loans include CNIC, salary slips, 12-month bank statements, and two years of employment under the current employer.

Website: Bank Alfalah

2. HBL

Through ‘HBL Home Loan,’ you can apply for a loan amount starting from Rs2 million to Rs. 15 million, payable in 60 to 240 monthly installments. HBL is also offering a loan calculator on its website that you can use to calculate the loan amount.

Requirements:

The minimum salary requirement for HBL is around Rs. 100,000. The person should be 22-60 years old. The documents required are CNIC, salary slips, a 12-month bank statement, a minimum 5-year experience, Pakistani nationality (Resident & nonresident Pakistani), and a letter from the employer.

Website: HBL

3. MCB

You can apply for a loan amount of up to Rs. 25 million, payable in 12 to 240 monthly installments.

Requirements:

The person should have a monthly salary of Rs. 50,000 and should be 21-60 years of age. The documents required include CNIC, salary slips, a 12-month bank statement, and proof of Pakistani residency.

Website: MCB

4. Askari Bank

Askari bank offers loan amounts starting from Rs. 500,000 to Rs20 million, payable in 36 to 300 monthly installments.

Requirements:

Just like MCB, the minimum salary requirement for Askari Bank is Rs. 50,000. The age limit is 22-60 years, and the documents needed for further processing include CNIC, salary slips, and a 12-month bank statement.

Website: Askari Bank

5. UBL

You can apply for a loan amount starting from Rs. 1 million, payable in 36 to 240 monthly installments.

Requirements:

To get the loan, the person should have a monthly income of Rs. 50,000. They should be 23-65 years old. The papers needed are CNIC, salary slips, a 12-month bank statement, proof of Pakistani residency, and proof of 12 years of employment.

Website: UBL

6. Bank Al Habib

Like other banks, Bank Al Habib is also providing a loan starting from Rs. 300,000 to Rs. 20 million, payable in 240 monthly installments.

Requirements:

The minimum salary requirement is Rs. 60,000 and the age limit is 23-60 years. The things needed for the paperwork include CNIC, salary slips, and 12 monthly bank statements.

Website: Bank Al Habib

If you want to verify your driving license by sitting at home, read: the process of driving license online verification in Pakistan.

7. JS Bank

JS Bank offers home loans ranging from Rs. 500,000 to Rs. 100 million, payable in 12 to 240 monthly installments.

Requirements:

For JS Bank, the salary bracket is a bit high. The minimum salary requirement is around Rs. 70,000. The person should be 21-60 years old and should have CNIC, salary slips, and 12-month bank statements with them.

Website: JS bank

8. Meezan Bank

With Meezan Bank, you can apply for a loan amount starting from Rs. 500,000 to Rs. 50 million, payable in 24 to 240 monthly installments.

Requirements:

Meezan Bank gives loans to a person who has a monthly income of around Rs. 40,000. The age bracket is 25-65 years, and the papers required for further processing include salary slips, 12-month bank statement and 2-year employment proof.

Website: Meezan Bank

9. Standard Chartered

Saadiq Home Financing division of Standard Chartered is also giving loans. Like HBL, this bank is also providing an online loan calculator for its customers. You can apply for a loan amount starting from Rs3 million to Rs30 million, payable in 12 to 240 monthly installments.

Requirements:

With Standard Chartered Bank, financing is available for up to 75% of property value. The salary requirement and age requirements are Rs. 50,000 and 21-60 years, respectively. If you are interested in getting a loan from SC, then do bring your CNIC, salary slips, 12-month bank statement and a letter from your employer with you.

Website: Standard Chartered

10. Summit Bank

Summit Bank allows its valued customers to apply for a loan amount starting from Rs. 300,000 to Rs. 100 million, payable in 12 to 240 monthly installments.

Requirements:

The base pay for Summit Bank is Rs. 80,000, and the age limit is 23-60 years. The documents needed for formal paperwork include CNIC, salary slips, a 12-month bank statement, and a letter from the employer.

Website: Summit Bank

11. Bank Islami

Bank Islami is also offering home financing, starting from Rs. 200,000 to Rs. 50 million, payable in 24 to 300 monthly installments.

Requirements:

The minimum salary requirement is Rs. 51,000, and the age limit is 25-65 years. Bank Islami requires CNIC, salary slips, a 12-month bank statement, 6-month employment proof, and the last 6 months’ utility bills for documentation.

Website: Bank Islami

12. Bank of Punjab

The BOP is also offering home financing from Rs10 million and above, payable in 240 monthly installments.

Requirements:

The person should be earning around Rs. 40,000. They should be 21-60 years old. They should also have CNIC, salary slips, bank statements and a copy of utility bills with them.

Website: Bank of Punjab

13. Al-Baraka

Al-Baraka is giving out loans starting from Rs0.3 million to Rs. 35 million, payable in up to 240 monthly installments.

Requirements:

The minimum salary requirement is Rs. 50,000, and the person should be around 21-60 years of age. The documents required include CNIC, salary slips and bank statements.

Website: Al-Baraka

14. MCB Islamic Bank Ltd

MCB, being one the leading banks of Pakistan is also giving a loan amount up to Rs. 30 million, payable in 24 to 240 monthly installments.

Requirements:

The minimum salary requirement is Rs. 60,000. Your age should be around 25-65 years. The documents needed are CNIC, salary slips, bank statement and a minimum of five years in service.

Website: MCB Islamic Bank Ltd

15. NBP (National Bank of Pakistan)

National Bank of Pakistan also provides home loans to its valuable customers on easy terms and conditions. NBP home loan provides the best home loan rates in Pakistan because of its variable annual return policy.

Under the NBP Saibaan program, the bank is providing construction loans and purchase loans to its customers. The maximum amount that you can get is around Rs.35 million for a period of 3 to 20 years.

Requirements:

To avail of the loan, the person should be at least 22 years old with a net income of around Rs.10, 000 (if he or she is a government employee) and Rs.15000 (if he or she is privately employed).

To apply for the loan, you need to have the following documents with you:

- Two attested passport-size photographs.

- Two attested copies of your CNIC.

- Two attested copies of CNIC of references.

- Cheque for the processing charges.

- Cheque in favor of legal counsel for a legal opinion.

- Cheque in favor of Valuator for valuation report.

- Cheque in favor of income Estimation Company for income estimation report, if applicable.

- Property Documents: an attested copy of title documents available.

- Bill of quantity (BOQ) in the case of HC and LPC.

Website: National Bank of Pakistan

16. Faysal Bank

The home loan program of Faysal Bank operates under the diminishing Musharakah principle. In this program, the bank and the customer purchase the asset jointly. The bank then rents out its share of units to the customer.

When all the units are being paid by the customer, the asset gets shifted in the name of the customer and he becomes the sole owner of that specific property.

Currently, the following types of loans are available:

- Home purchase.

- Home builder/ Plot + construction.

- Home renovation.

- Home re-finance (Transfer existing home finance facility).

To avail of the loan, the person should be a citizen of Pakistan. The salaried person should have a net income of Rs.100, 000 and the age limit for the loan is between 21 to 60 years of age.

Requirements:

The following documents are required by the bank for the application process:

- Copy of CNIC.

- 2 passport-size photographs.

- Last six months’ salary slips.

- Salary certificate/employment certificate (Designation, date of Joining, permanent – status, salary Breakup).

- Last 12 months’ bank statement (Original).

- Copy of complete property documents.

Website: Faysal Bank

17. Dubai Islamic Bank

If you are looking for a home loan without interest in Pakistan, then consider this bank. Dubai Islamic Bank is also providing home loans for its customers, that too without any Riba (a concept in Islamic banking that refers to charged interest). So, all those people who do not want to get involved with any kind of interest can opt for this bank as it provides loans up to Rs.75 million.

A Musharakah agreement will occur between the customer and the bank. The bank will purchase the asset for the customer and then it will lease out that property to the customer. When the amount of the loan is paid in full, the bank will shift the complete ownership to the customer.

The following types of home loans are being provided by the bank:

- Home purchase.

- Home renovation.

- Purchase of an undivided share of the property mortgaged by other banks (Balance transfer).

- Construction finance.

Requirements:

- Age: 25 to 60 years old.

- Monthly income: Rs.40, 000 for salaried employees and Rs.50, 000 for self-employed.

Website: Dubai Islamic bank

Document required:

- Copy of primary applicant’s CNIC

- Copy of co-partners CNIC

- 2 passport-size photographs

- Tax returns

- Copy of utility bill

- Professional degree (for self-employed professionals only)

- Salary certificate/proof of profession

- Latest salary slip

- Bank statement of the last 12 months & bank certificate

18. Allied Bank Limited

Allied Bank Limited is one of the most famous banks in Pakistan that provides home loans on easy terms. If you are a Pakistani citizen within the age bracket of 25 to 57 years and have a net income of 50,000 per month then you are eligible for the home loan.

You can get Rs.40 million in loan and you can repay it within 3 to 25 years, depending upon your preference and budget.

However, unlike many banks, Allied Bank requires you to have a prior relationship of around 6 months with a bank.

The following types of loans from the bank are available at the moment:

- Home/apartment purchase

- Home construction (Land already owned)

- Home Renovation

- Buy land & construct a home

Requirements:

- Last six months’ bank statement (ABL / any other bank, as the case may be)

- Copy of CNIC/ Smart NIC

- Proof of income

- Complete and duly signed “Application Form”

Website: Allied Bank Limited

19. Khushhali Microfinance Bank Limited

Khushhali Microfinance Bank provides home loans for renovation and repairs. If you are someone who wants to renovate their house and are looking for finances, consider this bank. Khushhali Bank is providing home loans up to Rs.1000, 000. Your tenure for the month is between 6 to 120 months.

Requirements:

- Age: 25 -60 years (65 years for pensioners)

- The annual income of the applicant should be equal to or less than PKR 600,000 per year

- Residing in the house/ ownership of the house (if the property has been given on rent) for at least 1 year

- Salaried individuals must be working with their current employer for at least 2 years

- 2 years of business experience

- NADRA CNIC/ SNIC holder

Website: Khushhali Microfinance Bank

20. Silk bank

Silk Bank is also providing home loans to its customers in easy installments. It is considered to be one of the best banks for home loans in Pakistan.

An eligible person can get a loan amount up to Rs.2 million and the tenure to return the money is between one to 5 years. You do not have to give security on the loan as well.

Requirements:

- Pakistani residents

- Foreign nationals with an approved company guarantee

- Salaried individuals

- Age: 21-65 years

- Income: minimum Rs.40,000 monthly

Website: Silk bank

Disclaimer:

All the content provided in this blog post is for educational purposes. The information provided in this article is should be considered for educational/ entertainment purposes only.

You get a loan for small businesses or startups as well. There are million business ideas out there, each catering to a different customer segment.

Pros of getting a home loan in Pakistan

- First of all, getting a home loan means that you are getting ownership of a tangible asset. A home loan will ensure that you become the owner of a house where you can retire after a long tiresome day.

- Financing a home can be difficult. For most of us, paying in bulk for the construction of the house is nearly impossible. This is when the banks come to our rescue. They provide you with the capital you need to build your house and let you return the money at easy terms and conditions.

- Very few people know that there are tax benefits attached to the repayments of home loans. The interest portion of the EMI paid for the year can be claimed as a deduction from your total income.

- Home loans also allow you to save on rent. The amount that you were paying to stay in someone else’s home can now be used to finance your tangible asset. Also, a home loan can save you from the uncertainty that you face when you are living in a rented property.

Things you need to know before signing up for home loans

- Unlike personal loans, home loans are long-term. When you get a microfinance loan or a personal loan, you pay it off within 2 to 3 years. but when you sign up for home loans, keep in mind that it will take 10-20 years to return your loan. If you are ready for this kind of financial commitment, go for a home loan for sure.

- When you purchase a home or build a house using a home loan, remember that you will not become the 100% owner of that property. You will only get full ownership of the property after making all the installments.

If you will fail to make the required installments, the bank has the authority to take legal action against you. In the worst of cases, can lead to you being evicted from the home and the bank taking possession.

Any action that you take upon the information on this website is strictly at your own risk. For more information on home loans, visit the bank’s website.

There are many online calculators like 1 trillion in crores conversion and home loan calculators in Pakistan. If you want to calculate and compare costs, then you can use Home Loan Calculator.

Currently, no bank is providing interest-free loans in Pakistan. However, the banks that we have mentioned above are offering loans on easy terms. If you meet all their requirements, you can easily get a loan against property in Pakistan. Get to know swimming pool construction costs in Pakistan.

Browse these banks and their terms and then decide which bank is best for your home loan in Pakistan. Get to know the best insurance company in Pakistan.

After building homes people are more concerned about home safety. For that, try installing a home automation system that makes your home smart.

Are you someone who has already received a home loan from any bank? If yes, then do share your personal experiences related to bank loans. We would love to hear from you. Get to know factors affecting the real estate market.

List of Banks Providing Home Loans in Pakistan

- Published in Al Baraka Bank, Alfalah Home Finance, Allied Bank Limited, Askari Bank Limited, Bank Al Habib, Bank Islami, Bank of Punjab, Dubai Islamic Bank, Faysal Bank, Habib Bank Limited, home loans, International, JS Bank, Khushhali Microfinance Bank, Lifestyle, loans, Loans for house, MCB Islamic Bank Ltd, Meezan Bank, Muslim Commercial Bank, National Bank of Pakistan, Silk bank, Standard Chartered Bank, Summit Bank, United Bank Limited

All About HBFC Home Loans

In Pakistan HBFC Home Loans, becoming a homeowner is a dream for many. However, the country’s soaring real estate market has made it impossible for many to achieve this dream, especially for the lower- and middle-income classes. If the current trends continue, these groups will be excluded entirely from the market.

To tackle this issue, the government of Pakistan launched a home financing initiative known as the Home Building Finance Company (HBFC), with the sole purpose of providing easy-installment home loans. The company continues to help those wanting to become homeowners through its financial assistance programs.

For those that want to know more about how to avail of these loans, Feeta.pk features everything you need to know about HBFC home loans.

A little about the Company

Established in 1952, House Building Finance Company (HBFC) is the country’s only real estate financing institution. With regional offices and area branches spread all over Pakistan, the institution aims at providing financial assistance to every Pakistani struggling with housing needs.

Over the years, the company has launched several programs to provide affordable housing to the lower- and middle-income classes. Programs such as ‘Ghar Pakistan’ and ‘Ghar Aasan Flexi’ allowed millions of Pakistanis to become homeowners with minimal debt.

Currently, the company’s objective is to reduce the demand and supply gap of residential units in the country, allowing the majority of the masses to own a home.

HBFC Home Loans

Despite majorly targeting the middle- and lower-income groups in the country, HBFC home loans are also available for almost all individuals that need some sort of financial assistance in closing the deal. Currently, the company offers three types of loans to its clients.

- Purchase of House or Flat

- House Construction

- Balance Transfer

These loans have extended to livestock owners, farm owners, and non-resident Pakistanis. These flexible payment solutions aim to assist anyone in Pakistan that requires finances for their housing needs.

Who is Eligible for an HBFC home loan?

Since the program’s primary objective is to facilitate lower and middle-income groups, a strict eligibility criterion has been set. To be eligible for the ‘Ghar Pakistan Scheme’, your monthly income should be below 100,000 PKR, while the ‘Ghar Pakistan Scheme Plus’ requires a monthly income below 175,000 PKR.

Affluent individuals can also apply for a home loan through the ‘Ghar Sahulat Scheme’. However, these loans offer higher interest rates since the target audience of these loans are the lower-income groups.

Moreover, those applying for the HBFC home loans must be salaried individuals, self-employed business owners, and self-employed professionals. For verification purposes, HBFC requires a one-year bank statement, monthly utility bills, and a salary slip.

How to Apply for an HBFC Home Loan

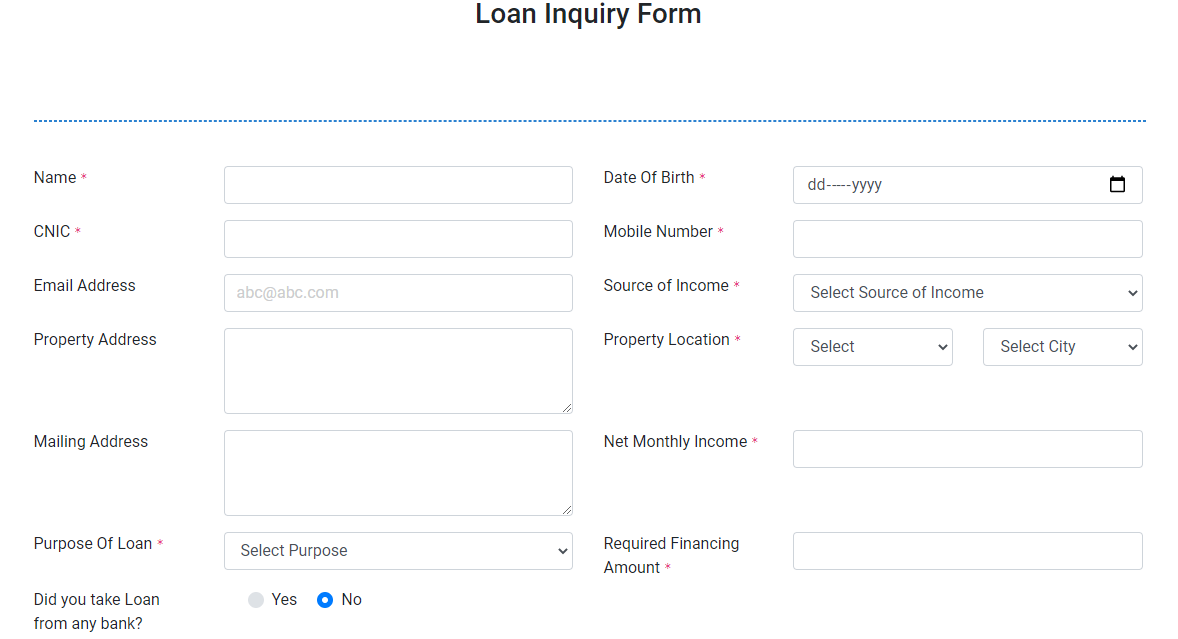

Source: HBFC

If you are unfamiliar with the application process for an HBFC home loan, simply follow the instructions below.

- Head over to the HBFC home loans website at hbfc.com.pk.

- Click on the ‘loan inquiry form’ option. This will take you to the next webpage, where you will need to enter your details and other credentials.

- Once the inquiry form has been submitted, the company loan agent will review the application and contact you within two to three working days.

- During the screening process, you can check your loan status on the company’s website at any time.

- After an initial screening of your inquiry, you will need to submit an application with the required documents and other processing fees.

- The next step involves filing a few legal documents for financing and security purposes.

- If approved, the loan amount will immediately be disbursed as decided in the terms and conditions of the agreement.

Pakistan’s real estate market is set to exclude middle- and lower-income groups, making it impossible for them to become homeowners. HBFC home loans aim to combat this exponential increase in prices by providing low-interest home loans with easy installments. For more information, visit Feeta.pk, Pakistan’s first online real estate market.

All About HBFC Home Loans

- Published in home loans, Housing Finance, International, Real Estate Guide

Banks Offering Home Loans for Pakistan Real Estate

While prices have been high for homes for sale, people still want to own their own homes. Although it is not shocking, it is a bit difficult to buy a house in Pakistan. A house that fits your budget and meets your expectations could be much harder to find.

You could give up on a smaller house or a job you didn’t want at first. All that makes it inevitable to borrow a home. A home loan from a bank has its own advantages.

We know that building a house in today’s era can be very difficult due to the rising cost of raw materials, labor and housing tax. You only know how to translate the size of the lot before collecting a loan for your house. Once you know the exact size of your land, then it is easy for you to get a loan with a suitable plan. Fortunately, some banks provide Pakistani citizens with home financing.

You only have to pay the bank a certain amount of money per month. This promotes and promotes the entire construction process. Middle class and upper middle class can enjoy the benefits of their own home, all with home financing.

To see which banks in Pakistan offer home loan services, we have mentioned very helpful and detailed features of each bank.

Advantages Of Obtaining A Home Loan Form Bank

Before we get started, let’s look at advantages of getting a home loan from a bank.

- High payments Permanent tenure: (home loans have the longest repayment, up to 30 years, among all types of loans, so that the burden of equivalent monthly payments can be reduced by extending the tenure). You can use a home loan EMI calculator to know how your home loan office is changing

- Assess the capital appreciation: So you can prosper with the time of real estate improvement.

- Save you from paying rent: They’re squeezing your monthly budget because rent is pretty high in subway cities. The EMI and families pay well.

- Tax benefits on a second home: In the case of a second home, you are entitled to claim a deduction for the total amount of home loan interest paid under Section 24B of the Income Tax Act.

- Unlike most loans, where loans cause down payment down payments, there are no down payment premiums for floating home loans.

- No down payments: That you can use it to finance part of your home loan and reduce the pressure if you have extra capital. In the case of a revolving home loan, however, down payment fees may be paid.

- Balanced Delivery Facility: In case of home loans, if your loan has a lower cost, you will transfer your home loan to a particular loan company.

- Easy to buy home dreams: For many people, home loans cannot be bought with their own money, as it can be repaid in simple monthly installments, and buying a home is much simpler.

Banks that offer home loan in Pakistan

Pakistani people spend their lives saving money to buy their own house. Yet only a few will truly realize the dream. In such a state of affairs, a mortgage can be a very useful option. It may not be ideal for everyone, but it should be considered for people with a decent monthly income, especially people who live in rented houses.

Here is the list of banks you should look for:

Islamic Commercial Bank (MCB) – Pyara Ghar

For a variety of uses, MCB offers a variety of financial options such as buying a home, building, building or purchasing real estate.

Features

Their domestic financial alternative is available in all major cities like Lahore, Karachi, Islamabad, Faisalabad and Rawalpindi. For 2 to 20 years, MCB offers up to 20 million loans, except for industrial assets that you cannot get the loan from.

Bank Alfalah

Simply put, Alfalah Home Finance offers home loans. The amount for the loan can be claimed in 36 to 240 monthly installments, starting from Rs2 million to Rs.50 million.

Features

The applicant wants a minimum wage of Rs 70,000 and the age limit is between 23 and 60 years. CNIC, salary notes, bank balance and two years of employment for a current employer include the records required for loans. Loan papers

United Bank Limited (UBL) – UBL Address

Under the term “UBL Address,” the UBL provides support for purchasing and construction purposes. These loans are sold at two separate interest rates (so-called floating and adjustable).

Features

You must be a Pakistani citizen and earn a minimum monthly income of 15,000 to apply. Note that although the combined income of both partners reaches 15000, a family can apply for this loan. Using this program, you can get up to 500,000 and larger loans. Brand prices range from 11.99% to 16.5%, and these loans are offered for a period of 3–20 years.

Bank Al Habib

Like other banks, Al Habib Bank also lends 300,000 to 20 million rupees for 240 months.

Features

The minimum wage threshold is Rs. 60,000 and the average age is between 23 and 60 years. CNIC, payments and 12 monthly bank statements are the things needed for paperwork.

Askari Bank

Askari Bank gives loans of Rs 500,000 million to Rs 20 million, charged in a monthly installment of 36 to 300 installments.

Features

Like MCB, Askari Bank’s minimum wage requirement is Rs. 50,000. The age limit is 22-60 years and CNIC, salary invoices and a 12 month bank statement are the documents needed for further processing.

Meezan Bank

At the Meezan bank you are allowed to apply in 24 to 240 monthly installments for a loan amount starting at Rs. 500,000 to Rs. 50 million.

Features

Meezan Bank offers loans to those with Rs. 40,000 monthly salary. The age range varies between 25 and 65 years. A pay cut, a 12-month bank statement and proof of work are expected for the coming years.

Norma Luita

The Standard Chartered Home Finance division also offers loans. Like HBL, this bank also offers an online loan calculator for its customers. It is possible, in 12 to 240 monthly installments, to apply for a loan amount between Rs3 million and Rs30 million.

Features

The financing available with Standard Chartered Bank is up to 75% of real estate valuation. The salary and age criteria are of Rs. 50,000 and Rs. 21 to 60, respectively. If you intend to secure an SC loan, bring your CNIC, your salaries and your employer’s 12-month bank account and a letter with you.

Banks Offering Home Loans for Pakistan Real Estate

- Published in building plan, home loans, Market Overview, MARKETS, News, News & Updates, News and Update, Real Estate