Pros and Cons of Homeowner Association

Several localities offer residents the option to join a homeowner association. These associations can be quite helpful in resolving minor community issues. However, they may come with several drawbacks that need to be considered. To understand the pros and cons of joining HOAs, you must first understand what HOAs are, what they do, and how they affect homeowners.

What are HOAs? A question that you might be wondering. The term simply refers to homeowner’s associations, which manage a community for the benefit of its residents.

What does HOA mean in Housing?

Homeowners associations exist to manage residential communities, maintain curb appeal, and keep property values high. In addition to this, property owners’ associations manage residential communities. Home developers are responsible for initiating the association.

As a result of legal advice, the developer drafts the association’s governing documents. Bylaws, amendments, rules and regulations and articles of incorporation are among the documents.

Simply put, it would mean living in a house that is a part of an association. Although there are plenty of benefits to living in an HOA, it may not be suitable for everyone. Living in an HOA community, for example, gives you access to amenities you would not otherwise have.

What is the purpose of an HOA?

As soon as you move into your new home that is registered with the association, you become a member. The HOA’s governing documents are automatically applied to you as an HOA member. The documents outline the dos and don’ts of a homeowner. Rules like these help preserve property values and keep neighborhoods safe.

Managing an HOA entails taking care of the best interests of the community, enforcing rules, and setting the amount for dues. A review of the HOA’s governing documents is recommended before moving into a homeowner’s association.

Pros of HOA

Here are some pros of HOA that can help you make a decision.

1. HOAs are responsible for maintaining common areas

The aesthetic appeal of a well-maintained community contributes to the ease of living within it as well. A landscape that offers clean roads, trimmed trees, and blooming flowers, brings harmony and peace. The wellbeing of a community is important, and it is comforting to know that these services are in place.

The benefits of living in a community with an HOA include common community areas being maintained by the organization. Swimming pools, playgrounds, barbecue areas, and community centers are included.

The spaces can be enjoyed without having to worry about maintenance. In addition to maintaining the landscaping in front of each unit, some HOAs also take care of maintenance in the backyards of residents.

2. A consistent value for each property

Property values are a primary reason people buy an HOA home. Your board helps you protect your investment and ensures its value remains the same. It is the owners’ responsibility to maintain their lawns, homes, and personal property in accordance with community laws. This offers several benefits for the homeowner as well as the community. The members of the board live in the same community, and they are just as eager to see it thriving as you.

3. Complying with standards

Every homeowner must follow certain guidelines. Prior to signing on the dotted line, buyers should familiarize themselves with the governing documents. There isn’t much tolerance for unruly behavior in a typical association – from a wild party in someone’s backyard to disregarding architectural guidelines. The neighborhood has a board that mediates neighbor disputes and sets forth consequences when things don’t work out.

Cons of HOA

Let’s take a look at the cons of HOA.

1. HOA fees must be paid monthly

Residents of the community must pay HOA fees because the association maintains the common areas and exteriors of homes.

The fees for these amenities vary from community to community. In addition, HOA fees are not set in stone, so they are subject to change from time to time. When the association is unable to collect enough funds to maintain the community, the association may have to increase the monthly fee.

2. Failure to pay HOA fees can have serious consequences

Paying your HOA fees is an important part of living in a community. Fees must be paid by all residents of the community. If the HOA remains unable to collect enough money from residents, the property may not be able to be properly maintained. This can result in the association firing the property manager, causing the community’s appearance and condition to deteriorate.

3. Rules and regulations are enacted by the HOA

The HOA sets requirements for your home’s appearance. Ranging from what type of front door and windows you can have to decide what color your front door or shutters can be painted – the association has complete control over your home’s appearance. You may even be restricted in how much outside decor you can use and how many vehicles you can park in your community. If you violate the community’s rules and regulations, you could receive a fine.

4. Inadequate management

Poor management can lead to deterioration in some HOA communities. As a preventative measure, electing board members who have the association’s best interests at heart is the perfect way to avoid such a situation. In addition, many HOAs hire a management company to ensure responsibilities and duties are properly fulfilled.

5. Foreclosures and lien rights

A lien or foreclosure is always a concern when living in an HOA. There are certain HOAs that can place links on your property and then foreclose on it. The lien will only occur if your association due aren’t paid.

Conclusion

It’s important to consider the pros and cons of living in an HOA before making a decision. Paying monthly fees and adhering to the rules of an HOA community is necessary. You’ll also benefit from things like preserving your property value and being able to access well-maintained amenities (like landscaping). In the long run, you will benefit more from HOAs if you can tolerate the minor inconveniences they bring.

Stay tuned to Feeta Blog to learn more about Pakistan Real Estate.

Pros and Cons of Homeowner Association

All About HBFC Home Loans

In Pakistan HBFC Home Loans, becoming a homeowner is a dream for many. However, the country’s soaring real estate market has made it impossible for many to achieve this dream, especially for the lower- and middle-income classes. If the current trends continue, these groups will be excluded entirely from the market.

To tackle this issue, the government of Pakistan launched a home financing initiative known as the Home Building Finance Company (HBFC), with the sole purpose of providing easy-installment home loans. The company continues to help those wanting to become homeowners through its financial assistance programs.

For those that want to know more about how to avail of these loans, Feeta.pk features everything you need to know about HBFC home loans.

A little about the Company

Established in 1952, House Building Finance Company (HBFC) is the country’s only real estate financing institution. With regional offices and area branches spread all over Pakistan, the institution aims at providing financial assistance to every Pakistani struggling with housing needs.

Over the years, the company has launched several programs to provide affordable housing to the lower- and middle-income classes. Programs such as ‘Ghar Pakistan’ and ‘Ghar Aasan Flexi’ allowed millions of Pakistanis to become homeowners with minimal debt.

Currently, the company’s objective is to reduce the demand and supply gap of residential units in the country, allowing the majority of the masses to own a home.

HBFC Home Loans

Despite majorly targeting the middle- and lower-income groups in the country, HBFC home loans are also available for almost all individuals that need some sort of financial assistance in closing the deal. Currently, the company offers three types of loans to its clients.

- Purchase of House or Flat

- House Construction

- Balance Transfer

These loans have extended to livestock owners, farm owners, and non-resident Pakistanis. These flexible payment solutions aim to assist anyone in Pakistan that requires finances for their housing needs.

Who is Eligible for an HBFC home loan?

Since the program’s primary objective is to facilitate lower and middle-income groups, a strict eligibility criterion has been set. To be eligible for the ‘Ghar Pakistan Scheme’, your monthly income should be below 100,000 PKR, while the ‘Ghar Pakistan Scheme Plus’ requires a monthly income below 175,000 PKR.

Affluent individuals can also apply for a home loan through the ‘Ghar Sahulat Scheme’. However, these loans offer higher interest rates since the target audience of these loans are the lower-income groups.

Moreover, those applying for the HBFC home loans must be salaried individuals, self-employed business owners, and self-employed professionals. For verification purposes, HBFC requires a one-year bank statement, monthly utility bills, and a salary slip.

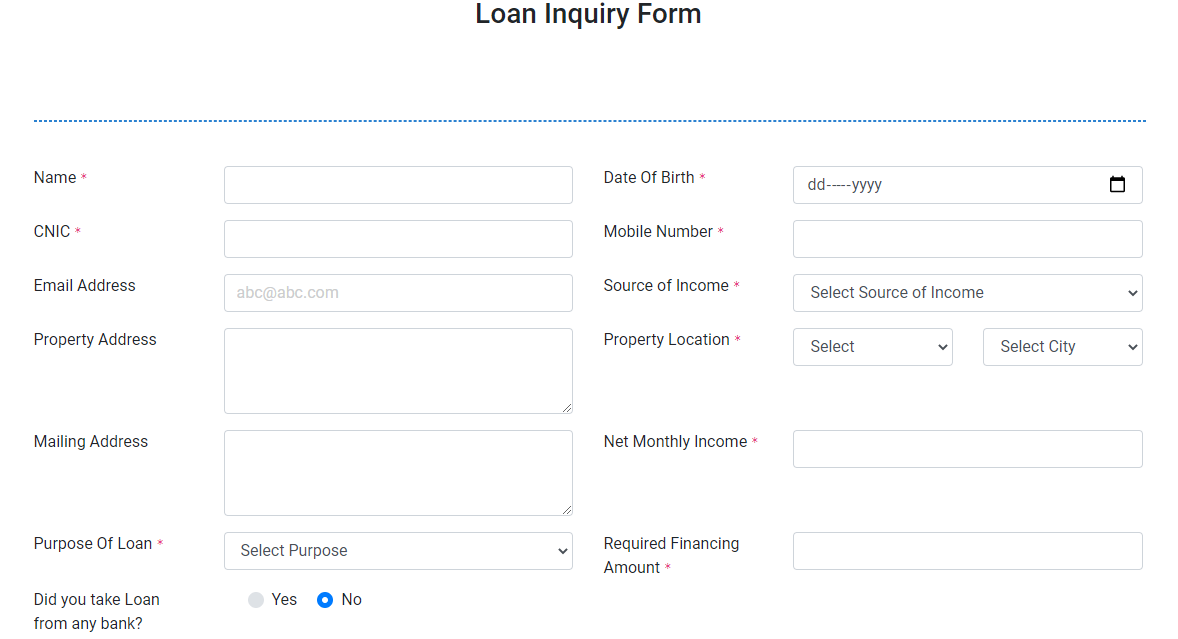

How to Apply for an HBFC Home Loan

Source: HBFC

If you are unfamiliar with the application process for an HBFC home loan, simply follow the instructions below.

- Head over to the HBFC home loans website at hbfc.com.pk.

- Click on the ‘loan inquiry form’ option. This will take you to the next webpage, where you will need to enter your details and other credentials.

- Once the inquiry form has been submitted, the company loan agent will review the application and contact you within two to three working days.

- During the screening process, you can check your loan status on the company’s website at any time.

- After an initial screening of your inquiry, you will need to submit an application with the required documents and other processing fees.

- The next step involves filing a few legal documents for financing and security purposes.

- If approved, the loan amount will immediately be disbursed as decided in the terms and conditions of the agreement.

Pakistan’s real estate market is set to exclude middle- and lower-income groups, making it impossible for them to become homeowners. HBFC home loans aim to combat this exponential increase in prices by providing low-interest home loans with easy installments. For more information, visit Feeta.pk, Pakistan’s first online real estate market.

All About HBFC Home Loans

- Published in home loans, Housing Finance, International, Real Estate Guide

How to Check the Federal Government Employees Housing Authority List

The government of Pakistan has launched several initiatives over the years to facilitate federal government employees. One such perquisite is the Federal Government Employees Housing Authority (FGEHA). The authority is responsible for introducing new housing schemes in the capital and allocating a quota for government employees.

However, accessing the FGEHA list can be a hassle if you’re not familiar with the procedure. To ease the process, Feeta.pk features a guide on how to check the Federal Government Employees Housing Authority list.

A little about the FGEHA

The Federal Government Employees Housing Authority was established in 2019 under the ordinance of the President of Pakistan. The objective behind creating this body was to ensure a safe and secure shelter for the lower-income groups in the capital that are currently residing in impoverished settlements or ‘katchi abadis’.

The FGEHA aims to deliver new housing units to federal employees at low and affordable costs, ensuring every employee becomes a homeowner. Currently, the authority is planning on pushing in almost five million low-cost units into the market, with federal employees being at the utmost priority for the allocation of these houses.

The government hopes that this initiative will be able to tackle the status quo in the country’s real estate market which completely excludes middle- and low-income groups, while extracting immense profits from the ones that can afford it. By pushing more units into the market, the demand for housing will decrease, allowing the skyrocketing prices to descend.

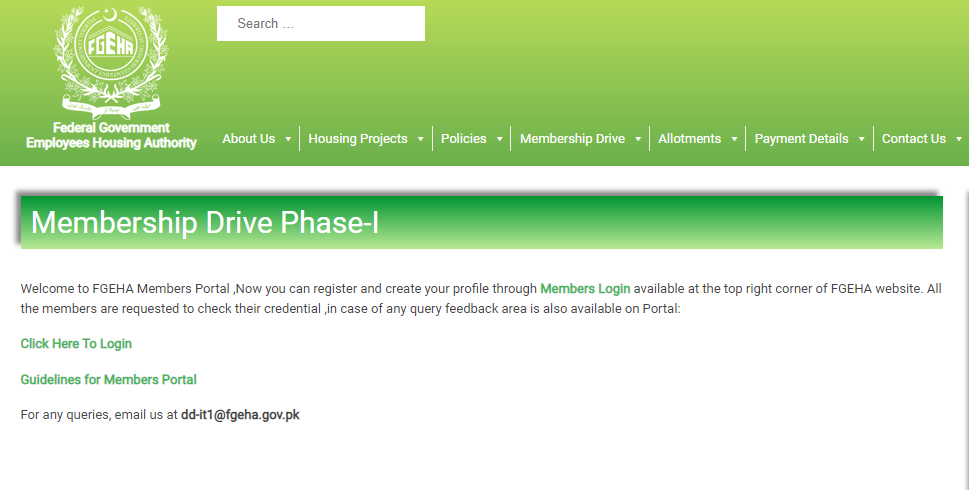

How to Check the Federal Government Employees Housing Authority List

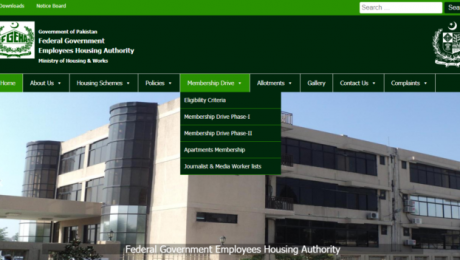

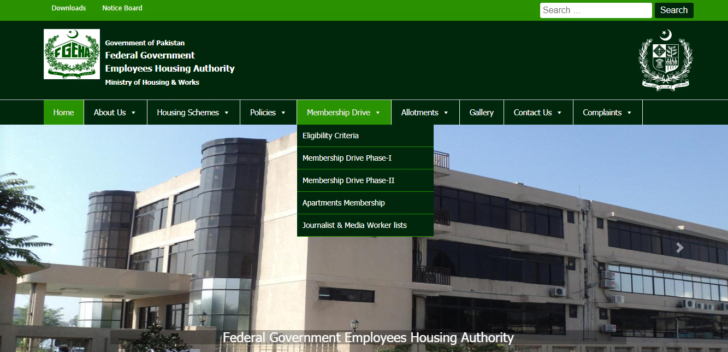

Source: FGEHA

The process for checking the FGEHA list is quite simple. Follow the instructions given below to access the list.

- Head over to the Federal Government Employees Housing Authority’s official website.

- At the top side of the webpage, you will find several drop-down menus. Select the ‘membership drive’ drop-down menu.

- The drop-down list will offer various options for different memberships. Click on your allocated membership program.

Source: FGEHA

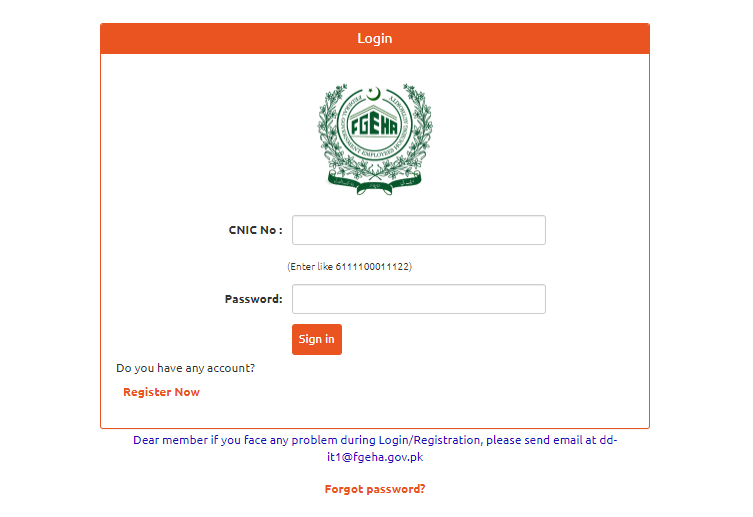

- The next webpage will have the message ‘click here to login. Click on this message and this will take you to the login page.

- Once you reach the login page, add your credentials to the specified fields. Enter your CNIC number (without dashes) and your password.

Source: FGEHA

- After logging in, the details of your membership will be available on your screen.

- If you encounter any issue while logging in or if there is no information regarding your membership, you can file a complaint at ‘complaint@fgeha.gov.pk’ to have the issue resolved.

- For any other issue or query regarding your membership in the program, you can visit the FGEHA office in G-10/4, Islamabad.

Pakistan’s government is known for its generous well-fare programs for its employees. The Federal Government Employees Housing Authority is one of such programs, making way for lower and middle-income employees to become homeowners in the country’s capital. The government is planning to expand the program to allow more federal employees to become part of the FGEHA list in the near future.

For more information, visit Feeta.pk Pakistan’s first online real estate market.

How to Check the Federal Government Employees Housing Authority List

Relaxed Curves Wrapped In Mellow Monochrome Decor

Like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

Relaxed curves and light, soft monochrome decor make a smooth minimalist statement through these two quiet modern home interiors. The laconic color palette presents clear spaces for a clear mind where one can indulge in deep thought and meditation, or enjoy deep conversation without the distraction of abundant color and tense linearity. Huge windows fill these elegant home interiors with blissful sunlight that falls softly on curved furniture silhouettes, huge round living room rugs, subtle decorative vases and architectural arches. Creamy, minimalist living spaces and bedrooms form a cohesive calm everywhere, gently lit by perimeter LEDs. Uber’s sleek modern fireplaces provide a welcoming, comfortable flare.

Our first soothing home interior has a double-height living room with huge windows that bring vast views of the city and abundant natural light. Creamy decoration reflects the daylight deep into the generously sized lounge. A modern fireplace flickers brightly inside its sophisticated understated fireplace.

Did you like this article?

Share it on any of the following social media below to give us your voice. Your comments help us improve.

For more information on the real estate sector of the country, keep reading Feeta Blog.

Relaxed Curves Wrapped In Mellow Monochrome Decor

Essential Info on Mortgage Housing in Pakistan

Pakistan has been one of the most difficult countries to secure a home loan. Very few banks offer and eagerly market mortgages, and those that do often have tedious and daunting conditions. As a result, home mortgages in Pakistan have historically been as low as the equivalent of just 0.3 percent of the country’s total gross domestic product (GDP).

However, this figure has started to improve gradually due to the initiatives of the ruling government aimed at moderating the access of Pakistanis to home ownership. The government of Pakistan has launched an ambitious push to build 5 million affordable homes under the Naya Pakistan Housing Scheme and consequently relaxed various bank rules governing mortgages, making it more convenient for poor families to secure home loans.

What is a Mortgage?

The term mortgage originates from the financial system of lending. It is a typical loan that is used to buy or keep a home, land or other types of real estate. In mortgage financing, the borrower unconditionally agrees to pay the lender over time, normally in a series of consequential payments that are secured to form a figure higher than the original amount of the loan. The property itself serves as collateral to secure the loan.

A borrower must apply for a mortgage loan through one of the trusted lenders, ensuring that the necessary conditions and requirements are fully met including minimum credit scores and down payments. Mortgage applications are passed through a rigorous insurance and review process before they are approved. La types of mortgage loans vary according to the needs of the borrower, for example, conventional and variable loans. However, in countries like Pakistan, mortgage financing is restructured in light of various principles in line with the banking system and economic dynamics of the country.

How mortgages work

Individuals and businesses around the world are using the mortgage finance model to buy real estate without having to pay the full purchase price in advance. The borrower repays the obtained mortgage loan with an additional amount for a defined period of time in a series of regular payments until they own the property free, clearly and by all legal means. Mortgages are also known as property claims or foreclosures against the property. If the borrower fails to pay or fails to pay the mortgage, the lender has the right to foreclose on the property.

The Mortgage Process: How to Apply for a Mortgage?

Home mortgage lenders begin the process by submitting an official application to one or more mortgage lenders. The lender requests proof that the borrower is quite capable of repaying the loan. This index may include bank statements, the most recent tax returns, and proof of current employment. The lender will also do a mandatory credit check.

If your required credentials are complete in all respects, and therefore acceptable, the application is approved. The lender will proceed by offering the required amount of loan at a certain interest rate. However, the fixed interest rate is a reason why many people in Muslim countries strongly oppose the acquisition of bank loans. Alternatives to interest, like other financial models, still lead to convincing people.

If the question in your mind is how I am pre-approved for a home loan, then the answer is simple. Homeowners can also choose to apply for a mortgage after choosing the property they are looking to buy or while they are still. in the hunt for the right property, this process is known as pre-approval. Being pre-approved for a mortgage can enable buyers to keep a margin in a demand-sensitive housing market where sellers need a full guarantee of whether the buyer will have the money to back up their offer.

Once a buyer and seller agree on the terms of their property, they or their real estate agents meet at what is called the closing. This is the meeting where the down payment is made by the homebuyer or on his behalf to the lender. Once the down payment has been received, the contract stating all the terms is signed and the seller agrees to transfer ownership of the property to the buyer and receive the mutually agreed amount of money. Therefore, the buyer signs any other mortgage documents as needed.

Purposes and types of mortgage loan

A mortgage loan is obtained by borrowers for multiple purposes; however, all of the mortgage loan applications fall within the real estate sector. These loans serve as an aid in buying property. Some of the most common mortgage types and types include:

New home construction

This type of mortgage loan is extended to people who already own a piece of land and need financial support to cover the cost of building a mortgage. house on that earth. The disbursement of this type of mortgage is made in installments during the construction phase by appraisal of the Invoice Amounts (BOQs) submitted by the mortgage applicant duly audited by an approved appraisal agency authorized by the bank.

Purchase of land and construction

This form of loan is given to customers who are looking to buy land with the aim of building a house on that land. The disbursement of a certain amount of this loan is made on the purchase of the plot by the customer, and then the rest of the amount is released in installments during the construction phase by estimating the Invoice Amounts (BOQs) submitted by the mortgage applicant. duly audited by an approved rating agency authorized by the bank.

Home Purchase

As its name suggests, this type of mortgage loan is obtained for buying a house that is already built. This can either be a pre-owned house or in the other case a newly built one.

Renewal

This mortgage loan is extended to those who already own the home ownership, and need funding for renovation. The disbursement of this loan is made in two installments after the borrower has provided BOQs duly audited and authenticated by an approved rating agency authorized by the bank.

Home mortgage in Pakistan

A recent study by Pakistan Housing Finance revealed the fact that there is a healthy demand for home mortgage loans in Pakistan driven by upper-middle-class families in various cities of the country. The report studied 26 Pakistani cities and found that with the right products, systems, financing and less stringent conditions, lenders could possibly have around 500,000 new borrowers. The study set the probative value of the mortgage market at about $ 4 billion with growing inflows into the country’s financial system driven by favorable government incentives.

Various institutions in Pakistan offer mortgage loans. If you are wondering how to apply for a mortgage loan, all you have to do is trust the information on this blog and visit any of the banks that offer mortgage loans in Pakistan. Some reliable banks that offer decent mortgage products with unbiased terms are Bank Al-Habib, National Bank of Pakistan, Standard Chartered, Askari Bank and more. Some other forums where you can get reliable information about mortgage loans in Pakistan include:

Pakistan Mortgage Refinancing Company (PMRC)

PMRC is a Mortgage Liquidation Facility established by the State Bank of Pakistan to address the long-term financing limit in the banking sector and to promote housing finance to the fullest. PMRC serves as an assured source of long-term funding at competitive rates. You can visit the PMRC website to learn more about mortgage financing.

Home Construction Finance Company (HBFC)

Established in 1952, HBFC is the only housing finance institution in Pakistan set up by the Government of Pakistan. Its services are focused on providing funding for the housing needs of lower and middle-income citizens. HBFC serves through its deep-rooted and national footprint of 51 Branches serving citizens across the country.

Conclusion

Real estate mortgage loan in Pakistan has never been a popular choice historically. This is because Islam strongly prohibits both borrowing and lending money in exchange for interest, which means that borrowers end up paying a much higher amount against the figure actually acquired. Therefore, the majority of Muslims prefer to avoid typical mortgages when buying property. Instead, they go for alternatives like rent or rented houses.

However, in recent times, with government initiatives and incentives aimed at helping the lower middle class buy a home of their own, we have seen a significant increase in the number of mortgage loans obtained during the ongoing financial year.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Essential Info on Mortgage Housing in Pakistan

- Published in Housing Finance, International, Real Estate Guide

Build a house with a limited budget

Owning a home is often viewed as a dream. It happens to many people that the construction of their dream home exceeds their budget limits. In other words; it’s not in your power to build now everything you’d like your new home to have. However, this dream can be easily achieved with dedication and long-term planning.

There are many materials or construction techniques that are less expensive and can lower the budget by a few zeros. These tips and tricks can save you money while building a house in Pakistan. Therefore, it is safe to say that building a house with a limited budget is possible.

In this blog, we bring you a selection of tips and tricks that you can use to lower the overall costs of your house.

Before starting with the purchases, it is necessary to have a detailed calculation of the required materials and the exact quantities. This is important to avoid buying more: this involves a higher cost because there is no possibility to negotiate a reasonable price for a quantity.

Al saves money when building a house, you need to be properly informed. Only then will you know what to expect and be able to better manage your resources. Don’t go payment about hiring without knowing exactly what you want; this will only make you lose money.

Ideally, you should dedicate yourself to researching the professionals who carry out this type of project, their work history, what tasks they perform or what their main duties are. It is also necessary to find out their professional fees to deal with various options, compare prices and ultimately make better decisions.

One of the biggest secrets we can share with you to save while building a house is that you work only with honest, trained and experienced professionals. If you don’t, you’ll most likely end up dealing with construction errors that will cost you a lot of money in the long run.

Honest professionals (from architects to builders) will focus on helping you and avoiding wasting your resources. This means that they will not be with you out of sheer financial interest, as they are sincere, loyal and honest professionals.

Sign a fair contract with the construction company:

If you are determined to save money when you build a house, you need to be clear that the contract with the construction company can have a profound effect on your budget. Construction is responsible for most of your budget as it is usually up to 80% of the total budget in most cases.

There are other residual expenses, such as a geotechnical study. That’s why you need to make sure that you sign a fair agreement with the construction company so that you don’t end up paying more than the bill.

To do this you need to get advice from the architect and the surveyor, which is why they should be independent of the construction company.

It has become one of the most preferred elements to build modern houses. On the one hand, it saves costs by covering the walls with plaster or cement, and on the other hand, they have become one of the essential pieces of the industrial style and even the minimalist, in some cases. In addition, it is a very durable material that does not need maintenance.

Concrete blocks are in vogue and are a great choice to build your house. It is a cheap material made of cement, water, and sand; it is highly resistant to any environment. You can create great architectural designs with concrete, including spiral staircases and Roman columns.

Install constant insulation

Renewing insulation every two or three years is a big mistake because it will cost you a lot of money. Therefore, if you want to save by building a house, you should install permanent insulation on the thick work.

For example, the foundation could be covered with special waterproof paint and the walls with polystyrene or fiberglass.

The roofs could be covered with wooden or ceramic tiles, which overlap like tiles and which act as excellent insulating and waterproofing agents.

Environmental insulation is ideal for taking care of the environment, but we recommend choosing more affordable materials if you plan to save as much money as possible.

Trying not to put on good insulation to save on the work is typical. In the long run, you will get exactly the opposite of what you are looking for, as you will spend a lot more on air conditioning, in addition to unnecessarily damaging the environment.

Avoid excessive walls and doors.

Excessive wall construction, as well as the extensive installation of doors in your new home, can significantly inflate your budget.

Assess the possibility of hiring an open concept design mainly because you could spend more time at home in the future because of the severe health crisis we are experiencing because of Covid-19.

Avoid enclosed spaces when choosing constructions that offer you a greater sense of spaciousness and freedom. That way, you won’t feel trapped in your own home, and you will also save good money during the construction phase. Additionally, you will not have to make any reforms in the future that will also be favorable to your finances.

Because this is the most basic and essential part of any construction, experts do not recommend maintaining it. It’s better to invest in the desired amount using a perforated foundation, where unique columns are drilled into the ground and then filled with concrete. Then, a monolithic grid is installed above the ground. There is still a minus sign: if the soil has a different density in one place or another, there is a risk of collapse of some pillar. Therefore, soil analysis is done in advance.

There’s another great option – this is a streaked foundation. It has a great support area, which makes the foundation more reliable. The base will not crack while it is fully settled, even with a small landing.

Choose affordable and durable materials.

Choosing affordable and durable materials is also a great strategy to save money while building a home.

Be sure to choose the ones that suit the climatic conditions of the place where you will live, to be comfortable all year round in your new home. Bricks and concrete blocks are two great cost choices, and the best part is that they are more affordable than many other building materials. After all, it’s not about offering style, beauty and elegance when you build your home with cheap and durable materials. Keep in mind that you can achieve incredible results if you work hand in hand with high-profile professionals.

It’s a great way to get a perfect floor that is decorative and cheap: smoothed concrete. This is completely smooth to a uniform appearance. You can use it in a variety of ways. Mix it with a few tiles for a more fun touch. Another alternative is to mix the cement with colored pigments to have a different color. Finally, you can leave it with the base color of the cement to make it look perfect.

So, here are some things to look for when selecting yours to build a house on a limited budget in Pakistan. Read this piece and try to incorporate these tips into tricks to build your house.

If you have any other questions or suggestions, leave a comment in the comments section below, and we’ll get back to you as soon as possible.

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

Build a house with a limited budget

- Published in Housing Finance, International, Real Estate Guide, Technology

Pros and Cons of Homeowners Association

If you want to understand the pros and cons of HOA living, you must first understand what HOA is, what they do, and how they affect homeowners.

HOAs – what are they? This is a common question. The term simply refers to homeowners’ associations. An association of homeowners manages a community for the benefit of its residents.

What does HOA mean in Housing?

Homeownership associations exist to manage residential communities, keep a limited appeal, and keep property values high. In addition to maintaining boundary appeal and preserving property values, associations of property owners manage residential communities. Home developers are the ones who initiate the association.

Following legal advice, the programmer drafts the governing documents of the association. Regulations, amendments, rules and regulations, and articles of incorporation are among the documents.

Simply put, it lives in a house that is part of an association of homeowners. Although there are many benefits to living in HOA, it may not be for everyone. Living in an HOA community, for example, gives you access to amenities you wouldn’t have otherwise.

What is the purpose of HOA?

As soon as you transfer to the homeowners association, you become a member. HOA’s governing documents are automatically applied to you as an HOA member. The documents outline what you are and are not allowed to do as a homeowner. Rules like this help keep property values and keep neighborhoods safe.

Managing an HOA involves taking care of the best interests of the community, enforcing rules, and setting the amount for fees. A review of the HOA’s governing documents is recommended before transferring to a homeowner’s association.

You will be able to get acquainted with the covenants and rules that must be followed if you relocate. Before you decide. Buy or luo house within the community, it is a good idea to determine the health of the association.

Advantages of HOA

Here are some benefits of HOA to help you make a decision.

1. HOAs are responsible for the maintenance of common areas

The aesthetic appeal of a well-groomed community extends to the ease of living within it as well. A landscape without rubble, trimmed trees and blooming flowers bring harmony and peace. The well-being of a community is important, and it is comforting to know that these services exist.

The benefits of living in a community with HOA include shared community areas maintained by the organization. Landscapes, swimming pools, playgrounds, barbecue areas and community centers are included.

The spaces can be enjoyed without having to worry about maintenance. In addition to preserving the landscaping in front of each unit, some HOAs also maintain landscaping in the backyards of residents.

2. Consistent value for each property

Property values are a major reason people buy into HOA. Your board helps protect your investment and ensures that its value remains the same. It is the responsibility of the owners to maintain their lawns, homes and personal property in accordance with community law. There are many benefits to a homeowner, but there are also many benefits to the community as a whole. The board members live in the same community, and they are just as eager to see it thrive as you are.

3. Complying with standards

Every homeowner should follow certain guidelines. Before signing on the dotted line, buyers should be familiar with the prevailing documents. There is not much tolerance for uncontrollable behavior in a typical association, from a wild party in someone’s yard to a distraction from architectural guidelines. The neighborhood has a board that mediates neighborhood disputes and presents consequences when things don’t work out.

Disadvantages of the United States

Let’s look at the disadvantages of HOA.

1. HOA fees must be paid monthly

Residents of the community have to pay HOA fees because the HOA maintains the common areas and exteriors of homes.

The fees for these amenities vary from community to community. In addition, HOA fees are not fixed, so they may change from time to time. When it does not raise enough money to keep the community going, the association may have to increase the monthly fee.

2. Failure to pay HOA fees can have serious consequences

Paying your HOA fees is an important part of living in a community. The state in which you live will determine whether you can be executed for failure to pay HOA fees. The amount you owe will get until you pay, even if your state does not allow foreclosure in these circumstances.

Fees must be paid by all residents of the community. If the HOA cannot raise enough money from residents, the property may not be properly cared for. Because of this, a community may have to fire its property manager, making the appearance and condition of the community worse. The impact can be negative on the value of the community.

3. Rules and regulations are implemented by the HOA

In the event that the monthly HOA fee is affordable, paying these fees may seem like a minor inconvenience. You should understand, however, that the HOA sets requirements for the appearance of your home regardless of whether you agree with the fee. In addition to what front door and windows you can have, they decide what color to paint your front door or shutters. You may even be limited in how much exterior decoration you can use and how many vehicles you can park in your community. If you violate the rules and regulations of the community, you could be fined.

4. Inadequate management

Poor management can lead to deterioration in some HOA communities. As a precautionary measure, electing board members who have the best interests of the association in mind is the best way to avoid such a situation. In addition, many HOAs hire a management company to ensure that responsibilities and duties are properly met.

5. Executions and custody rights

Care or execution is always a concern when living in an HOA. There are certain HOAs that can put worries on your property and then exclude it. The custody will only take place if your membership fee is not paid.

Conclusion

It is important to consider the pros and cons of living in an HOA before making a decision. Paying monthly fees and adhere to HOA community rules are required. You will also benefit from things like preserving your property value and being able to access well-preserved amenities (such as landscaping). In the long run, you will benefit more from HOAs if you can tolerate the small annoyances they bring.

In the same way, homeowners can benefit from HOAs, HOAs can benefit from professional management services and vendor assistance. Browse the comprehensive HOA Management directory to find the right services.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Pros and Cons of Homeowners Association

- Published in Housing Finance, International, Real Estate, Real Estate Guide, real estate market, Real Estate News