Why Real Estate: Best Global Investment?

When we have money, many options for the best Investment come to mind. Like investing in the stock market, forex or commodities, these days cryptocurrencies are another good choice or you can just put your money in the bank or mutual funds and so on. These are good businesses, some of which can even be profitable, but almost all of these investments have a high risk potential. A successful and profitable business is one that is driven by your passion. When you put your passion into something, it brings you joy and comfort and becomes a symbol of success for you. It keeps you motivated and you continue to learn and invest in such an entity.

Real estate is easily the number one choice for any investor. You will never find a person in any corner of the world who says he has no interest or confidence in real estate. Firstly, real estate is a necessity for every person in the present day, secondly, it is the most valuable physical asset and thirdly it comes with minimal risk.

About 15 to 20 years ago, Kodak was worth billions of dollars, but where is it today? Nokia used to dominate the mobile phone world but now its share in the mobile phone industry in the world is negligible. There are so many examples of such enterprises that could not adapt to the modern world and have now disappeared.

However, one entity that has been in constant operation for decades, centuries, and thousands of years is now a property. Real estate is a proven tool to earn passive income without the risks involved. What’s even better is that you can improve the profits of your real estate investments with good management just like any other business.

According to various researches around the world, real estate has been declared the non-1 passive income investment in the world. In almost all the research I have studied real estate is placed first or second place. There was not a single search that ranked real estate in the third position or below. All their research has shown that real estate is a minimum risky investment. The wheel does not need to be reinvented now by any person/party because it is a proven fact by the world’s leading economic researchers.

Take a look at this ranking of Financialsamurai.com, real estate is at No. 2 and No. 3, where the RECs, REITs, etc. are placed at No. 2, which are also real estate investments, and physical real estate is ranked at No. 3 with a 45 score. The higher the score, the better it is, a risk in physical property is noted at 8, which is only a second after putting your money in the bank. This is obviously related to the US market because in Pakistani real estate market will most certainly top the list.

Whether you are investing in a portfolio or a passive income, real estate is the best and highest investment in the business world. You are no longer creating land and our population is accelerating. In 1900, the world population was about one and a half billion but in just a matter of 122 years in 2022, it is close to 8 billion and is growing exponentially. In the next 50 years, the world’s population is expected to be around 11 Billion.

Real estate is therefore a necessity, as everyone needs shelter over their head.

Many people will beg to differentiate and believe that stocks can offer a better return. I urge you to differentiate, especially in the Pakistani market. Real estate especially rental real estate is the only option that can give you 15 to 20% annual return without putting much at risk. It is a tangible physical asset and is suitable for every type of investor.

Every physical investment in real estate you make is headed by you as CEO. As a CEO, you can make improvements, reduce costs, increase rent, find better tenants, and market accordingly. Real estate is something you can see, feel and use. Life is about living, and real estate can provide a higher quality of life. Given that we all spend much more time in our homes due to the pandemic, the internal value of the real estate has greatly increased. When the world is over, you can look for shelter on your property. Real estate is one of the three pillars for survival, the other two being food and health.

The most important factor in favor of real estate is that it is much simpler and easier for everyone to invest in. Real estate makes more millionaires than any other asset class in the world.

One of the biggest mistakes most investors make over time is speculation, one wrong decision can end in bankruptcy for many. Bill Hwang, CEO of Bows, who lost $ 20 Billion in 2 days, is a classic example of such damage. Shares that were the reason for his enormous wealth turned out to be the reason for his ultimate failure as well. You can read the full story at Bloomberg.

The money that comes from such speculation in stocks follows a vicious cycle where you end up losing what you have earned. The temptation finally takes over at some point and you risk everything.

Real estate on the other hand can be risky when you speculate but due to its tangible and physical nature, it will never be the reason for your bankruptcy. It is therefore best practice to actively manage your business and/or invest in intangible assets for passive income while maintaining at least a 50% portfolio in rental property and real estate.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

Why Real Estate: Best Global Investment?

- Published in Learn the game

How Rich People make easy Money | Rental Income Solution

How Rich People make easy Money | Rental Income Solution

I’m sure you’ve often wondered how some people seem to succeed in life with minimal effort. And to some, it seems like a constant struggle. Well, unless you’re lucky enough to be born into a billionaire family, most people spend their lives working hard just to succeed. So why do some people always seem to get rich in life while others spend a lifetime chasing after their wealth ?.

Right now, you’re probably trading time for money. Most people’s jobs involve being paid for their time at work, trading expertise in exchange for a salary. Think about all the time it takes to build a business, the time in the office, the hours to answer calls, strategic meetings, networking, chasing customers. It is exhausting and labor intensive.

Why do the poor stay “poor”

So, we all know what poverty looks like when people can’t cover their basic expenses for life. They have difficult choices just to pay their rent or their bills. They spend their lives chasing money like a rat in a cage. Instead of investing in themselves and trying to improve their situation, they are reluctant to take risks and seize an opportunity because they are worried about the future. But the truth is most people don’t feel equipped to face challenges and so can often vent their frustrations by blaming others – politicians, bad luck, and so on. The poor want wealth, but they don’t know how.

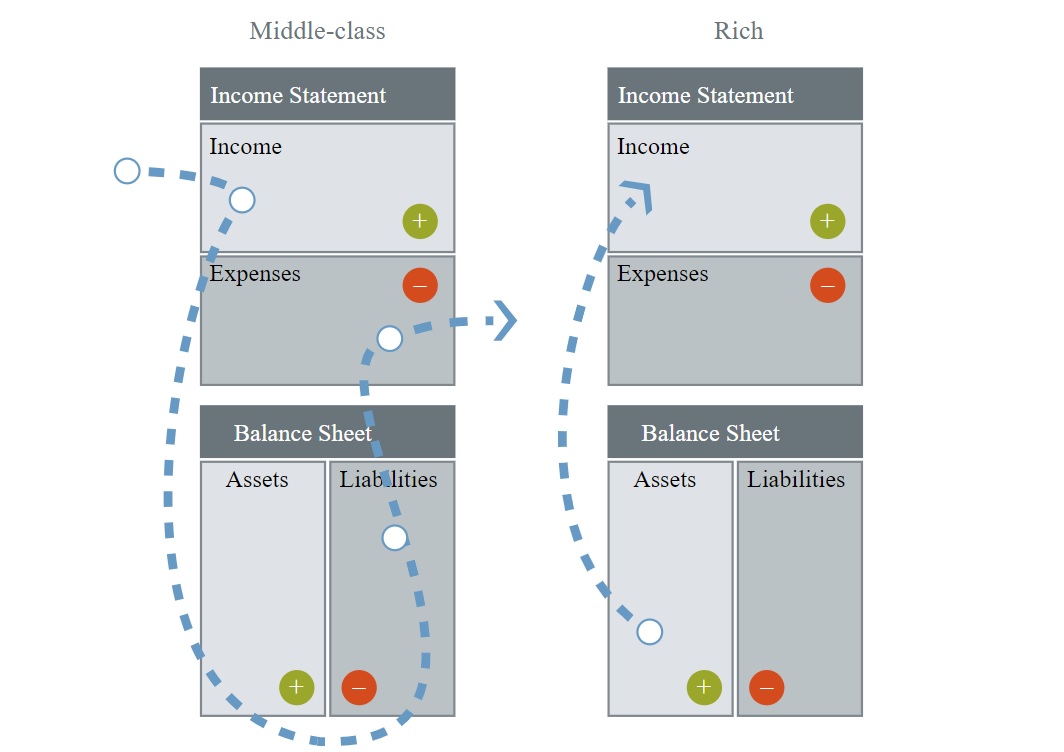

Why the middle class remains “poor”

And then there’s the middle class. They have disposable income and savings. They work hard and aspire to be rich. But they often never quite reach that next financial level.

Imagine. You have a monthly income available. So you buy the latest technology, a new car or a vacation to indulge yourself. And that’s where you make a mistake that costs you the opportunity to get rich.

When things lose their value, that’s called depreciation. And that’s what drags you down. The technology will quickly become obsolete. That beautiful watch is worth less than half as soon as you walk out of the store. The car will quickly lose its value. The holiday will be a distant memory. These are not good investment choices. You are caught up in a cycle of working harder and harder just to keep things as they are.

For short-term gain, you lose the opportunity to enter the next financial bracket and become really rich. The car needs repairs. The technology needs to be replaced. You feel pressured to maintain or even outdo your lifestyle. This lifestyle costs you more and more money. When things cost you more in the future, it’s called responsibility.

So how do you get rich?

Rich people make their money work for them, while the poor work to make money. Wealthy people learn to invest wisely in assets that are going to make them appreciate and give them a positive cash flow.

Paul Getty, the world-famous billionaire, famously declared,

“The key to wealth is learning how to make money while you sleep.”

So, what is he talking about? Sounds like a fairy tale. Not at all. It’s a smart way to make money, and it’s called “passive income.”

Passive income is a smart way to make money and free up your time. It is the gain of wolf ownership, limited partnership, shares, stock or other business in which a person is not actively involved.

Definition of asset and liability according to Robert Kyoski

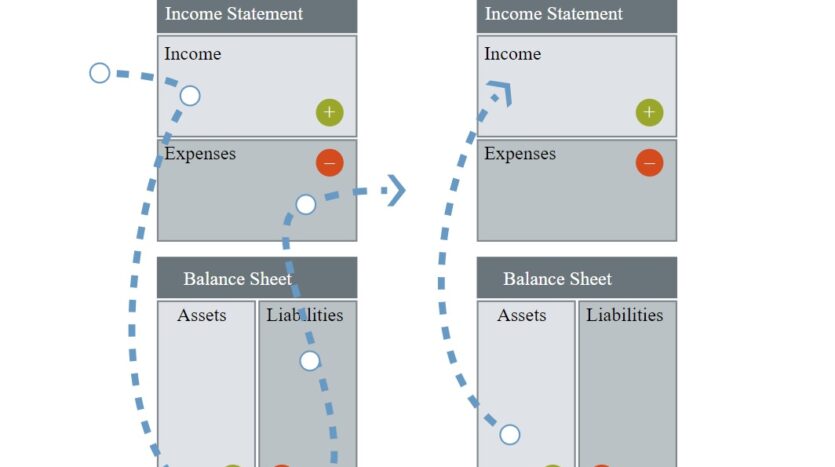

As Robert Kyoski explains in his book “Rich Dad, Poor Dad,” the biggest mistake most middle-class people make is that they continue to gain compensation by believing that these are assets.

La asset it’s something that increases in value and puts money in your pocket every month, giving you a regular cash flow.

Responsibility it’s something that takes the money out of your pocket.

Your house, for example, is not an asset but a liability by Roberts definition the plots and files you have purchased are passive also. You will pay for its maintenance, taxes, development costs, non-construction penalties. Only if you are able to sell it profitably will it become an asset or if they are paid for with your passive money. Until then, although they may increase in value over time and give you capital gains, which is not always the case, you pay for them and that classifies them into liabilities.

Conversely, rental property can be valuable if you do your due diligence correctly and are able to collect more rent than you have monthly costs. The difference between the rent and the expenses is the net operating income, and it is a cash flow that flows into your pockets every month. Therefore, it is a valuable asset.

I can tell you that cash is king. Assets do not pay bills; cash does! Robert K’s definition of an asset is not accurate from an academic point of view, but to define the types of assets to focus attention on, he is correct.

So, really, you can call yourself rich only if your assets pay off your liabilities, expenses and also generate capital for you to get more assets. Now you don’t have to work for money but your money works for you.

That’s why if you continue to collect assets that are passive, you will continue to pay for them until you die and while it seems your net worth is rising, it can’t pay for your monthly expenses or your lifestyle, and the profits are only realized when you sell. it.

The safest investment property

Partnerships can be sour. But real estate tends to rise steadily and can provide two streams of income: rent and capital growth. If the market is stagnant, you can always rent a property and continue to make money “while you sleep”.

And what kind of passive income has the least risk? Lua Farm, of course.

So the safest way is to invest in real estate. As the old saying goes, ‘Nothing is as safe as houses. With some expert help in choosing an investment property, you can double your money. How? Because you can rent the property while it is constantly increasing in value. So you literally make money while you sleep. And even better, you can invest your rental income from your assets and invest after the next investment opportunity.

This is how the rich move up and up. They make easy money rental income, see how their carefully selected property is also valued in value, and then move on to the next project. Such an investment is called ‘passive income ‘– where there is an initial cost but then the income stream does not require you to spend time enslaving it every day. It leaves you free to spend your precious time in an easy life, or look for the next opportunity,

Work Wiser NOT Harder

You can’t help it if you weren’t born with a silver spoon in your mouth. You may have a ‘comfortable’ lifestyle but wonder how you can become really rich. The lesson is that you need to actively take calculated risks. No one will offer it to you on a silver platter. You need to put in some initial time, money and research and then sit back and enjoy the results. Invest in a property that will not only be worthwhile but will also earn you rental income. You can use your assets to continue your next project.

And then you can enjoy what it really means to be rich.

Time is precious | Lua income solution

It’s not about working 50 years of your life during a few years of retirement. Have the constant stress of being tied to your desk, to the phone, juggling investments, and constantly watching the stock market returns.

Time is the only thing we can’t buyback. Passive Income is about saving time. It’s about making smart investments that work for you in the background .; quietly earning income. So you can spend your precious time earning more money if you wish. Or enjoying your life to the fullest for as long as Allah wills.

For more information on the real estate sector of the country, keep reading Feeta Blog.

How Rich People make easy Money | Rental Income Solution

- Published in Learn the game, Real Estate, real estate business, real estate buyer sales

Exposing the dirty secret of Pakistan real estate | Black money and FBR values

Aiming at the dirty secret of Pakistani real estate “black money”. The FBR has announced new land valuation tables and has been revising property prices across Pakistan since March 2022. Many people do not understand what these prices are and why they will affect certain sectors of the real estate market. So in today’s blog, we’ll try to explain to you the concept of these FBR values, why they were introduced, and how they can affect real estate and prices in the future.

Please note that FBR values are not the only factor to consider when analyzing real estate prices and it is best to consult a professional consultant before investing.

When FBR values were launched in Pakistan

In 2016, FBR values were first introduced by the Nawaz Shareef Government when Dar, the finance minister, launched the FBR assessment tables in the 2016-17 budget. Stakeholders initially rejected the idea. However, the government and real estate later agreed, and the appraisal rate was initially released for only 12 cities on July 31, 2016. Coverage increased to 20 cities in 2019 and 40 cities in December 2021. FBR price was introduced in 20 cities. for the first time. This is significantly higher than the price of District Collector (DC), but of course below the market price.

Why do we need the FBR Land rating chart?

The new FBR values are used to calculate federal taxes such as capital gains tax and withholding tax. Pakistan has three real estate appraisal rates: FBR rate, DC rate and the real rate. Internationally, real estate transfers are taxed at actual transaction amounts, but in Pakistan, real estate was taxed at DC values by 2016, and later, federal taxes were taxed at FBR rate, and provincial taxes are collected at DC rates which both are. below real market rates even today.

The FBR value is used to determine the following:

- Taxes payable to the federal government.

- White money statement according to the FBR land value at the time of purchase.

So when FBR values increase, property taxes increase. Second, the white money needed to carry out that transaction increases. While both of these affect real estate trading, the white money statement is much more important and has far-reaching consequences.

The dirty secret of Pakistani real estate

The Pakistani housing market has long been a safe haven for billions and trillions of black money, which is part of our informal economy. Almost every corrupt individual in our society parks his or her poorly earned money in real estate. In addition to this, industrialists and entrepreneurs will park huge amounts of untaxed money in real estate. This has transformed our real estate industry into the 21st century as it has become an easy source of hiding undeclared or black money.

The other important part of introducing FBR values, then, is to stop this black and undeclared money from ending up in real estate.

To understand how real estate is the refuge of black and gray money, let us assume that a certain property has a market price of 1 crore but an FBR value of only 30 Lacquers. This means that if you pay 30 lakhs to the seller through the banking channel and the remaining 70 lakhs with cash, you have successfully invested 70 lakhs in real estate that is poorly earned or untaxed. Now when you sell the property after a certain number of years and declare the extra money as profits, it will become your white money.

How it affects Pakistan and its economy

Land developers in Pakistan soon realized that there is a huge potential for new real estate development to attract this black and gray economy. These new developments would experience the rapid business and speculative cycles, making them even more attractive to investors. Now, not only can they easily invest black or gray money in real estate, but they also have a chance to make money through speculative trading.

Simply put, a corrupt employee, a drug lord, a terrorist, etc. can easily park all their ill-gotten money in real estate, and a businessman can easily defraud taxes by investing in real estate. Real estate in Pakistan has served as a lasting amnesty for all these people to save and invest their undeclared money. This resulted in significant price bubbles seen in 2002-2005 then 2011-2013 and now in 2020-2022 after the tax amnesty was given to the construction sector.

Now that property prices are rising, white and declared money is also being invested in these areas and offering an easy money-making opportunity. As a result, our industrial and manufacturing sectors have suffered as investors have felt that real estate in Pakistan is easier and safer than a developing industry, and is shifting their investment to real estate, especially in the last two decades.

Impact of FBR values increases

If the FBR value increases, the white money needed to buy certain land increases. We all know that our informal economy, which includes this black money, is around 50% so we can assume that real estate transactions will be reduced by 25 to 50% in the coming years. This effect will be more neglected in sectors where FBR value has increased and is around 60 to 70% of the market price. Any subsequent increase will further decrease these transactions in affected areas. Overall, since March 2022, I have seen the following effects on some of the real estate sectors:

- The recent increase in FBR values will reduce transactions of residential plots in certain phases of DHA Lahore. This can result in very slow growth or negative growth in the coming years.

- Business plots and rental locations in DHA Lahore will thrive due to the huge difference between FBR values and actual market values.

- FBR land value will not affect the prices of DHA Multan, Gujranwala and Bahawalpur as there is a negligible increase. Rather, we may see an increase in real prices as speculative traders move to these areas.

- Construction projects will become more attractive to investors, especially those registered with the FBR amnesty scheme.

- End users and wolf holdings in mature areas will continue to thrive.

If your company or city is not included in the above analysis, you can use the above logic to find out the effect of an increase in FBR values. However, FBR values are not the only factor you need to consider when evaluating real estate and may not be 100% accurate. So, please consider other factors such as development, current prices, market sentiment, etc. before investing.

The team of our experienced consultants is always here to help you choose property investments wisely.

Advice for investors

In the future, Government will take more stringent measures to direct this informal economy to industry and manufacturing. The government has already granted amnesty to these sectors and the roadmap is now clear. The market is already expecting more real estate taxes and a further increase in FBR values in the next budget. While some of us may not be happy about the rise in FBR prices, in the long run, it is very good for the real estate sector of Pakistan. A prosperous economy will create more wealth for the people of Pakistan and strengthen their purchasing power to invest in real estate.

We, as patriotic Pakistani, should support the Government of Pakistan in its action against corruption and tax fraud. Prosperous Pakistan is in everyone’s favor and will end up in a prosperous real estate in Pakistan as well. It is, therefore, best to invest in real estate, which is not the center of such black money and is unjustifiable by stricter government repression against the informal economy and black money.

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

Exposing the dirty secret of Pakistan real estate | Black money and FBR values

- Published in Learn the game

Maximizing Time and Money: Passive Income

Creating wealth is a fairly simple relationship between time and money for Passive Income. Time is the most valuable commodity. It’s only 24 hours a day. Time can never be recreated or re-used. It existed once, then it disappeared. And that’s why building a passive income is so important – because time is more valuable than money.

Even the richest man in the world cannot replace the time he has lost or wasted. Time certainly does not discriminate. It’s the biggest equalizer, we all have limited time and can’t buy any more.

Time is money

Time is credited as the most valuable commodity. So precious that you can’t buy more. Once lost, it can never be refilled. Time is also the commodity that people most often waste. Every activity we do in this world, such as jobs, business, learning skills, building relationships, watching movies, hanging out, clubbing, etc. requires your time in return.

The average life expectancy in Pakistan is 25000 days, if you are 40 years old, you have already lived 14600 days and only received 10400 additional days. Considering that most people work for a living, exchanging time for money, this precious commodity must be prioritized.

Financial freedom

Before we move on, it is important to understand the concept of financial freedom.

Financial freedom means having savings, investments and money to provide the kind of life we want for ourselves and our families. It means increasing our passive income to enable us to retire or pursue the career and dreams we want instead of being driven by our need to earn a fixed salary every year. When you are financially free, you let your money work for you rather than vice versa.

The road to financial freedom is not a get-rich-quick strategy. And financial freedom does not mean that you are “free” from the responsibility of managing your money well. All bad. Having complete control over your finances is the result of hard work, sacrifice and time. And all the effort is worth it!

Types of income in relation to time

There are mainly two types of income:

Active income

Active income consists of income that you earn while you work full-time or run a business. This type of income involves a direct exchange of money for valuable time. This involves the time it took you to acquire that set of specific skills that made you suitable for that particular job or business.

Passive income

Passive income is income from real estate, rent, limited partnership, dividends, shares or other businesses in which a person is not actively involved. Maybe become more productive without spending a lot of the most precious commodity you have “TIME”.

The purpose of passive income is to make money while you sleep. Here’s how to make your assets work for you. You invest time in building something ahead that will generate revenue along the way with little effort on your part.

Building Passive Income is the most important factor in getting rich. This eliminates your ability to earn from the limited time you have in one day. With passive income, you make money while you sleep. You also make money while you’re awake. It’s automatic and just keeps coming in.

The strategy of wealth creation

For almost all people, active income is the primary source of income. This is a direct exchange of time for money and how much money you earn will depend on your skill and time spent. However, not all of you will be able to create wealth and achieve financial freedom. That will depend on how you use this income. Will you create more liabilities by buying desires and or assets that earn?

Let’s see what happens when one small step in your entire strategy can completely change the outcome. And like two people with similar active income, one can end up with one achieving financial freedom and the other living wage to wage.

The triangle of desires

You exchange your time for active income and use the money you earn to buy things you want. Bigger house, better car, travel and so on. On the contrary, all these things need more time and money while saving them so you go back and forth exchanging more time for more money, and continue this triangle of desires until it is too late.

Unfortunately, most people live their lives without realizing that every day, minute, or hour means they have one less day, minute, or hour to use. They unconsciously treat time as an endless resource, thinking they are immortal.

Many of us get stuck in this triangle of desires, living paycheck to paycheck. And unable to save enough to build any acceptable passive income stream.

Our energy is finite, and you can only do so much to become more productive. It is much easier to stop wasting time than to become more productive.

Road to Wealth

Just like before you trade your time for active income, but this time use it to invest in an asset that gives you passive income. You use this passive income to feed your desires to change one basic dynamic in the whole circle of wealth creation. Instead of buying your wishes directly you buy them and save them with your passive income. A little patience for a moment will become a lifetime of success and wealth.

Your time now increases as you make money working for yourself. Your passive income supports your desire to consume your money earned from automatically generated passive income, as a result, you earn more time. The time you save is then used to earn more active money or build a quality lifestyle.

Eventually, you achieve the financial freedom you have always dreamed of, breaking the chains and finally becoming free.

Why Passive Income Matters

“If you can’t find a way to make money while you’re sleeping, you’ll work until you die.” – Warren Buffett

The get-rich-quick virus keeps most of us engaged in activities that end in failure. Every day I get calls from people who want to invest in real estate with the hope of earning quick bucks, believing that there is easy money waiting to be reaped by those who know where to find it.

Nothing can be further from the truth unless you happen to win a lottery or if you were born rich. There is nothing easy about getting money. The only way to get rich is to build a solid infrastructure and feed your assets.

Passive income is a cornerstone of a rich growth strategy. Having a solid income base that does not require active management can keep a steady stream of money for your portfolio or living expenses. With a certain amount of income set on autopilot, you can take more aggressive investment attitudes elsewhere with a little more comfort, and help protect your profile against market volatility and economic recession.

What’s more, you only have so much time to invest in making money — whether it takes the form of a job that generates income, or active money management with other investments. Once a passive investment flow is established, it is a kind of fixed-and-forget-it asset. Basically, generating wealth does not take time on your part.

Stay tuned to Feeta Blog to learn more about Real Estate Pakistan.

Maximizing Time and Money: Passive Income

- Published in Learn the game, Marketing, MARKETS

FAQ on Rental properties in Pakistan / Passive income in real estate

Frequently Asked Questions – Pakistani Rental Properties / Passive Income

Earning a passive income from Rental properties in Pakistan is by far the safest and surest way to get rich. This FAQ will answer some of the basic questions you may have in mind.

Q-1 Rental properties are depreciating and therefore do not offer high yields.

Answer- The problem of depreciation only exists in houses, especially since they offer only 3 to 4% rental yield per year. Advertisements and shops can be like new after small renovations and some apartments offer up to 10% rent to offset any depreciation effect. As a general rule, rental real estate should give you an average of 15% earnings per year. In some value classes, rent can be more than capital gains and vice versa, but it’s good as much as you get 15% of the total earnings. In addition, the benefits you receive from your rental income will be value added over this 15% or will make up for any shortcomings.

At the end of the day, you have to be careful to find a rental property that gives you a nice return. That’s why you need an expert who can analyze and predict capital gains and expected rents for at least the next 5 to 6 years.

Q-2 Do rental properties need time to build and therefore cannot offer returns as shown?

Answer- When you buy a rental property in Pakistan, you need to look at both aspects of income which are capital gains and rental income. Normally, the already-built property will offer 6% rent per year. However, if you plan to build one or buy one that is still under development, what you lose in rentals during the time it is being built, you get capital gains. Those that need time to build, such as tall ones, are usually much cheaper while they are being built.

On average, a good high-growth project will add at least 60 to 80% in capital gains over the construction period, which lasts 3 to 4 years. This capital gain is usually more than 20% thus compensating for the lack of rental income during this period.

Q-3 In rental properties, can problems arise such as lower rents, which can decrease your ROI?

Answer- Like all investments, even rental property can change under certain circumstances. However, this change can be negative or it can also be positive. For research and analysis, target conditions must be ideal for both rental property investment and speculative business investment. Because the chances that speculative traders are wrong are much higher than the tenant investor losing a few months of the lease. Therefore, maintaining the ideal situation for both types of investors is important and is in fact more favorable to the speculative trader.

Q-4 Do houses or commercials give more capital gains than apartments?

Answer- Houses, commercials and apartments are three different asset classes and will not follow similar cycles. A gain in houses over time is due to a gain in plots, which calms down after the area matures, similarly, apartments will also slow down after the building matures. Later, many other factors will come into play to decide whether that property will grow further or not. Similarly, commercials have their own cycle to follow with their own risks because a very large number of commercials do not show much appreciation.

As long as you understand the different dynamics and act accordingly, all of this will yield very good capital gains. Therefore, capital gains will depend on many other factors than just the active class.

Q-5 Which is the best rental property among houses, apartments, commercials and shops?

Answer- Houses are not suitable for rentals, however, as for the other three, each property must be judged separately to identify who will give you optimal rental returns. It will be wrong to give any preference depending on the active class as such.

Ultimately, it all depends on your choice of individual property rather than its value class. A good housing project can outperform an average business in capital gains and conversely, a good commercial property can beat an average housing project easily.

Luxury serviced apartments in Gulberg Lahore for Air BnB rentals are a safer and safer bet than other types of real estate for rental purposes.

Q-5 ROI on rental income is slow, while plots can double their price in a very short period of time.

Answer- You must have heard the old saying. ” slow and steady wins the race“. Rental properties are that turtle that seems slow but never stops, thus giving you a more stable consistent income over the period.

The unpredictability in speculative trading is its biggest enemy. Although speculative trading gives an illusion of higher returns, the high failure rate balances it out. In addition, speculative trading is not suitable if you are an emigrant or a busy person who will not have time to look at the real estate markets constantly.

Our study has shown that both rental returns and successful speculative trading can make almost equal amounts of money in the long run. So renting property leads to being the safest and safest way to achieve your financial freedom goals.

Q-6 Rental properties usually only give 3 to 4% rental income per year.

Answer- That’s not true, only houses give 3% and we already consider them as lame wolf property. Apart from this, some commercial real estate does offer only 4% rental production, but this is usually because they are not yet fully mature and offer much more in terms of capital gains. So investors are happy with them considering that the combined gains are usually 15% or more.

Q-7 (Part 1) Suppose I invest 13 million in a 562 sq.Ft apartment. After 13 years will I get my capital back on 10% rent?

For example:

Hotel Apartment Sq.Ft: 562

Tariff (kv.Ft): 23000

Total Price: 12,926,000

10% Annual Income: 1,292,600

Annual Service Fees (Kv. Ft): 30 Rs * 562 = 202,320

Own tax: 50,000

Rent Tax: 60,000

Annual in Manluo: 980,280

Answer- The calculations we provide do not cover any taxes or liabilities, no matter if you are investing in speculative real estate or rental property in Pakistan. The impact of these taxes will be felt on both sides and will certainly affect ROI but is the bare minimum. For example, the service costs are not as high as 30 PKR and in some cases, they should not be paid by you but by the developer or tenant. In addition, after one or two years, a 10 to 20% increase in rentals will cover any debts without putting a big dent in your rentals.

Second, if the purpose of the question is to compare plots or files with wolf holdings, then similar duties apply to commercial plots as below:

a. Instead of annual service costs you pay a non-construction penalty on parcels and even sometimes development costs.

b. Property tax will be paid even if you also own land, so it is not only applicable to the wolf property.

c. You will pay capital gains instead of income tax because during trading you will sell plots mostly in less than 4 years.

Q-8 (Part 2) If rent is in between it can get my capital back in 11 to 12 years?

Answer- The mistake most investors make when it comes to this calculation is that they do not calculate the profit on rental income. In reality, it will take a maximum of 5 to 6 years for the repayment of capital investment, if you reinvest your rental income at 10% per annum. This could be even faster if you invest with Feeta.pk 1 crore challenge where we can get you up to 20% annual returns.

Take a look at the calculations below, based on a conservative analysis of the apartment in question. During the construction process, we expect 80% growth, then 12% for three years, and 10% later for capital gains. Similarly, the reinvestment of capital is only calculated at a conservative 10% per annum instead of 20%. You can clearly see that it will only take 6 years for the return of your capital after ownership.

Even if we calculate capital gains at 5% after the 3rd year, the value of your asset will still be close to Rs 4 crore. However, it can be said that the rent capital should grow by 15 to 20% rather than 10%, so realistic performance can vary and the calculations below are just to understand the concept of rental investment and the compounding effect.

Q-9 (Part 3) During this period If I want to sell my apartment to invest in some other area. I will be stuck in the apartment.

Liquidating Assets (housing) will be more difficult. You may be blocked for a longer period than plot Winding. Because Average Liquid Asset (plot/house) lasts 6-12 months on normal days.

Service Apartments are good for rental purposes. But for monetization, we may be stuck for a longer period of time. Because people prefer to book new apartments for a fee not 5-10-year-old apartments at full payment?

Answer- Selling a rented built property will take a little longer than a plot or file. However, rental property continues to give you cash every year, unlike a plot or file, which is in fact a liability because you will pay the non-construction penalty and other company charges as well as development costs in case of any plots and files.

So it all depends on how you define liquidity. a property that will sell out quickly or a property that will repay you 10% in cash each year and repay 100% capital in 5 to 6 years.

Ultimately, like any other property, how quickly your apartment will sell depends on the quality of the project rather than the value class. Not all projects will be the same and sales will vary depending on your choice today. Monotation is also much better in relation to wolf ownership because you will have full capital in 6 years which can be invested again in other places.

For more information on the real estate sector of the country, keep reading Feeta Blog.

FAQ on Rental properties in Pakistan / Passive income in real estate

Avoiding the Real Estate Wealth Trap in Pakistan

Beware, this article will change your mindset and real estate investments, so read it carefully while we reject the false rich trap of real estate in Pakistan. Read this carefully and if you have any questions please comment and ask.

After nearly 10 years of going through various cycles of real estate myself, I’ve realized that most of us don’t create any real wealth. Do we live in a paradise of fools and amass false wealth? This prompted me to do some research and analysis of the previous 15 years of investment cycles to find out what exactly we are doing wrong.

During our search for the truth about real estate, we learned that there is a huge difference between returns in USD and PKR. While you may think you made money in PKR, this may not be true for USD. Eventually, almost every other thing in your life and your purchasing power depends on the USD and not on PKR. This means that if your wealth does not grow by the USD, then you are not actually getting richer.

USD is therefore one of the most important factors of wealth creation. This is especially true for foreigners who invest in USD and expect to take their returns in USD.

The Dollar vs. PKR and Real Estate Investments

Just to understand how important this aspect was, we will choose Phase 6, 1 Channel plot in DHA Lahore as an example and compare its price in various years since 2005 in USD. Most real estate investments follow a similar pattern with small variations.

Year 2005

1 x USD = 60 PKR

Average price of DHA Lahore Phase 6 in 2005 = 9 Million ($ 150,000)

Year 2010

1 x USD = 80 PKR

Average price of DHA Lahore Phase 6 in 2010 = 6.6 Million (USD 82,500)

Year 2013-2014

1 x USD = 100 PKR

Average price of DHA Lahore Phase 6 in 2013 = 15 Million ($ 150,000)

Year 2016

1 x USD = 105 PKR

Average price of DHA Lahore Phase 6 in 2016 = 24 Million (USD 228,571)

Year 2019

1 x USD = 160 PKR

Average price of DHA Lahore Phase 6 in 2019 = 28 Million (USD 175,000)

Year 2021

1 x USD = 172 PKR

Average price of DHA Lahore Phase 6 in 2021 = 42 Million (USD 244,000)

Long Term Business

Looking at the USD chart for Phase 6, 1 Channel plot is very clear that long-term trading is almost worthless. I know a lot of people who have kept plots in these phases for over a decade and although you may have overcome inflation or PKR depreciation, you have not created significant wealth.

Most people have this idea that the longer they keep a plot or file, the more fruitful it is. Unfortunately, I hate to report this bad news, which is not the case. At least the property in Pakistan does not adhere to that law. In 2005 the plot which was at USD 150000 is only USD 244000 today. Even buying it in 2019 gives you a much better ROI instead of buying it 14 years earlier in 2005.

Actually buying the phase 6 plot in 2010, then selling it in 2016 and buying it again in 2019, and selling it again now in 2021 would be really quite lucrative.

The reason that devalues a long-term business is that someone who has held the same property for 15 years earns much less money than someone who has held the same property for 10 years. This same aspect makes long-term trading riskier, which can eat away at your wealthy creative endeavors like a termite.

Business Plots and Files in Speculative Cycles

The speculative trading cycles are the next option that most investors choose. It’s a really good choice but with just two big problems:

- You never know what the future holds. So everything you do is based on either guesswork or information that may not work exactly the way you want it to. It’s much easier to just look at the past data and see where you should have invested but planning it for the unknown future is not for everyone.

- If you can’t execute or the market doesn’t work as you hoped, you may be sucked in for a very long recession period.

Speculative trading is much easier said than done and it wasn’t until 2016 when the recession hit the real estate that investors realized what they were doing wrong. A considerable portion of investment has stalled in some areas because some investors felt it was worth trying to wait and hold on. These areas included Broadway Phase 8 commercial, residential plots in various places such as Phase 7, 8, and 9 of DHA Lahore, Malikpur, Shivpur 4 marl commercial files of DHA in Phase 8 ex Park View, and later on Gwadar.

As a result with a huge share of investments stuck in recession, investors have failed to seize new opportunities that have emerged from 2017 to 2020 such as indigo highs, Goldcrest Mall, DHA Peshawar, Downtown Mall and DHA Multan.

Although the return on investment was much better than long-term trading, but still not very impressive, as it included long periods of recession with zero to negative growth.

keyboard_arrow_leftPrevious

Thenkeyboard_arrow_right

What does the data say?

For an argument, let’s assume that everything went well and being the smart guy who is Mr. X, he kept money safe in the bank from 2005-2010 and then invested in phase 6 plots in 2010, then took an exit in 2016, and then took entry again in 2019 and has taken an exit now when the average plot price is at 42 Million.

To achieve this, Mr. X needed to make seven decisions during these 16 years. These included selling in 2005 and then investing in reliable locations to earn at least 10% a year. Taking an exit from wherever your money was and then reinvesting in 2010 in real estate. Repeating the same thing again from 2016 to 2019 and then finally taking an exit in 2021.

The location for an error is almost nil, if Mr. X had taken an exit in 2013, it could have gone awry. Similarly, if Mr. X could not take an exit in 2016 the results would be different.

Finally, it was also important to carry out a profitable business during the recessionary periods between 20015-2010 and then in 2016 to 2020. Timely exit from these investments and regaining entry into real estate should be surgically accurate.

How many of you are confident that you can read the market and do this type of business in the future?

The Good Old Rental Income

Rental income has always been considered a very essential and important source of income. However, not many people believe that it can enrich you as a speculative business. Some general problems you may encounter with rental income are:

- If you do not invest in the right rental property, your capital gains may suffer.

- Houses in Pakistan are the worst form of rental income due to huge depreciation and only 3 to 4% rent per year.

Choosing a rental property that would give you at least a 6% rental yield and some good capital gains over the years can be a challenge, but it is much easier to execute than a speculative business. In addition, you now have the option to invest in real estate that can offer an 8 to 10% return on annual rent above your initial investment.

Rental cash flows may seem minimal when you start, but over time they build up and give speculative traders a run for their money. It won’t be wrong to say that slow and steady wins the race because you have a much better chance of being rich if you invest in rental properties instead of plots of land.

What does the data say?

Now for the sake of argument let’s say, Mr. A, who is not as wise as Mr. X and was not sure if he can pull off that miraculous 16-year cycle with such precision. That’s why he decided to buy a property that gave him regular cash flows and average capital gains.

Mr. A has invested € 9 million in wolf ownership, which has given him an average of 10% in annual capital gains and 6% in rental income, which has increased by 10% a year. Ultimately, he invested his rental income in assets similar to where Mr. X kept his money during recessions to make 10% profits a year on them and the results will surprise you.

YES, it is quite true that Mr. A made almost the same amount of money as Mr. X and without ever having to go into the complications and risks that Mr. X took.

The magic actually happened because of the compounding effect on the rental income, this is one factor we never consider when we discuss rental properties.

The 16 years of rental income, which started at just 540000 a year, ended at 4 crores when accumulated and put together at only 10% a year. This is where most of you do your math wrong and only calculate the rental income and do not consider the impact of profits on your rental income.

keyboard_arrow_leftPrevious

Thenkeyboard_arrow_right

The way forward

The speculative business cycles of real estate and rental income are almost equal when creating real wealth. Renting is an easier and more stable way to secure your success compared to speculative trading. You can certainly mix them both or opt for rent alone, but I would never recommend just opting for a speculative trade.

Lesson learned

- Rental projects are always green investments that will give you good profits in almost any market.

- Rental properties are the backbone of your real estate investment.

- Plots and files should be invested only for speculative business cycles.

- Long-term keeping of plots and files is counterproductive in general and has not rewarded investors in the last 15 years.

- For better chances of success, rent is much more effective than any other investment in real estate.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.