Pakistan Real Estate 2023 – Analysis, Forecast & Investment Options

The real estate industry is one of the major and fastest-growing industries in Pakistan. The country spends over $5 billion in construction work annually. Today, we are going to analyze the Pakistan real estate 2021. We will discuss and predict the performance of the real estate market considering the current situation and possible future events.Despite the fact that the real estate market is growing drastically in Pakistan, the country still lacks basic living facilities, i.e house with necessary living facilities. This fact indicates that there’s still wide room for growth in this sector so that people belonging to every class of income can afford a respectable living for themselves.

Pakistan Real Estate 2021 Investment And Budget 2020-21

The government believed that the budget they present is tax-free and this is a significant achievement amid the worst economic situation of the country. However, the opposition parties criticized the budget on charges that it could not handle the ongoing financial crisis.

The budget was said to be a big economic booster, but the boom will collapse ultimately and the real estate sector will continue to decline.

The freely falling Economy

The budget 2020-21 presented by the PTI government is merely paperwork far away from ground realities. As per IMF, Pakistan’s economy is expected to decline by 1.5 percent in 220-21, while the government’s estimate is up by 2.1 percent. If we consider the government’s inflation target of 6.5, the real GDP decline will be 4.5 percent.

COVID-19 and Locust Attack acted as the final nail in the coffin of Pakistan’s economy. Unstable border conditions are another misery to the economy. The unreliable political and economic situation is further discouraging people from investing in real estate.

The Record High Debt to GDP Ratio

The property market was enjoying a boom in 2003 and 2013. The debt-to-GDP ratio was declining during both boom periods. In 2003, the Debt to GDP ratio was 50 percent, while in 2013, it was 65 percent. However, the debt to GDP ratio is 86 percent at the moment and still rising. So, we don’t have high hopes about the prices of real estate in Pakistan at least in the near future.

Declining buying power; rare end-users in the market

The local Pakistani professionals, businessmen, and expatriates are the potential customers of the real estate market. However, the declining purchasing power of these local Pakistanis is one of the many concerns of the real estate sector. On the other hand, Gulf countries have passed a law asking private companies to reduce the salaries of overseas workers by 40%. By this ratio, the remittances in the year 2020-21 are expected to decrease by around $5 billion, the amount is equivalent to what the government required to build 1 LAC house. In simple words, bad days for our real estate will continue.

Economy & Future Of Real Estate Business In Pakistan

After 75 days of closure due to the COVID-19 lockdown, production throughout the country resumed in June. The country’s largest auto tire maker, General Tyre and Rubber Company posted that net sales increased by 42% in the first quarter of 2020 as compared to the 3.2 billion of last year for the same time. The growth in sales is also partially due to the government’s efforts to curb the illegal imports of tires.

The cement industry also posted significant growth in sales in the current year as monthly sales hit a record high in October 2020. The mills shipped 5.73 tonnes to consumers. The domestic consumption also increased by 15.8 percent to 4.85 million tonnes from 8.19 million tonnes in October 2019. In terms of Export figures, a rise of 11.58 percent from 784,433 tonnes in October 2019 to 875,266 tonnes in October 2020 was observed. Cement sales reached 19.3 million tonnes in the first quarter which is 19.3 percent more than the last year for the same time.

Talking about another major industry of Pakistan’s economy i.e telecommunications, the government has announced the launch of Spectrum Strategy 2020-2023 to assist commercial telecommunications operators in their network planning investments due to a significant rise in demand. Mobile data traffic in Pakistan rose from 165 percent to 69 petabytes in 2017 to 128 petabytes in 2018. Data use increased from 0.34 Gb/user/month in 2016 to 1.75 Gb/user/month in 2018.

Exports rose by 10.5 percent in October 2020 over the last month, with a rise of US$ 196 million to US$ 2.1 billion. On the other hand, imports decreased by 15 percent to US$3.7 billion in October 2020 by US$647 million compared to the previous month.

Real Estate Contribution To Pakistan’s Economy

Pakistan’s real estate sector is one of the major pillars of Pakistan’s economy. As per the World Bank’s Calculation, the size of the country’s real estate assets is between 60 and 70 percent of the country’s total wealth; if we extend this estimation to Pakistan, the average size of our real estate sector is between $300 and $400 billion.

Pakistan’s Real Estate did not perform well due to several financial, economic, and political challenges. But we can hope that things will get better if not immediately then gradually in 2021.

Real estate has slowed since 2017 due to political turmoil and volatility in economic and financial policies. With no incentives for investors and ban imposition on non-filers played a key role in deteriorating the real estate sector.

FBR’s strict regulations on non-filers’ banking transactions further discouraged the investors from investing their into the real estate market in 2018-19. The inability to utilize the development budget led to a contraction in the building sector is another factor to contributed to the real estate sector’s downfall.

One of the few reasons we believe to see the boom of Pakistan’s real estate market in coming years is CPEC. China Pakistan Economic Corridor is the iconic project between the two countries that has the potential to change the dynamics of Pakistan’s economy. The significant economic zones of CPEC are yet to be established, however, the benefits of CPEC can be seen with improved power situation and partial completion of the Lahore-Karachi motorway.

Pakistan’s real estate market is quite unpredictable. Therefore, you should be very vigilant and aware of the latest developments and updates related to Pakistan’s real estate market. Being aware of the current real estate conditions will help you make a rational and lucrative decision regarding real estate.

Property prices in Pakistan usually don’t go up even during inflation and uncertainty. This fact can make the investment much more challenging.

The real estate industry is fully capable of persevering through difficult times and that’s something special about this industry. Fair property values are the need of time to make the property affordable for every citizen which will be the ultimate success of the country’s real estate market.

What 2021 has for Real Estate?

The pandemic and uncertain political situation have affected the real estate market in 2020. We can hope things can get better and the real estate market will start to attract investors in the years to come

CPEC is an important venture. The economic corridor offers a source of overwhelming foreign investment. The web of roads under the megaproject is connecting Pakistan’s Gwadar port to China’s Xinjiang capital. This corridor will not only facilitate the economic activities of both countries but also open new doors of opportunities and growth to Pakistan’s real estate market. As the hub of CPEC activities, the demand for real estate is expected to rise in Gwadar and its outskirts.

2021 And Karachi’s Real Estate

Let’s discuss how Karachi’s real estate market is expected to perform in 2021 and what are our recommendations regarding investment in Karachi’s real estate market.

Karachi, the country’s largest city and the world’s seventh-largest metropolitan, is the major business hub of Pakistan. With ample opportunities for every sector, the Real estate sector still rules the city as the best investment domain.

Area Wise Recommendation For Investment in 2021

1) Gulshan E Maymar

Gulshan e Maymar is Karachi’s one of the most famous areas of Karachi. Maymar, located in the heart of Gadap Town, is a sophisticatedly designed area that has beautiful and well-trimmed parks, greenery, and serenity. Maymar is also known as Mini Islamabad, as the town was planned along similar lines as that of the federal capital. Gulshan-e-Maymar essentially consists of 10 sectors. According to recent research, Gulshan-e-Maymar is one of the most favorite destinations for renters. The peaceful and Calm environment of this vicinity is the key factor behind its rising demand. Let’s explore some of the other factors that attract people to opt out Maymar as their most preferred rental option in Karachi.

Gulshan-e-Maymar saw a significant improvement in terms of prices in 2019. Construction activities in Maymar are also in full swing due to the rising demand for housing on the outskirts of the city. Up to 70% of Maymar has already populated and still, the demand is high. Maymar has also attracted some of the city’s reputable builders such as Saima builder, Ayesha Builder, and Mehran Builder. Interestingly, all the new projects in Maymar are having a price tag of between 9 to 11 million. Therefore, Maymar has a lot to offer in the residential as well as in the commercial sector. We can say that Maymar will continue this potential in 2021 as well.

Latest Prices of Gulshan E Maymar

2) Scheme 33

Scheme 33 is our second recommendation for the year. Prices in Scheme 33 increased significantly in 2020, therefore, whether you’re a genuine buyer or investor, we suggest you invest in those societies of Scheme 33 where the lease is available along with all basic utilities such as water, electricity, and gas, etc. my key society of scheme 33 is Saadi town, Saadi garden and peer Ahmed zaman for investment purpose. No matter which society you choose, never forget to visit our list of illegal societies to ensure your hard-earned investment will not go in vain.

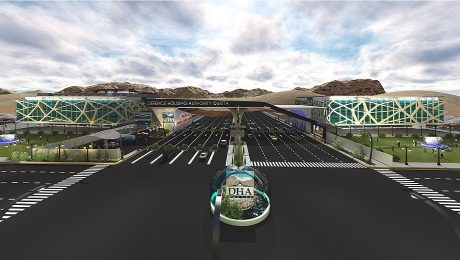

3) DHA City

DHA city is our third recommendation Defense Housing Authority is another massive success in the paradigm of house schemes that are under the administration of the Pakistan Army and mainly takes care of the development of residences for military officers that are in-service and retired.

The construction of the Malir expressway is another major development complimenting the DHA city. We can predict a lot of potential and significant jumps in prices for DHA city in 2021. We recommend you go for DCK if you’re interested in making a long term investment. DHA city has the potential of returning 100 percent of the investment within the span of three years.

Latest Prices of DHA City

4) Garden City

Garden City is our fourth recommendation for 2021. The project is situated near to Gulshan-e-Maymar and has all the utilities. Due to the significant rise in Maymar’s prices, Garden city experienced a boom in 2020. So, Garden city can offer a good alternative near Maymar.

5) Taiser Town

If you’re short of capital and really want to invest with a very minimal budget, our fifth recommendation for you is Taiser Town.

Property Ranking Analysis Of Pakistan

Pakistan has made significant improvements in the Property Rankings. The country is on the right path to establishing suitable conditions for corporations. As per the study of “Doing Business in 2020”, the World Bank has placed Pakistan at 108th position globally. Which is better than Pakistan’s previous 136th position. The jump of 28 spots indicates the enhancement in the economic environment which will ultimately draw direct foreign investment in the country and create job opportunities.

According to the World Bank, the flow of foreign investment and the widening of the market have a direct link to the valuation of real estate. The better economic factors suggest that the coming year will raise the market for luxury and commercial housing societies.

Our Advice for Pakistan Real Estate Investors in 2021

As a real estate investor, you should explore various asset categories of real estate before making your real estate investment such as residential land, apartments, homes, and commercial units such as offices, multifamily, industrial, and farmlands. You should ensure that you invest in such tangible assets instead of just a piece of contract or paper. We never recommend you invest in misleading products and documents claiming to be real estate but have no physical existence and actual value.

Pakistan’s real estate approach is very solid. The real estate market attracts not only local but also foreign investment. Other than that, several residential and industrial projects across the country are under development that provide lucrative investment opportunities. These properties are legal with investor-friendly repayment plans.

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

Pakistan Real Estate 2023 – Analysis, Forecast & Investment Options

- Published in Analysis, Bahria Town Karachi, Buying, DHA, DHA City, Gulshan-e-Maymar, Investment Tips, Market Overview, News & Updates, Scheme 33

How to Increase Sales on Your eBay Online Store: Proven Methods

Introduction:

Running a successful eBay online store requires more than just listing products; it demands a strategic approach to attract customers and boost sales. With millions of sellers competing in the vast online marketplace, standing out and driving revenue can be challenging. In this guide, “How to Increase Sales on Your eBay Online Store: Proven Methods,” we unveil effective strategies that have stood the test of time and proven to elevate sales performance. From optimizing product listings to leveraging promotional tools, join us as we explore actionable techniques to maximize your eBay store’s sales and establish a thriving online presence.

1. Understanding the Importance of Increasing Sales on Your eBay Online Store:

Understanding the importance of increasing sales on your eBay online store is essential for a successful e-commerce venture. By leveraging strategies like eBay login, which enables seamless access to your store and personalized buyer experiences, you can attract more customers, enhance engagement, and ultimately drive higher sales and revenue for your business.

2. Optimize Product Listings for Maximum Visibility and Appeal

Optimizing product listings on your eBay online store is crucial, even on the eBay app. Ensure clear and compelling product titles, detailed descriptions, and appealing images. By implementing relevant keywords and tags, you can enhance search visibility on the app and website, reaching a wider audience and increasing sales potential.

3. Implement Competitive Pricing Strategies

Implementing competitive pricing strategies on your eBay online store is essential for staying ahead in the market. Conduct competitor research to gauge pricing trends, and offer competitive prices. Utilize eBay coupon codes strategically to entice buyers and drive sales, creating an edge over competitors and attracting cost-conscious customers.

4. Leverage Promotional Tools and eBay Marketing Solutions

To maximize sales on your eBay online store, leverage promotional tools and eBay marketing solutions. Utilize eBay Promotions Manager and Promoted Listings to increase visibility. Seasonal promotions and discounts can further attract buyers. For investors, monitoring eBay stock performance can provide insights into the company’s financial health and growth potential in the e-commerce market.

5. Build Trust and Credibility with Excellent Customer Service

Building trust and credibility through excellent customer service is crucial for your eBay online store. Provide prompt and courteous responses to customer inquiries, address feedback and reviews, and offer hassle-free returns and refunds. This fosters a positive reputation, encouraging buyers, including those from eBay Estados Unidos, to have confidence in your store and make repeat purchases.

6. Offer Bundles and Cross-Sell Products

Boost sales on your eBay online store by offering product bundles and cross-selling opportunities. Create attractive bundles of eBay motor parts or auto parts, enticing buyers with added value. Implement cross-selling strategies to showcase relevant accessories and complementary products, encouraging customers to make additional purchases and increasing your store’s revenue.

7. Expand Your Product Range and Diversify Inventory

Expand your eBay online store’s success by diversifying inventory with a wide range of eBay car parts. Identify trending products and niche markets to cater to a diverse customer base. Offering a comprehensive selection of car parts ensures customer satisfaction and positions your store as a go-to destination for automotive enthusiasts and repair professionals.

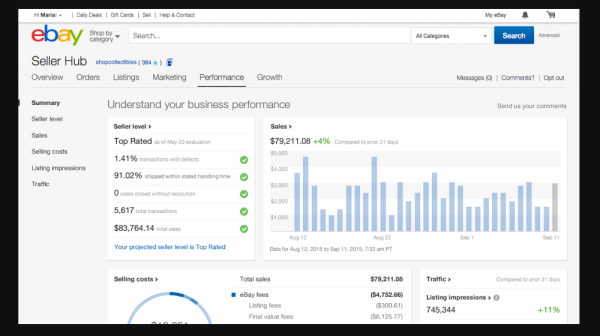

8. Utilize eBay’s Seller Hub and Analytics

Leverage eBay’s Seller Hub and Analytics to gain valuable insights into your online store’s performance. Monitor sales metrics, analyze customer data, and identify opportunities for improvement. eBay Seller Hub empowers sellers to optimize their strategies, and by using eBay discount codes strategically, you can attract more buyers and boost sales, enhancing your store’s success.

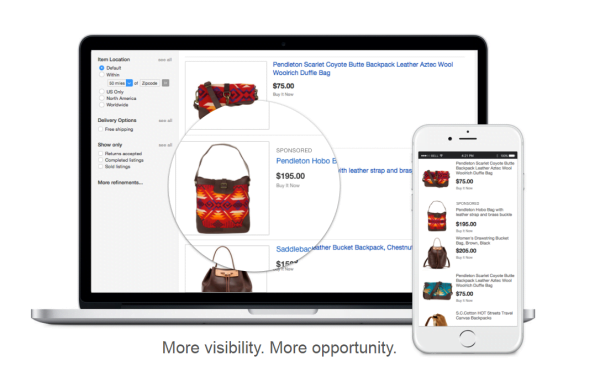

9. Engage in eBay Promoted Listings and Advertising

Engaging in eBay Promoted Listings and Advertising can significantly increase your store’s visibility and sales. By utilizing these marketing tools, you can reach a broader audience and attract potential buyers. In case of any questions or issues, eBay customer service chat provides a convenient and efficient way to seek assistance and ensure a positive shopping experience for your customers.

10. Optimize Shipping and Offer Fast Delivery Options

To enhance customer satisfaction on your eBay online store, optimize shipping processes and offer fast delivery options. Providing free or discounted shipping can attract buyers. Utilize eBay’s Fast ‘N Free program for efficient shipping. Additionally, offering eBay gift cards can incentivize purchases, encouraging customers to return and increasing brand loyalty.

11. Leverage Social Media and Email Marketing

Boost the success of your eBay online store by leveraging social media and email marketing. Promote eBay listings on various platforms to reach a wider audience and drive traffic to your store. Building a subscriber list for email marketing campaigns enables personalized communication, informing customers about new products, promotions, and exclusive offers, encouraging repeat purchases on your eBay online stores.

12. Implement Cross-Promotions with Other eBay Sellers

Enhance your eBay online store’s visibility and sales by implementing cross-promotions with other eBay sellers. Collaborate with complementary sellers to create joint promotions and discounts, expanding your customer base. Utilizing eBay Seller Hub to manage cross-promotions efficiently ensures effective partnerships and increased exposure for both your store and partner sellers.

13. Monitor and Respond to eBay Performance Metrics

Monitoring eBay performance metrics is crucial for evaluating your store’s success. Track sales metrics and key performance indicators (KPIs) to identify strengths and areas for improvement. Addressing customer feedback and reviews can enhance your reputation. If you encounter issues or need assistance, eBay’s phone number offers direct access to customer support for prompt resolutions.

Conclusion: Implementing Proven Methods to Elevate Sales on Your eBay Online Store

In conclusion, implementing proven methods to elevate sales on your eBay online store can significantly impact your business’s success. By optimizing product listings, offering competitive pricing, and leveraging promotional tools, you can attract more customers and boost revenue. Building trust through excellent customer service and expanding product range further enhances your store’s reputation. Utilizing eBay’s resources like Seller Hub and advertising tools maximizes visibility and sales potential. By embracing these strategies, your eBay online store can thrive and establish a strong presence in the competitive e-commerce landscape.

How to Increase Sales on Your eBay Online Store: Proven Methods

- Published in Ebay, London, Marketing, MARKETS, online shopping, Shipping Container, shop, top Featured, trend, uk, USA, viral, wholesaling, World Business News, Zillow

The Ultimate Guide to Amazon Customer Service: Tips and Tricks for a Smooth Experience

In “The Ultimate Guide to Amazon Customer Service: Tips and Tricks for a Smooth Experience,” we delve into essential strategies and resources that can empower users to navigate Amazon’s customer support effectively. From resolving order issues to understanding return policies, this guide equips you with the knowledge to make the most of Amazon’s customer service offerings and enhance your shopping journey. Amazon, the e-commerce giant, has become an integral part of our daily lives, offering a vast selection of products and services. As a customer-centric company, Amazon prioritizes providing top-notch customer service to ensure a seamless shopping experience for millions of users worldwide.

1. Introduction to Amazon Customer Service

Amazon Customer Service is a cornerstone of Amazon’s commitment to customer satisfaction, and its support extends to all users, including Amazon Prime members. As a premium service, Amazon Prime offers exclusive benefits like fast shipping, access to a vast library of streaming content, and more. This guide will explore how Amazon Customer Service supports Prime and non-Prime users, ensuring a smooth and enjoyable shopping journey for everyone.

2. Navigating Amazon’s Customer Support Channels

Navigating Amazon’s customer support channels is crucial for resolving issues efficiently, whether you’re a customer or an investor interested in Amazon’s stock performance. Amazon provides various support avenues, including its website, mobile app, phone support, and live chat. Similarly, understanding Amazon’s business operations and financials, including updates on Amazon stock, can help investors make informed decisions in the stock market.

3. Resolving Order Issues and Tracking Shipments

![]()

Resolving order issues and tracking shipments is integral to ensuring a positive shopping experience on Amazon. By accessing their website or mobile app support, customers can track deliveries and address any shipment-related concerns promptly. For investors interested in Amazon’s performance, monitoring the Amazon stock price is essential for gaining insights into the company’s financial health and growth potential, as it directly impacts investment decisions in one of the world’s leading e-commerce giants.

4. Understanding Amazon’s Return and Refund Policies

Understanding Amazon’s return and refund policies is essential for customers seeking hassle-free returns. Amazon provides clear guidelines on return eligibility, timeframes, and initiating the process. Additionally, for those interested in a career with Amazon, exploring Amazon jobs can offer exciting opportunities to be a part of the company’s diverse and dynamic workforce, contributing to its continuous growth and innovation in the ever-evolving e-commerce industry.

5. Managing Amazon Prime Memberships and Subscriptions

Managing Amazon Prime memberships and subscriptions is crucial for users to make the most of Amazon Prime Video’s extensive streaming library and exclusive content. Subscribers can access various features like offline downloads and parental controls to enhance their viewing experience. Understanding how to manage Amazon Prime memberships and subscriptions ensures uninterrupted access to a wide range of entertainment options available on Amazon Prime Video.

6. Solving Account and Payment Issues

Solving account and payment issues is essential for a smooth Amazon shopping experience. By accessing Amazon login, users can review and update their account settings, payment methods, and billing information. Resolving issues promptly ensures uninterrupted access to orders, subscriptions, and services, providing customers with the convenience and security they expect when shopping on Amazon.

7. Preventing and Addressing Common Scams and Fraud

Preventing and addressing common scams and fraud is crucial for both Amazon customers and investors. Customers should be vigilant against phishing emails, fake sellers, and counterfeit products to protect their personal information and purchases. For investors, monitoring updates on Amazon stock price can provide insights into the company’s financial health and stock market performance, helping them make informed decisions and avoid potential investment scams related to the e-commerce giant.

8. Leveraging Amazon’s Self-Help Resources and Tools

Leveraging Amazon’s self-help resources and tools empowers customers and job seekers alike. The Amazon Help Center and FAQs provide valuable assistance for common queries, while virtual assistants like Alexa can enhance the support experience. For those interested in Amazon hiring, exploring the company’s career website can lead to exciting job opportunities across various departments, making it an excellent platform for aspiring candidates to join the diverse and innovative workforce of this global e-commerce giant.

9. Escalating Issues and Seeking Further Assistance

When facing unresolved issues while Amazon shopping, it’s crucial to escalate problems and seek further assistance. Customers can contact Amazon’s Executive Customer Relations for complex matters, while the A-to-z Guarantee offers added protection. With effective communication and documentation, escalations can lead to satisfactory resolutions, ensuring a positive shopping experience for users on Amazon.

10. Tips for a Positive and Productive Interaction with Amazon Customer Service

For a positive interaction with Amazon customer service, be prepared and clear in communication, providing necessary order details and case IDs. Be courteous and patient with representatives, recognizing their efforts to assist. Customers can utilize Amazon’s self-help resources like the Help Center. Additionally, those interested in Amazon warehouse jobs can explore career opportunities within Amazon’s vast distribution network and contribute to its seamless order fulfillment process.

11. Conclusion: Enhancing Your Amazon Shopping Experience with Effective Customer Service

In conclusion, effective Amazon customer service plays a pivotal role in enhancing your shopping experience on the platform. By navigating various support channels, such as the Amazon customer service number, website support, and live chat, users can resolve issues swiftly and seek assistance when needed. Understanding Amazon’s return and refund policies, managing Prime memberships, and leveraging self-help resources optimize the benefits of shopping on Amazon. Whether addressing account problems, preventing fraud, or exploring Amazon jobs, utilizing the right strategies ensures a seamless and satisfying experience, making Amazon the go-to destination for millions of satisfied customers worldwide.

The Ultimate Guide to Amazon Customer Service: Tips and Tricks for a Smooth Experience

- Published in amazon, Market Overview, Marketing, MARKETS, News, News & Updates, News and Update, Nigeria, top Featured, uk, USA, World Business News, Zillow

Stories You May Have Missed: The Netflix Long Read

In the ever-evolving landscape of entertainment, few companies have made a more significant impact than Netflix. As the streaming giant continues to dominate the industry with its vast library of content, captivating originals, and personalized recommendations, there are countless stories that have shaped its journey to success. In “Stories You May Have Missed: The Netflix Long Read,” we delve into the untold narratives and behind-the-scenes insights that have propelled Netflix to its current prominence. From its humble beginnings as a DVD rental service to its global streaming dominance, join us on a captivating journey through the moments that have defined Netflix’s rise to become a cultural phenomenon.

1. Introduction: The Rise of Netflix in the Entertainment Landscape

In the rapidly changing entertainment landscape, few companies have left a more indelible mark than Netflix. From its modest beginnings as a DVD rental service to its global streaming dominance, this is the remarkable story of Netflix’s ascent in the world of entertainment.

2. From DVD Rentals to Streaming: The Evolution of Netflix

The evolution of Netflix from DVD rentals to streaming marked a groundbreaking shift in the entertainment industry. With the convenience of Netflix login, users embraced the transition, accessing a vast library of content at their fingertips. This pivotal move propelled Netflix to become the streaming giant we know today.

3. Netflix Originals: Captivating Audiences Worldwide

Netflix Originals have captivated audiences worldwide, becoming a hallmark of the streaming platform. With a Netflix account, subscribers gain access to a diverse array of exclusive and critically acclaimed content that has reshaped the way we consume entertainment.

4. Global Expansion: Netflix’s Reach Beyond Borders

With its global expansion, Netflix has transcended borders, offering its streaming services to audiences around the world. Utilizing the free trial Netflix provides, users can experience a diverse range of content, further solidifying Netflix’s position as a prominent player in the international entertainment market.

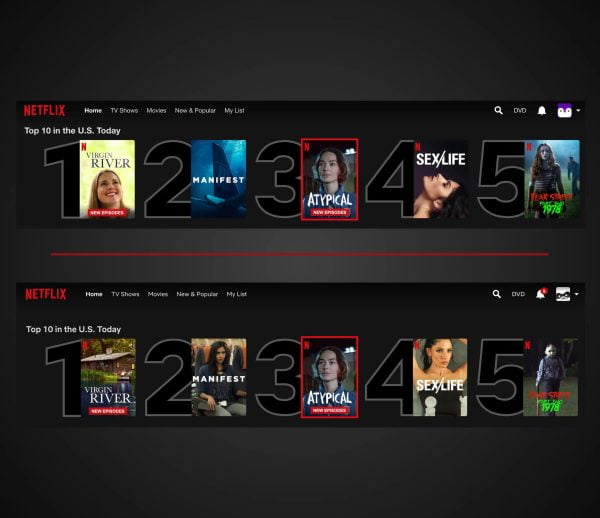

5. Data-Driven Success: How Netflix Personalizes the Viewing Experience

Netflix’s data-driven success lies in its ability to personalize the viewing experience for users. Through extensive analysis of user behavior, preferences, and interactions with series on Netflix, the platform delivers tailored content recommendations, ensuring that subscribers discover and enjoy shows that resonate with their unique interests and tastes.

6. Challenges and Competition: Navigating the Streaming Wars

As Netflix continues to dominate the streaming market, it faces challenges and fierce competition from other platforms. The race to watch Netflix‘s latest content intensifies, prompting the company to innovate, invest in original programming, and maintain its position as a leading player in the ongoing streaming wars.

7. Uncovering Untold Stories: Behind-the-Scenes of Netflix’s Success

Uncovering untold stories reveals the behind-the-scenes efforts contributing to Netflix’s success. Beyond the best shows on Netflix lies a captivating narrative of strategic decisions, content curation, and the innovative spirit that has elevated the streaming giant to new heights in the entertainment industry.

8. The Future of Netflix: Innovations and Ambitions

The future of Netflix promises groundbreaking innovations and ambitious endeavors. By offering a free trial Netflix continues to attract new subscribers, fueling its growth and potential for captivating audiences with fresh content, cutting-edge technology, and an unwavering commitment to redefining the future of entertainment.

9. Impact on Pop Culture: Netflix’s Influence on Modern Entertainment

Netflix’s impact on pop culture is undeniable, reshaping modern entertainment consumption. With a vast library of TV shows on Netflix, the platform has revolutionized how audiences access and binge-watch content, contributing significantly to the rise of on-demand streaming and changing the way we engage with television programming.

10. Conclusion: The Ever-Evolving Journey of Netflix

The ever-evolving journey of Netflix showcases a transformative force in the entertainment realm. From its pioneering days as a DVD rental service to its current position as a global streaming giant, Netflix’s impact is profound. Behind its success lies a trailblazing team contributing to its growth, making Netflix careers and jobs a beacon of opportunity for those seeking to shape the future of entertainment. As Netflix continues to innovate and inspire, its journey is far from over.

For more interesting topics, search Feeta Blogs and If searching Real estate or Property, please visit Feeta Pakistan’s Property Website.

Stories You May Have Missed: The Netflix Long Read

- Published in Entertainment, homes, Innovations, Market Overview, Marketing, Netflix, News, News & Updates, News and Update, Nigeria, Norway, Poland, portugal, switzerland, The Netherlands, top Featured, trend, Trends, uk, USA, World Business News, Zillow

The History and Description of Pakistani Currency

PAKISTAN GETS 75 RUPEES CURRENCY NOTE ON ITS 75TH BIRTHDAY

If you are searching for Pakistani Currency, Overall, the public gave a warm welcome to the new denomination. It was acknowledged that the currency would lead to a significant boost in cash flow and economic activity in the country. Furthermore, it was also noted that the banknote’s emerald green color would make it easier for visually impaired people to detect. Taking all things into consideration, Pakistani Twitter users have responded positively to the introduction of the PKR 75 note in terms of its design, past history and future utility.

The value of our currency has decreased steadily over time. But because of efforts from the government, things have improved from 2008 onwards. Our currency is sturdy, durable, and hard to counterfeit, so we can expect it to stick around for the foreseeable future.

HISTORY OF PAKISTANI CURRENCY NOTES

With this monetary agreement, India was permitted to station a limited number of officers in Pakistan. Pakistan also granted India the right to settle trade accounts in Indian currency as well as to buy gold in Pakistan. In 1950, the Indian Rupee was made legal tender in Pakistan.

AFTER 1947

Pakistan is a newly independent country, and therefore, does not have the privilege of participating in or contributing to the economic growth of the whole world. However, it is a developing country and it has enough potential to be a leading member of regional organizations as well as an active participant in the international community.

AFTER THE ESTABLISHMENT OF THE STATE BANK OF PAKISTAN

With Pakistan’s turbulent history and existence as an independent nation for a relatively short period of time, it is no surprise that the country has had more than eight different series, or types, of notes in circulation. Many of the banknotes that have been issued are still used on a regular basis. The 1-Rupee note may have been replaced by coins over the years, but its use will hopefully be revived in the near future.

Pakistani banknotes are going through a process of gradual change in accordance with the directives of the State Bank of Pakistan. The aim of this exercise is to introduce new designs to combat the problem of fake money that is circulating around the country. The latest notes in circulation include: 5 Rupee, 10 Rupee and 100 Rupee available on www.bankofpakistan.org.pk

AFTER THE SEPARATION OF EAST PAKISTAN

Most people do not really know much about the history of Pakistani currency, or even its specifications. But since it is an important part of our lives, it can be worth knowing a little bit about it. There are many legends about why each denomination has its value, but that is for another day.

Although it has been over a half-century since the first Pakistani currency was released, there are still a lot of people who don’t know about the specifications and history of these notes. In this article, I will be talking about the various types of notes that have been in circulation, describing their features and trying to make sense of some common issues surrounding them.

I hope you’ve enjoyed learning about the notes of Pakistani currency. The notes have gotten more sophisticated over time and the country has even begun issuing commemorative notes to honor its national heroes. I’d like to thank you for reading and I hope that you’ll share this article with others who may be interested in Pakistani currency as well.

HISTORY OF PAKISTANI COINS

Pakistani currency has a long history that dates back to the 1930s. Its coins have been reformed and modified over time, with their number growing until Pakistan changed over to the metric system, but the average Pakistani is familiar with these coins and is likely to find them in circulation today.

DEPICTIONS ON THE BACKS OF THE NOTES

Pakistan is home to an estimated 3 million people, each of whom has a different set of ideals and traditions. The architecture and iconography of Pakistani currency reflect these differences.

PAKISTAN CURRENCY MUSEUM, KARACHI

A museum is also a great place for children to come in contact with history, and to learn about money, numbers, and economics. It teaches them about how Pakistan has shaped its currency over the years, what each note looks like and how many of it equals a certain amount. It’s charming that the museum was established in honor of Sir Mohammed Zafarullah Khan. It’s amazing how one man can shape the future of an entire nation.

Hope you enjoyed the Article. For more interesting Articles, visit Feeta Blogs.

The History and Description of Pakistani Currency

- Published in Banking, Market Overview, Marketing, News

Lahoris are ready for apartment living – if only the real estate agents would let them do it

About apartment living, In a speech to parliament in 2016, current prime minister and then opposition member Imran Khan defended his possession of an apartment in London. This was the height of the Panamanian newspapers and discussed the different apartments and flats that they had or did not own by Prime Minister Nawaz Sharif. During the speech, Imran Khan mentioned an anecdote in which, when he bought his own London apartment in the 1990s, he told Mian Nawaz about it at a social gathering. Curious about this, Mian Nawaz asked what a marquee was, and Khan diligently explained that it was the top floor of a building. To this, Mian Nawaz quite seriously asked what Imran Khan would do if a tornado occurred and the upper apartment was blown up in it.

The little story got bipartisan laughter from the house, but what it also did was say something about the Lahori obsession with land ownership, and the resulting reluctance to housing and vertical growth. Karachi is still the largest city in Pakistan, but by some means, the larger metropolitan area of Lahore can now be almost equal in size, if not already a bit larger. However, for most of its history, the residents of Lahore have avoided the notion of vertical expansion of the size of their city, making it difficult to find housing in the city.

This was largely attributed to the “Punjabi mindset” of wanting to own the land under your feet. And while that has been a seemingly reasonable cultural explanation for a long time, another explanation is that so far Lahoris have probably never needed to depend on housing. With a smaller population and no need for mass labor, Lahore was a metropolis that mostly kept in its residential areas either cramped but flat enclaves or large suburban living conditions in its more posh places. But as the city expands rapidly, Lahoris will have to get used to housing.

However, in recent years there has been a movement toward this, and several real estate developers are investing in the construction of residential houses in the city. And indeed, some of them have become quite advanced: it is now possible to buy a $ 1 million apartment in Lahore, at least as much as listed prices on Feeta.pk. And although all of this sounds very promising, there are major setbacks due to how the regulation of apartment buildings in Lahore works.

Stay tuned to Feeta Blog to learn more about architecture, Lifestyle and Interior Design.

Lahoris are ready for apartment living – if only the real estate agents would let them do it

- Published in Featured, Market Overview, MARKETS, News, News & Updates, News and Update, Real Estate, Top Non Business

The most famous Dams in Pakistan

Dams are mostly built across flowing waterways to regulate flood control, produce hydroelectricity, and absorb food, and power from the locals. Most barrages lead to the establishment of silent lakes with some 150 dams in Pakistan, much of which in Punjab and Khyber Pakhtunkhwa, where the Indus River and streams run all throughout mountains south to the Arabian Sea. So there is no shortage of barrages.

Dams highlight potential lakes, which have become popular recreational locations for residents, with several parents having picnics by the lake and engaging in water sports mostly on the lake’s surface. Today, we’ll look for some of the most well-known dams that were erected in Pakistan so over years, and also the recreational opportunities they can provide residents.

Here is a list of famous dams in Pakistan

Tarbela Dam

The construction of the Tarbela Dam began in 1968 but was finished in 1976. Tarbela Dam is among Pakistan’s largest dams. And also has the distinction of becoming the largest global earth-filled dam. With a height of 143.26 meters and a length of 2,743.2 meters, it built this amazing dam on the Indus River. The dam has a storage capacity of 13.69 cubic kilometers.

The dam was built mainly for the reasons of producing hydroelectricity and irrigation. For energy production, the Tarbela Dam has a capacity of 4888 Megawatts. This is Pakistan’s largest hydroelectric dam, producing about 70% of the total electricity generation. One of Pakistan’s largest hydroelectric dams is the Tarbela Dam. Islamabad, Pakistan’s capital, is only a two-hour drive from Tarbela Dam. Tarbela Dam is among Pakistan’s best-known dams, and locals consider it to be the best picnic spot in the country. Swimming, boating, and fishing also are activities all that engage in.

Mangla Dam

Mangla Dam is currently the second dam. It is in Azad Jammu and Kashmir’s Mirpur District. The Mangla Dam project began in 1961 and was finished in 1967. It is indeed far more than a supply of energy. This one has a significant part in the Indus Waters Basement Treaty, a bilateral arrangement between Pakistan and India. With a height of 147 meters and a length of 3140 meters, the bridge was built on the Jhelum River. This has a 7.39 million acre-foot water holding capacity (M.A.F).

This dam was initially constructed to pump energy, but then it was later upgraded to provide hydropower electricity. It has an electricity generation capacity of 1,150 megawatts. Mangla Structure was constructed on Mangla Lake, which is about a 2-hour drive from Islamabad and a 4-hour drive from Lahore. Mangla Dam is among the most popular picnic spots within the area. Fishing, swimming, rowing, boating, and jet skiing are some activities it participates in. Mangla Dam is considered one of Pakistan’s largest hydroelectric dams.

Mirani Dam

Mirani Dam is located in Balochistan, upon on Dasht River, toward the south of the Central Makran Range. The development of the Mirani Dam began in 2002 and was finished in July 2006. The dam was built to give water to the cities of Gwadar port and Turbat. It has a height of 127 feet and a length of 3,080 feet. It has a water storage capacity of 302,000 acre-feet. Mirani Dam is one of Balochistan’s largest dams. In Balochistan, there are nearly 29 dams, however, Mirani Dam is among the most well-known.

Warsak Dam

Warsak Dam, a water reservoir constructed on the Kabul River, may well be reached by driving 20 kilometers beyond Peshawar. The structure was constructed in 2 stages, one of which was completed in 1960 and the second of which was completed in the 1980s, with additional electricity-generating abilities. This boosts the dam’s total size by about 240 megawatts, with intentions to expand it to 525 megawatts in the future. Locals visit the spot for boating and fishing excursions, and there is a motel on-site for overnight stays. However, you first must get authorization from WAPDA before visiting the region.

Hub Dam

Hub Dam is 56 kilometers from Karachi and sits on the Sindh-Balochistan boundary. It is established just on Hub River, which would be a major source of drinking water in Karachi. The development of the hub dam initiated in 1963 and lasted nearly 20 years to finish. The project was built in 1981, and the government released this to the public. The dam was created for water irrigation and also has a storage capacity of 857000 acre-ft (0.847742 km3). At a cost of Rs 1191.806 million, this was the first dam constructed.

Namal Dam

Namal Dam is near Rikhi, a village throughout the Namal Valley, 32 kilometers from Mianwali in Pakistan’s Punjab. The British government developed Namal Lake, with a surface of 5.5 km2, in 1913. We can see the view of beautiful mountains from the dam’s southern and western sides. The city’s agricultural areas lie mostly on the east and north edges.

The dam’s primary purpose was to supply irrigation for the region’s farmlands, but it is also a favorite vacation destination for locals. Birdwatchers flock to the area because the migratory birds and boaters explore options here too. Namal Lake is among four tourist destinations in Punjab that’ve been chosen for future development, attracting more residents and visitors.

Rawal Dam

Since 1962, the Rawal Dam, one of Pakistan’s water reservoirs, provides supplied water to the twin cities of Islamabad and Rawalpindi. It collects water from the Margalla Hills’ Mastering River and other small streams. Rawal Lake, including the Margalla Hills, is just a popular tourist destination, having a lovely park lake with lush trees, walkways, and picnic areas. The park’s tallest mountain provides a stunning view of Rawal Lake, the Margalla Hills, and also the dual cities. Diving, sailing, boating, swimming, and water skating just are a few of the things that specialized tours can organize. The Islamabad Club, which really is close by, offers a wide range of water sports activities on the lake regularly. Many species of birds, animals, and reptiles call this region home, and birdwatchers visit frequently Rawal Dam to see native birds. The lake is also a great place to go fishing, with roughly 15 distinct species in its waters.

Gomal Zam Dam

The Gomal Zam Dam is in Pakistan’s Khyber Pakhtunkhwa, inside the South Waziristan Tribal District. The Gomal River, a branch of the Indus River, is dammed at Khajuri Kach, rendering it one of Pakistan’s greatest strategically significant dams. We constructed the dam for irrigation, power generation, and food production. Construction began in 2001 but was completed in 2011. With a storage capability of 1,140,000 acre-feet, Gomal zam is among Pakistan’s top power stations (1.41 km3).

Having two x 8.7 turbines, a height of 437 feet (133 meters), and just a length of 758 feet (231 meters), Gomal Dam is among the most famous six tourist destinations. That’s a 0.5-kilometer-long roller-compacted concrete hydroelectric dam. Locals come to the dam for fishing and picnics alongside their groups. When it comes to considering Pakistan’s hydroelectric dams, the Gomal zam dam is by far the most powerful, providing 17.4 units of power.

Khanpur Dam

Khanpur Dam is in Pakistan’s Khyber Pakhtunkhwa, in the Haripur district. It was developed on the Haro River in 1983 to regulate the river flow. The dam created Khanpur Lake, which supplies drinking water to Islamabad, Pakistan’s capital, and Rawalpindi. Including its lovely blue water beaches, Khanpur Lake attracts all tourists and locals. The fact that this really provides irrigation to Attock, Rawalpindi, Lahore, and Haripur makes this one of Pakistan’s best-known dams. This dam cost Rs. 1,385.10 million to build and took 15 years to complete. Khanpur is indeed a rock-fill dam that is 51 meters high (167 ft). Boating, zip-lining, glamping, hiking, fishing, cliff jumping, waterskiing, and kayaking were all important attractions at this dam.

Neelum Jhelum Dam

The Neelum–Jhelum Dam was completed primarily and provided hydropower to Azad Jammu and Kashmir. Water from the Neelum River was diverted to a power grid on the Jhelum River, culminating in this yet another dam that collects water from one river and discharges it into the other. The dam, which has a capacity of 970 megawatts, started building in 2008 and also was officially opened in 2018. Few people have seen the dam’s reservoir as it is still relatively new, but tourism is expected to increase continue in the early years.

Satpara Dam

USAID is supporting the development of the Satpara Dam, a multipurpose water and power facility on the outskirts of Skardu City in Gilgit-Baltistan, close to the Chinese and Indian borders. The dam, powerhouse teams 1 and 2, as well as the development of powerhouses 3 and 4 and mainly two preparing the budget drainage systems, are all funded by USAID. The Satpara Dam is projected to provide 17.6 megawatts of power-generating ability to a local power grid, enough just to power around 40,000 households. The dams will also help prevent flooding in the area, store water for irrigation, as well as provide 3.1 million gallons of water per day for domestic use.

Darawat Dam

Although this dam on its own, and also the realization that storage level has been increased by 2.5 meters to 106 meters since about Friday from 103.5 meters, is favorable for the province’s water-stressed farm workers, the water the reservoir stores only at moment could be of immediate benefit to farmers so because irrigation department has still yet to develop the dam’s sufficient mass. It means that farmers who depend on rainwater to irrigate their land will have to wait a bit longer. Whenever the irrigation ministry assumes control of the dam, it plans to develop the command area by laying watercourses on property that the Sindh government intends to distribute to landowners.

Sabakzai Dam

The Sabakzai Dam, lying in Balochistan’s southern district, directs the amount of the Zhob River. The structure was constructed between 2004 and 2007, helping in the watering of local lands and providing a much-needed relaxation area for the community.

Conclusion

So now you have it: the top 13 dams in Pakistan which provide water for irrigation, hydropower, and food. In fact, it has played an important role in promoting tourism in Pakistan. We’ve already provided you with basic significant knowledge on dams, like the fact that Pakistan has 150 total dams. Dams are needed for water storage and electricity generation, as experts predict there will be a global water scarcity by 2025. Pakistan is also an agricultural country, and in this difficult era, we need resources to grow. We hope you will find this information to be interesting.

Watch this space for more information on that. Stay tuned to Feeta Blog for the latest updates about Architrcture, Lifestyle and Interior Design.

The most famous Dams in Pakistan

- Published in 300 people town, Dams, Dams in Pakistan, International, Market Overview, MARKETS, News, News & Updates, News and Update

Bank Al Habib buys Centrepoint from TPL Properties for nearly $50 million

On May 17, TPL Properties and Bank Al Habib said they had successfully completed the sale and transaction of the TPL’s main “Centrepoint” project, which is located on the Shaheed-e-Millat highway near KPT Road, Karachi. the creation – it is a consequence of the earlier notice the company sent to PSX on August 20, 2020, in which Bank Al Habib said it had decided to buy the building.

TPL Properties is the property arm of TPL Corp Ltd., a technology conglomerate that today focuses on automotive, fire, life and health insurance, real estate development and security services. TPL Properties Limited was incorporated in Pakistan as a private limited company in February 2007. Later in 2016, the company changed its status from a private limited company to a public limited company.

Center point incidentally is, quite literally, the center of TPL’s ambitions. This is one of the biggest developments in the real estate sector of Pakistan. Some facts about the building: the 28-story Centrepoint, 385 feet high, and was built on 26,226 square feet of land. It has 197,810 square feet of rentable space, with offices on 17 floors (from the 11th floor to the 24th, and the 26th and 27th floors).

The building is considered a major TPL property project and was built accordingly, with facilities such as a built-in IT infrastructure, international safety and fire safety standards, nine floors of dedicated parking, and an internal independent power generation unit. The high, which according to TPL was intended for a “luxury company”, also has a health club, a swimming pool and a café.

Here’s the problem: the company managed to share information with the cafeteria, not the actual valuation and sale price.

For more information on the real estate sector of the country, keep reading Feeta Blog.

Bank Al Habib buys Centrepoint from TPL Properties for nearly $50 million

- Published in Featured, Market Overview, MARKETS, News, News & Updates, Real Estate, Top Non Business

Impact of COVID-19 on Pakistan’s Real Estate

The COVID-19 pandemic is currently a truly global phenomenon, with more than 100 million people across the world staying home or trying to do so if their way of life allows them. The short-term human and economic impact have been undeniable since people who can wait to work at home have closed their offices, shops and production positions have also closed.

The level of economic uncertainty can be said to be at its highest point, with the trajectory of the recovery challenging to forecast. Although there has not been a joint response at the global level, individual countries are taking the necessary measures to cope with these challenging times.

Before the virus shook the world, the real estate sector in Pakistan had forecasted a significant growth of 4% during 2020; however, this forecast will be delayed.

In real estate, we can see that the contingency is accelerating some trends, while others may eventually reverse. At the digital level, the search for properties has decreased by 40% in the most critical portals around the world; however, in Pakistan, the drop has only been 34% from January to March, and in April, we see that it begins to stabilize.

Digital portals have become the primary sales channel and the first point of contact when a person is looking for a property for sale or rent. Although the purchase decision is being postponed for the moment, it is essential to note that it is not stopping.

Although the number of searches has decreased, those who perform them are willing to continue with the process. The total of people who are looking for a property and who have followed up with advertisers increased 19.2% in January, 18.2% in February, 16% in March and 17% in the first two weeks of April.

Regarding home income, the information that circulates is that approximately two out of every five contract renewals have been canceled, derived from the lack of work. The Ministry of Labor recorded the loss of roughly 350 thousand jobs since mid-March, and as the pandemic evolves, there is a risk of more layoffs.

The office rental market in Pakistan is also beginning to face a bleak outlook with an increase in the unemployment rate that could reach up to 5%.

Coworking offices are being hit the hardest by the initiative of many companies to make their workforce work from home, and the construction of corporate buildings will face a contraction, at least for the next few months, until the global economy stabilizes.

In addition, retail and shopping centers have also been forced to close. Indeed, their recovery will be slow and long-term since, in addition to the contingency, they face new sales models such as electronic commerce; this is one of the trends that accelerated during the contingency.

In these uncertain times, it is essential to note that although the volume of transactions has decreased, the sale and rental of properties have not stopped; The real estate sector is changing the way of doing business, but not its bottom line and digital tools are the best options to continue moving the market, which from past experiences, we know that once this situation passes, its recovery will be intense.

Factors such as the maintenance of interest rates and accessible terms for financing by banking institutions during the contingency, because it is predicted that these could increase once the situation has normalized and that the authorities have announced economic plans to revitalize the construction sector, they give certainty that the market is not going to stop.

Looking towards China

The nature of the challenge in the world economy forces us first to look at the effects of the coronavirus on the Chinese economy to try to analyze the potential impact on any business area across the globe. After 55 days of quarantine, China’s transportation came to a near-complete halt; hotel occupancy fell by more than 90%. Car sales plummeted 92%, although the number of actual transactions declined only 35% during the months of January and February. At the same time, 55% of residential projects began construction, and 77% of constructions reached completion during this period. Within the Chinese GDP, the real estate industry represents a sectorial weight of 14%. It is fair to say that despite the blockade, activity in this sector of the economy was able to remain low.

Future development of the local market

Undoubtedly, there is more concern about the behavior of the local market in the coming months. It is inevitable that the total stoppage of the tourism industry will have a negative impact on unemployment rates and that a higher level of uncertainty will slow down the first-home market. However, we must highlight the macroeconomic conditions that govern the real estate market to understand that it is only a transitory situation and that the local demand for housing will soon recover, driven by the shortage of supply, the increase in population, and the tourist industry to be recovered. Pakistan leads tourism worldwide. We have great faith in the ability of their companies and local authorities to adapt to new conditions., with the accumulated experience of more than 50 years of innovating in the leisure and travel industry internationally. In addition, it is categorical to understand the behavior of the population of an island towards the real estate market as a generator and guarantee of wealth. The culture and tradition of the inhabitants of Pakistan are to preserve the land that produces crops and to maintain the apartment or store that generates rental income, even if this means making an additional effort for a certain period of time.

A New Era for nature and the environment

This global wake-up call will transform many aspects of life, aspirations and our responsibility to the planet. Pakistan has dedicated, for many years, efforts to protect the environment locally, and its tourism companies, with a presence in many countries and with thousands of employees around the world, have made sustainability at the heart of their business. At the local level, we invest sustainably and responsibly in local actions and consumption. Pakistan has a bright future as a reference to support the local producer, who is now receiving the deserved interest from the country’s population and visitors who appreciate the nature of Pakistan and wish to protect it. This global shift towards health, responsible consumption, and environmental protection will positively affect the Pakistan real estate market. It will become an increasingly determining factor in new projects that already have energy savings and the responsible use of construction materials among their priorities.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

Impact of COVID-19 on Pakistan’s Real Estate

Property Tax in Pakistan 2020: Latest Updates and Criteria

Less than 1% of Pakistanis pay property tax. This is a bad and risky statistic for a country’s economic well-being.

Most residents in Pakistan do not pay taxes. In return, this weakens our financial and economic situation. There is not enough money for the government to pay for roads, hospitals, education and defense.

In addition, the state needs to rely on foreign sources to raise revenue due to the lack of taxation. This involves loans from other countries and large-scale banks.

Property Tax In Pakistan 2020 – Important Details

You need to have details about the size of the lot and how to know it correctly if you are measuring the tax on your home.

This blog should remove all confusion related to properties in Pakistan 2020.

What is a Property Tax?

In the type of money the owner would pay, the property tax is the amount. The government is collecting the bill. The government is helping taxes. It is used in various fields, e.g. In road construction, increase in the required imports, payment of wages of people, and so on.

The word property applies not only to plots or homes but to all materials you own. Your car, farm, office building and other things on your behalf will be part of concrete help. Pakistan’s current property tax rate is 25% in 2020.

Although it costs to buy some material objects, e.g. To build your houses, raw material costs, labor costs, interiors, floors and others. Many banks in Pakistan lend a home to facilitate the construction of your home.

How You Can Pay Your Taxes

In Pakistan there are three types of property taxes:

- Each province has its own tax department. You must call the local tax department to pay the tax.

- By creating an online asset tax, you can also pay your tax in banks.

- You can change electronically through your online banking systems.

Tax Year of Pakistan

The fiscal year will begin between July 1 and June 30, so the property tax, which began on July 1, 2020, will end on June 30, 2021. Real estate can be contacted for in-depth perspectives. The books offer insights into both industrial and residential.

Property Tax And The Situation In Pakistan

In the third world countries, Pakistan is flourishing and progressing if we are to see it. Now is the time for us to act. The housing tax is not the same for everyone and the more you receive, the more you pay tax. It ensures a balance between the social class of different status. The rate often varies between cities and districts. The taxes are in format and they are charged conveniently by any citizen.

Many citizens do not pay the taxes that do not build such good financial conditions. The administration would not earn adequate funds for financial compensation, health insurance, education, and defense. The government has gone to foreign outlets because of these circumstances. This implies the take-off of high-interest loans from the IMF and other nations.

Important Issues To Consider WRT Property Tax In Pakistan

- There is no distinction between plots and some buildings

- CGT was shortened to 4 years the retention time

- 100% of the capital gains taxed because it is less than one year of the retention period

- 75% of the capital gains tax if the retention period is longer than 1 year but less than 2 years

- If the retention period lasts 2 years but not 3 years, 50% of the capital gains will be taxable

- In which the retention period reaches 3 years, but not 4 years, 25% of capital gains are taxable

- No tax on CGT after four years of tenure

Types Of Property Tax In Pakistan

Capital Gains Tax

You have to give the government a certain amount of money when you buy some land. The Capital Gains Tax is charged at a rate of 2% of the recorded value, in accordance with the Finance Act 2006.

In the current budget, however, the general value-added tax on urban spaces is 2% and the stamp duty rate is 3%. Stamp duty is an amount you pay for the legal records of the property.

Capital Gains Tax

This tax is the inverse of VAT. Capital income tax is a certain amount of money that the seller needs to pay for selling his assets. The tax applies to the income of the seller.

The Pakistan Finance Act 2017 stipulates that capital duty can be imposed only if the property is sold within the first three years of the sale. In addition, annually, tax rates are adjusted.

The tax rate is 10% in the first year, 7.5% in the second year, and the tax limit is 5% in the third year. The seller does not have to pay the capital gains tax in Pakistan after three years.

Withhold Tax

Capital gains tax and capital gains tax are a combination. The buyer and the seller must share a certain price when an item is sold.

In Pakistan 2018-19, a buyer of the house, which is also an income tax, will pay a 2 percent withholding tax, while a non-advertiser will buy a 45 percent tax. The taxpayer must pay a 2 percent withholding tax.

Will you see the gap between taxpayers and non-registrants in the tax bracket? This huge increase in the tax rate is aimed at ensuring that taxes are made. Similarly, buyers of the property must pay a 1% tax for registrants and 25% for non-registrants.

Which properties are tax-saved?

Any active groups are exempt from the imposition of taxes. The following categories are addressed:

- Houses built on land less than 5 Marla, instead of the category “A” place

- Property cannot operate above the annual rent of PKR. 5211 / –

- A single house with an annual rent of no more than PKR. 6480 / – if the owner’s house is occupied

- The annual deduction of the tax debts of buildings occupied by widows, small orphans and / or the disabled is PKR 12150 / -.

- Housing up to one Canal owned and rented by a former government worker is removed from the ownership of a dwelling house

- Government buildings, such as businesses, districts or cities. buildings maintained by a government or magistrate

- Mosques and other monasteries.

- Urban parks and children’s fields, schools, boards, homes, inns, bookstores and hospitals, buildings and real estate.

- Places rented only to public charities, religious or prescribed.

Summarizing it

Regardless of what property you own, one must stand as a responsible person. The conscientious citizen keeps his tax data accurate. The company economy is set up by this action. When we look at the land, people in various private businesses like to buy land and houses.

The values of the property are growing steadily as it is the perfect opportunity to buy. Today’s investment is tomorrow’s investment. Contact Globe Estate & Builders for more information on property news.

Property Tax in Pakistan 2020: Latest Updates and Criteria

Everything You Need To Know About Real Estate Investment In Pakistan

We often hear that real estate investing has a bright future in Pakistan – but sometimes it can cost you a huge fortune in the form of scams and frauds.

We know that in Pakistan real estate and real estate are spreading through many regions. Although each area is distinguished by its investment offerings and options, Karachi, Lahore and Islamabad are the three main cities in the country for real estate.

This article has all the important details about real estate in Pakistan, the investment benefits and factors related to real estate.

What You Need To Consider Before Making A Real Estate Investment In Pakistan

The following things should be considered:

Real Estate Investment Information

Sufficient real estate education is essential for real estate investors. The income from real estate investing needs to be well understood to you. Take a long time to get to understand every aspect of the property. In Pakistan, it is a growing industry and has a fast pace.

The design of a property must be high quality and smooth. It is important to have a realistic awareness of all the current developments in the real estate market in order to keep this unpredictable rate and become a profitable investor.

You can read about real estate for free from too many newspapers. Some mass media are most frequent:

- Newspapers

- Real estate YouTube channels

- Real estate books

- Real estate podcasts

- Real estate blogs

- Real estate television programs

Both of these resources are easily accessible and convenient. Take advantage of them and try to learn from them as best you can.

Follow Strategy

It’s no joke if we conclude that real estate is definitely possible for a lifetime cash flow. You just need a workable approach.

Spend some time planning an integrated plan for your investment in the property before you spend your hard earned money.

Would you like to invest in all kinds of assets or just stay in a niche, for example? Do you want to spend as an exclusive owner or do you want to participate? Would you like to develop your investments locally or would you like to grow your investment in other cities?

Such financial decisions will make or break your investment in your home. You will receive a decent income within a limited period of time if you have a good plan in place.

Select Redeem Properties

The fate of the draw is not to get the best property. For the perfect property, you need to be diligent and polite. Before buying real estate, ask about the land, rates in the area, country styles such as whether to buy in the apartment, house or store, details of facilities and the area.

Above all, make sure that it is accepted by the municipal planning authorities. Check the property carefully to make sure all property papers are accurate and complete, keeping your eyes open for any defects.

Buy Your Property

Once the preliminary research has been completed and your real estate investment options in Pakistan have been limited, it is time to buy your house. Consider all legal aspects and advise reviewing the accompanying transition and sales articles.

Furthermore, remember your plot or home location and construction level. These variables significantly influence how fast property prices rise. Often buy property authorized by the relevant government authority so that in some legal matters you do not miss out on investments.

Things to Consider For A Better Return On Real Estate Investment

Here are some moves you can make to achieve the highest investment speed and return:

Don’t rely on one resource

Don’t rely on just agents or insecure portals to create your buying or selling cost. Browse Zameen.com’s listings for the region of the property to see the latest trend in prices. Also, contact some agents to get the trading pressure and see what prices they offer.

Make sure your property is worth it

It takes some pretext to make this move. Contact one or two agents from the buyer’s point of view and ask for the cost for your preferred home. Call one or two additional agents from the seller’s point of view or ask about pricing. The fair market value is among the listed prices, as the purchase prices are usually higher than the sellers.

Go to the previous stages for token capital

If a contract has been terminated, the buyer collects symbolic money. This is the customer’s promise that the property is purchased and binds all parties to the contract. Sign money is usually a very small percentage of the total value of the land, preferably between 50,000 PKR and 100,000 PKR.

The receipt of a sign includes the full details of the property and shows whether a conflict occurs.

Less Volatile

Real estate portfolios do not face sudden changes such as the trading of stocks and bonds. Real estate is also very stable and rates are smoothly priced. This means that failure is less possible internally.

If you want to build your capital smoothly in a risky person, the investment in real estate is right for you.

Try to meet the other party face to face

If you are a buyer or seller, it will help facilitate the process by seeing each other face to face. You will also reliably confirm the ownership status and legal status of the property in this way.

If you are buying a home, make sure the assignment or transfer letter is reviewed by the owner’s NIC.

Double benefits

You may receive many benefits from a house or apartment. You can rent/lease your place, put your room on Airbnb, use it for your own home, and as the cost of the property grows, you can sell it. How incredible is it?

If you are looking for a great investment option in Pakistan, real estate is the ideal alternative for you.

Better Returns

Real estate offers you a reliably strong income. You can earn a monthly return of up to 20% on average. For example, you can sell it for RS.560.000 next month if you buy a property for RS.500.000 without doing anything as well. Staying at home, you get an additional Rs.60,000.

Tax Benefits

Investors usually earn property tax exemptions. You will, for example, get mortgage interest deductions. This is generally done by politicians to promote additional spending.

Possession

holding house representing home ownership

The complete ownership of the asset is one of the most significant and desirable factors inland. You will be wholly owned and no one will take your property from you when you buy a house, and you have all the legal rights to it.

You do not have perceptible assets and ownership of other types of investments such as bonds, mutual funds, and vice versa. That said, immobilization helps you rule your land.

Everything You Need To Know About Real Estate Investment In Pakistan

Taiser Town Scheme 45 – Brief overview of History, Developments, and Future

SCHEME 45 TAISER TOWN KARACHI

As we wrote earlier about Taiser Town, this project was started in 1986 by the Karachi Development Authority (KDA). Ten years later, in 1996, this project was handed over to the Malir Development Authority (MDA). After this project was submitted, MDA relaunched this project in 2005. Taiser Town is basically located in the northeastern part of the city. Upcoming well-known projects in this area include Gulshan-e-Maymar. Dreamworld Resort is another popular water park located in the same area. The project is planned to house about 2.5 million people with the area extending to about 21,000 acres. The housing structure was divided into two phases. Phase I will have nine sectors, and Phase II will have 30 sectors.

The Taiser Town Scheme 45 master plan was designed by The Engineering Consultants International Limited (ECIL). The design includes a wide range of facilities and amenities such as recreational avenues and parks for families. A total of 9,500 acres of the area has been earmarked for recreational facilities in the town. The housing association was planned so that it itself would be a small town. This means that the society will include all roads for commercial and recreational activities so that its residents do not have to travel far into the city to reach these facilities. One of the attractive features of the project includes the business district along Karachi North Bypass. This is one of the main routes in Karachi, which has a lot of potential for business opportunities as the route is well-connected and offers easy travel to residents.

Initially, the area was viewed slightly away from the city center. However, the city is rapidly developing and expanding which is leading Scheme 45 to fame and people are now looking to invest in this project.

SCHEME 45 TAISER CITY: STATE OF DEVELOPMENT

Taiser Town still receives NOCs from service companies. However, this should not be a critical aspect for investors, as many real estate experts have predicted that prices will rise in the coming years. Therefore, Taiser City Plan 33 will give a healthy return against medium-to-long-term investments.

Speaking of the development action, according to the official website of Scheme 45, the Taiser Town area will consist of the dedicated residential sector, commercial sector and mixed buildings. However, 10% of the total area of the project will be reserved for parks, playgrounds and for other recreational activities. In addition, the project aims to provide the following facilities for 1000 apartments each:

- schools

- colleges

- places of worship

- library

- Water treatment plant

- hospitals

- clinic

- offices for useful departments

- wedding halls

- community centers

- auditorium

- bus station

- local post office

- dumps

- fire stations

- police stations

- parking lots

- markets

- public toilets.

AVAILABLE EVAPS IN TAISER CITY

Buyers have a wide range of residential and commercial plots when it comes to investment options in Taiser Town. As we mentioned before, the project was classified into two phases. Phase I has relatively higher prices compared to Phase II. However, even phase I is quite affordable for many investors. For example, you can easily get a 120-square-foot plot in a range of PKR 6 to 8 lakh. The cost of 80 square meters is about PKR 4 to 5 lakes. In phase II, you can get plots even at a lower price.

Authorities on foot get water, electricity and other services from the housing society. All projects are leased by the government, but the MDA has put in place a proper procedure to obtain your property in the name of the buyer. This procedure should not take more than a month. Most sectors of phase I have assets available, as major development work has already ended there. However, in phase II, development work is still progressing and properties will be available in the future.

Phase I properties include residential plots of land of the following sizes:

- 80 kv

- 120 kv

- 240 kv

- 400 kv