Park View City Lahore Launches Overseas Block

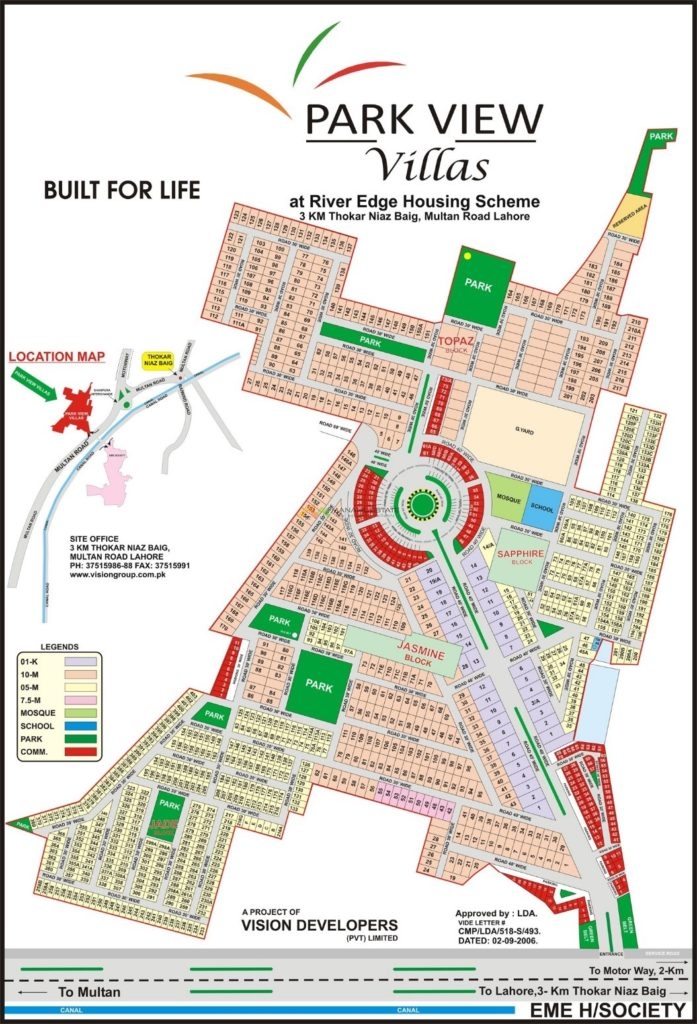

After successfully delivering the previous blocks, Vision Group has come up with a new mega block designed for Overseas Pakistanis in their high quality housing project “Park View City Lahore”. The project was formerly called “Park View Villas”, however, it has now been renamed Park View City. The Overseas Block is now open for booking and different sizes of accommodation are offered with easy installments.

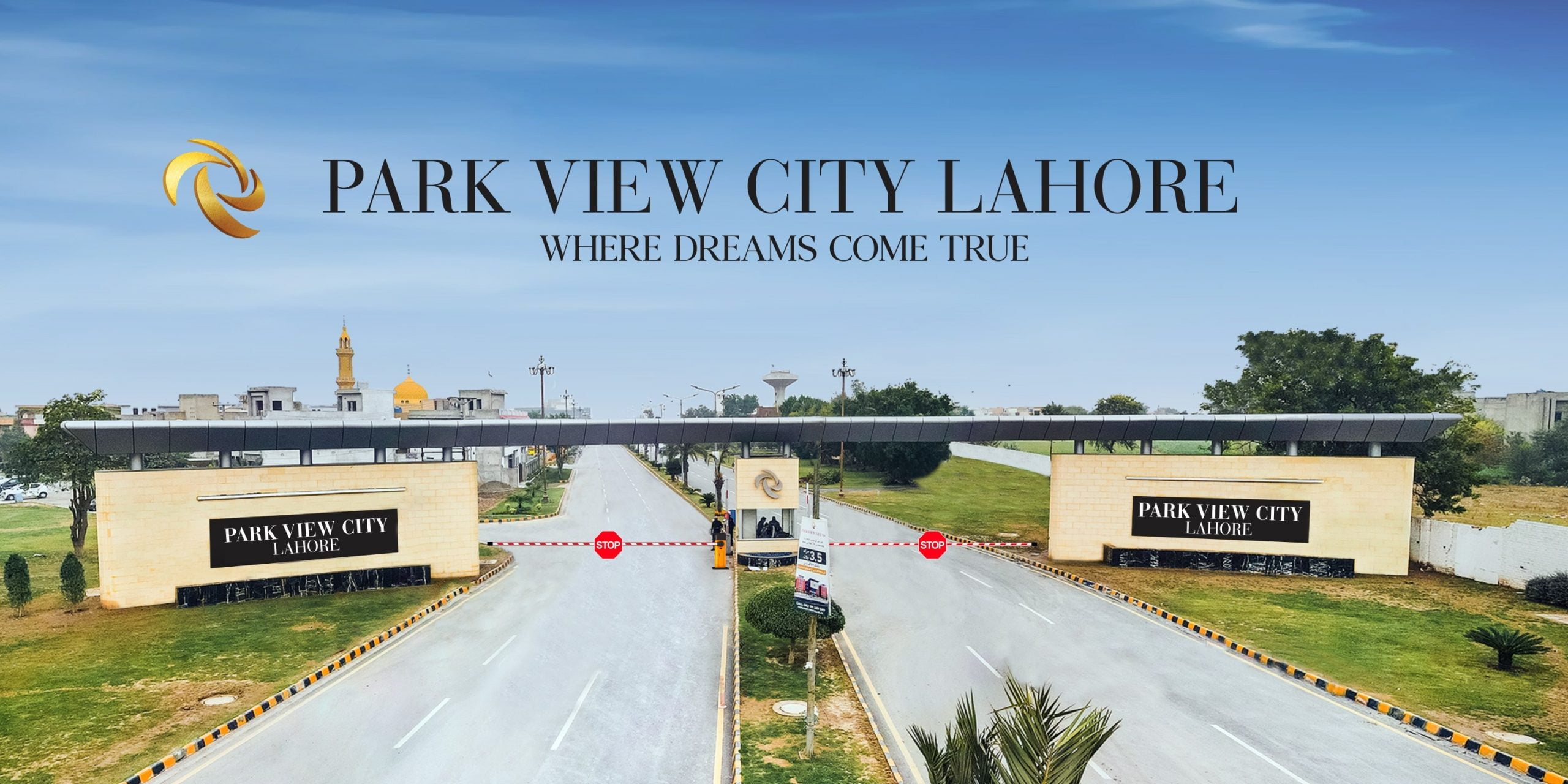

Park View City is ideally located on main Multan Road at about 3 KM from Thokar Niaz Baig. It is located right opposite DHA EME Sector as can be seen on the local map given below:

The company has easy access to M-2 Highway and GT Road, and it has convenient access to Ring Road, which connects it with all major areas of Lahore including DHA and Airport.

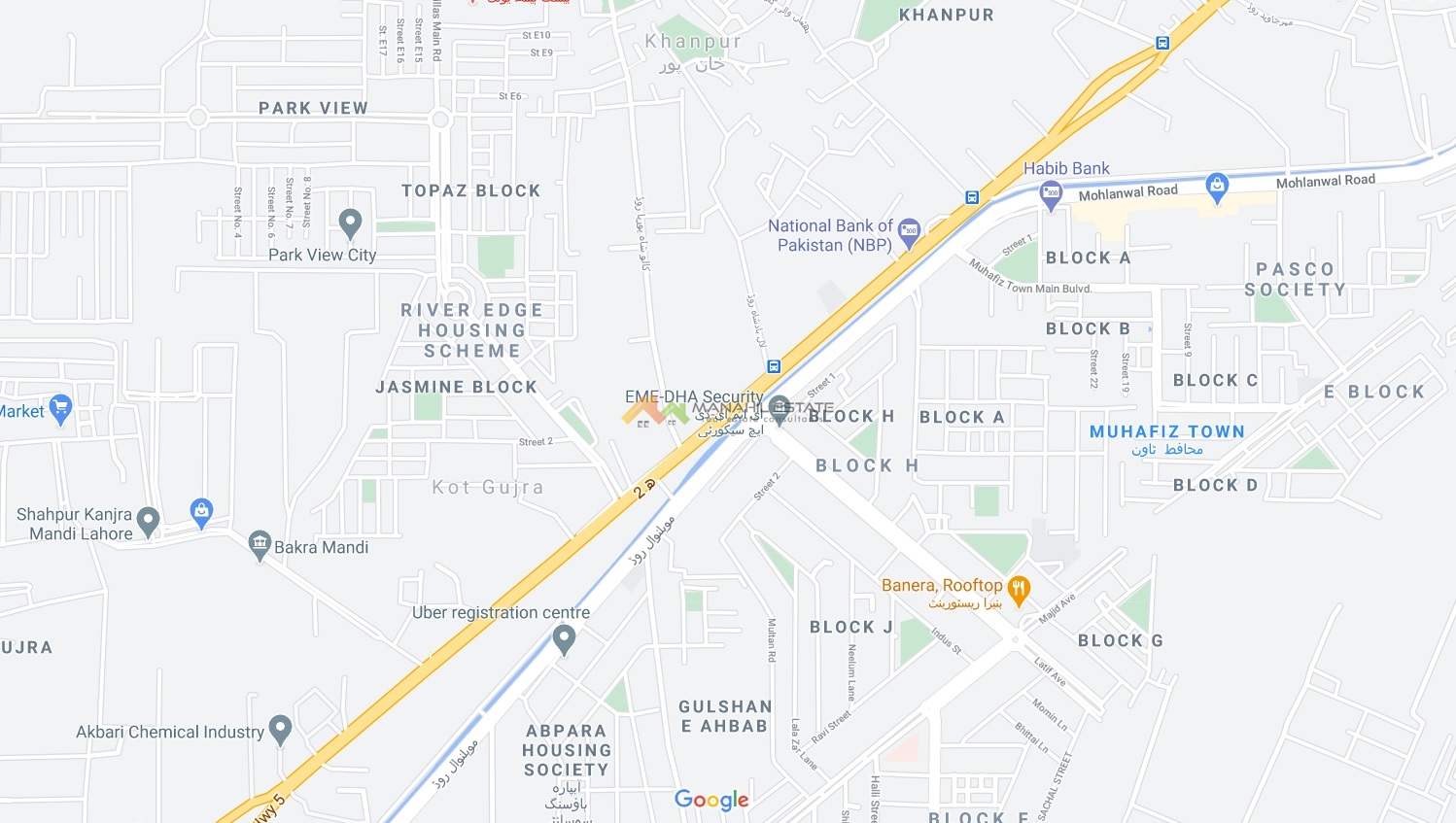

You can check out the existing map view of Park View City Lahore below:

Park View City is an LDA Approved Housing Scheme and has already acquired the land for Overseas Block. Existing blocks in Park View City are fully developed, where properties have been given to owners. A large number of families are already living and enjoying the most modern amenities provided by Vision Group.

You can watch the introductory video of Park View Lahore below:

Park View City Overseas Block is planned to have the highest standards of infrastructure and amenities, making it the most desirable address in Lahore.

Some of the amenities offered by Park View City Lahore as given below:

- Secure Entrance Community

- Ecological Environment

- Educational Facilities

- Wide Carpeted Roads and Street Network

- Diligent Business Zones

- Modern Shopping Malls

- Modern Health Facilities

- Community center

- Uninterrupted Services

- Backup Power Generation

- Parks and Play Areas

- Trained Security Staff

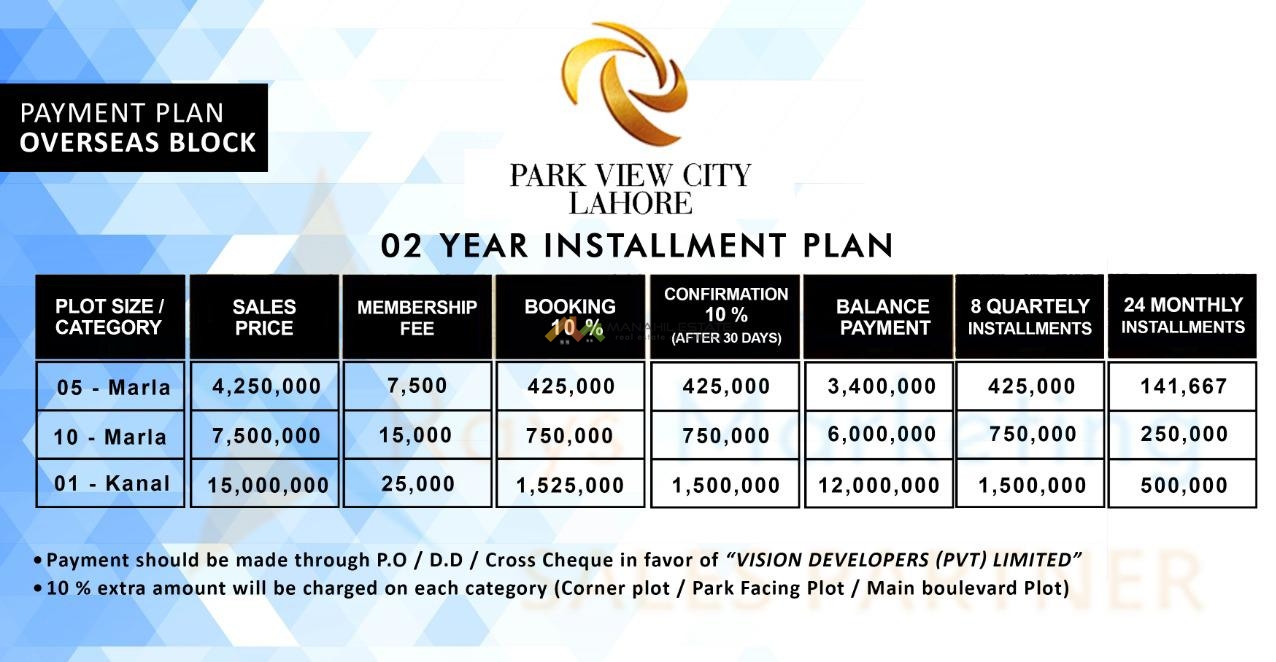

Currently, the society has launched a limited number of 5 marl, 10 marl and 1 canal residential plots in Park View City Overseas Block. Reservations start from just a 10% down payment followed by a 10% confirmation fee after 30 days. Remaining amount is payable in 2 years by monthly or quarterly fees.

The following are pre-launch housing prices and payment plans:

Please note that we currently offer pre-launch prices as shown above, however official prices have already been revised once. Another price increase is expected in March 2021, so you can take advantage of this short-term opportunity to make a quick profit.

Park View City Lahore Launches Overseas Block

Property Tax in Pakistan 2020: Latest Updates and Criteria

Less than 1% of Pakistanis pay property tax. This is a bad and risky statistic for a country’s economic well-being.

Most residents in Pakistan do not pay taxes. In return, this weakens our financial and economic situation. There is not enough money for the government to pay for roads, hospitals, education and defense.

In addition, the state needs to rely on foreign sources to raise revenue due to the lack of taxation. This involves loans from other countries and large-scale banks.

Property Tax In Pakistan 2020 – Important Details

You need to have details about the size of the lot and how to know it correctly if you are measuring the tax on your home.

This blog should remove all confusion related to properties in Pakistan 2020.

What is a Property Tax?

In the type of money the owner would pay, the property tax is the amount. The government is collecting the bill. The government is helping taxes. It is used in various fields, e.g. In road construction, increase in the required imports, payment of wages of people, and so on.

The word property applies not only to plots or homes but to all materials you own. Your car, farm, office building and other things on your behalf will be part of concrete help. Pakistan’s current property tax rate is 25% in 2020.

Although it costs to buy some material objects, e.g. To build your houses, raw material costs, labor costs, interiors, floors and others. Many banks in Pakistan lend a home to facilitate the construction of your home.

How You Can Pay Your Taxes

In Pakistan there are three types of property taxes:

- Each province has its own tax department. You must call the local tax department to pay the tax.

- By creating an online asset tax, you can also pay your tax in banks.

- You can change electronically through your online banking systems.

Tax Year of Pakistan

The fiscal year will begin between July 1 and June 30, so the property tax, which began on July 1, 2020, will end on June 30, 2021. Real estate can be contacted for in-depth perspectives. The books offer insights into both industrial and residential.

Property Tax And The Situation In Pakistan

In the third world countries, Pakistan is flourishing and progressing if we are to see it. Now is the time for us to act. The housing tax is not the same for everyone and the more you receive, the more you pay tax. It ensures a balance between the social class of different status. The rate often varies between cities and districts. The taxes are in format and they are charged conveniently by any citizen.

Many citizens do not pay the taxes that do not build such good financial conditions. The administration would not earn adequate funds for financial compensation, health insurance, education, and defense. The government has gone to foreign outlets because of these circumstances. This implies the take-off of high-interest loans from the IMF and other nations.

Important Issues To Consider WRT Property Tax In Pakistan

- There is no distinction between plots and some buildings

- CGT was shortened to 4 years the retention time

- 100% of the capital gains taxed because it is less than one year of the retention period

- 75% of the capital gains tax if the retention period is longer than 1 year but less than 2 years

- If the retention period lasts 2 years but not 3 years, 50% of the capital gains will be taxable

- In which the retention period reaches 3 years, but not 4 years, 25% of capital gains are taxable

- No tax on CGT after four years of tenure

Types Of Property Tax In Pakistan

Capital Gains Tax

You have to give the government a certain amount of money when you buy some land. The Capital Gains Tax is charged at a rate of 2% of the recorded value, in accordance with the Finance Act 2006.

In the current budget, however, the general value-added tax on urban spaces is 2% and the stamp duty rate is 3%. Stamp duty is an amount you pay for the legal records of the property.

Capital Gains Tax

This tax is the inverse of VAT. Capital income tax is a certain amount of money that the seller needs to pay for selling his assets. The tax applies to the income of the seller.

The Pakistan Finance Act 2017 stipulates that capital duty can be imposed only if the property is sold within the first three years of the sale. In addition, annually, tax rates are adjusted.

The tax rate is 10% in the first year, 7.5% in the second year, and the tax limit is 5% in the third year. The seller does not have to pay the capital gains tax in Pakistan after three years.

Withhold Tax

Capital gains tax and capital gains tax are a combination. The buyer and the seller must share a certain price when an item is sold.

In Pakistan 2018-19, a buyer of the house, which is also an income tax, will pay a 2 percent withholding tax, while a non-advertiser will buy a 45 percent tax. The taxpayer must pay a 2 percent withholding tax.

Will you see the gap between taxpayers and non-registrants in the tax bracket? This huge increase in the tax rate is aimed at ensuring that taxes are made. Similarly, buyers of the property must pay a 1% tax for registrants and 25% for non-registrants.

Which properties are tax-saved?

Any active groups are exempt from the imposition of taxes. The following categories are addressed:

- Houses built on land less than 5 Marla, instead of the category “A” place

- Property cannot operate above the annual rent of PKR. 5211 / –

- A single house with an annual rent of no more than PKR. 6480 / – if the owner’s house is occupied

- The annual deduction of the tax debts of buildings occupied by widows, small orphans and / or the disabled is PKR 12150 / -.

- Housing up to one Canal owned and rented by a former government worker is removed from the ownership of a dwelling house

- Government buildings, such as businesses, districts or cities. buildings maintained by a government or magistrate

- Mosques and other monasteries.

- Urban parks and children’s fields, schools, boards, homes, inns, bookstores and hospitals, buildings and real estate.

- Places rented only to public charities, religious or prescribed.

Summarizing it

Regardless of what property you own, one must stand as a responsible person. The conscientious citizen keeps his tax data accurate. The company economy is set up by this action. When we look at the land, people in various private businesses like to buy land and houses.

The values of the property are growing steadily as it is the perfect opportunity to buy. Today’s investment is tomorrow’s investment. Contact Globe Estate & Builders for more information on property news.