How to Generate Buyer Leads in Real Estate

It is not very difficult to generate buyer leads in real estate if realtors follow the right strategy after studying the market.

The real estate business has witnessed tremendous growth during the past few years due to the exponential population boom. Real estate companies are investing in big construction projects and expanding their business to large extents. However, individual realtors are facing a tough challenge to grow in the market.

Realtors solely depend on market trends and competition to generate sales. A successful strategy in a stable market helps them generate buyer leads in the real estate business.

However, fierce market competition, changing consumer demands, evolving technology trends, and environmental changes are causing economic uncertainties in markets. It affects the sales strategies of realtors in the long run. So, they have to keep a track of several factors and update their strategies accordingly.

Feeta.pk, Pakistan’s smartest property portal, has compiled a guide that can help realtors generate buyer leads in real estate.

Ways to Generate Buyer Leads in Real Estate:

From arranging physical tours of the property to using digital media platforms for marketing, the following strategies can help generate buyer leads in real estate.

- Focus on a niche

- Become your local subject expert

- Create a website

- Create a social media marketing strategy

- Use email marketing

- Develop real estate content

- Offer virtual tours

- Provide testimonials and portfolio

- Build partnerships

- Advertise through traditional media

Focus on a Single Niche:

One of the most common mistakes that realtors make is that they don’t have a single defined niche. They think that focusing on multiple areas will help them generate buyer leads and build their portfolio. However, that is a false assumption. Taking multiple areas of investment into account diverts the prospective client’s focus, causing a loss of confidence.

Therefore, focusing on a single niche at one time is essential. It will help you gain expertise in that particular area strategically and stand out amongst other realtors. Potential clients mostly consult realtors who possess expertise in their area of interest and, hence, can help in securing growth investments.

Moreover, by covering your area you will be able to create the right content and market it to the right investors.

The following are certain niches that individual realtors can choose from:

- First-time home buyers

- Commercial real estate

- Luxury real estate

- Relocations

- Rental Properties

- Mountain homes

- Farms

Apart from these, you can choose a niche depending upon the demographics of the area. For instance, in every area, the population is divided into various groups ie, hostels, single-family homes, multiple-family homes, university areas, etc. So, you can opt for a single area and build the presence of your services in it.

Become Your Local Area’s Expert:

Most real estate agents prefer to work in more than one area. They keep track of various projects in those areas and provide investors with potential investment opportunities. However, in most cases, they lack expertise in all of these locations, which goes on to cause problems later on.

To attract potential clients, becoming an expert in one area can increase your chances of gaining leads. A local area expert realtor must be aware of schools, parks, entertainment spots, restaurants, and all other facilities and amenities that can attract investors.

For instance, if you are working with a first-time home buyer with kids, you should provide them with options where schools and parks are nearby. It will help them choose the best property according to their needs. Therefore, it will eventually build investors’ confidence in the realtor.

If the realtor is confused about his or her area and has to consult others in the market, it gives a red signal to the investors. Becoming a local area expert will help you build your portfolio within a short period.

Create a Website:

With the evolution of technology and the online presence of real estate firms, investing in real estate has become quite easier. Although investors make their final decisions after physically visiting the properties, the internet and digital marketing can also influence their choices.

From finding a property to selecting a real estate agent, investors are now relying on the internet for information. With a single search, they can find thousands of properties and real estate agents to make their investment easier. Therefore, to stand out from the competition, building a website is an essential step for a real estate agent.

If you are working with a real estate firm, they may provide you with a web page presence, but that is not enough. You should create your own website to present your work to potential investors.

Having your website will help you in:

- Building a strong online presence

- Generating more leads

- Providing exposure to properties in your inventory

- Bringing innovation to your business

- Spreading the word about your business

- Using web listings during presentations

- Displaying testimonials and portfolio

Create a Social Media Marketing Strategy:

Over the past few years, social media has been influential in boosting the success of businesses. With an effective online presence through a defined strategy, companies can attract a large roster of clients.

Digital marketing with engaging and cohesive social media content provides the best strategy for the long-term success of a business. Having a social media following can bring in loyal customers who are influenced by your content and services.

Your social media content should focus on:

- 80% engaging content to build the interest of the public and keep them updated with industry trends.

- 20% sales-related content and messages to promote your business.

The following are some benefits of having social media presence:

- It gives a better exposure to your business.

- It provides a cost-friendly approach to reaching more investors.

- Reporting and analysis of lead generation are easier.

- It helps in enhancing customer relationships.

- It builds brand trust.

Use Email Marketing:

Source: Cmarix

Keeping clients regularly informed about your services is important as it helps build permanent relationships with clients. Website content and social media play a major role in maintaining bonds with investors and clients.

However, not all investors may have a social media presence. In this case, building an email marketing list will help a great deal. Once you have compiled the list of emails, send them weekly newsletters about upcoming local events or the latest developments in the real estate market.

The following are some benefits of email marketing:

- Enhances brand presence

- Helps in closing more real estate sales

- Reaches a broader range of customers

- Nurtures relationships with the clients

- Save time and money

Develop Real Estate-Related Content:

In the digital age, the traditional concept of real estate marketing has changed. Now, clients look for more information about projects and possible areas of online investment. So, real estate firms and agents have been generating informative content for this audience through blogs.

A real estate website is the ultimate platform to keep clients informed. However, having a website with your portfolio and client testimonials is not enough. You need to produce quality content on your site. Clients have a bundle of questions and concerns that should be answered.

Being aware of the most common real estate questions will help you plan content related to client concerns. With such content, you can address the client’s problems, build brand authority, and ultimately attract a regular audience. In case you are unaware of the most common real estate problems, you can follow the most famous real estate blogs on the internet and generate related content.

Offer Virtual Tours:

With the latest developments in technology, most real estate firms and realtors are adopting modern techniques to attract clients. Virtual tours, for instance, have become one of the most important tools for an agency. Clients need to view the condition of properties before they can consider investing in them. In such cases, physical visits and virtual tours play their role.

Most investors do not have enough time to visit the properties physically, so they prefer virtual tours. These allow them to assess the overall condition of properties. Virtual tours can also be helpful to a realtor.

They help in:

- Displaying property in the best way

- Gaining the trust of the clients

- Saving time and money spent on arranging physical tours

- Attracting more customers to your website

- Standing out from the other agents in the market

Provide Testimonials and Portfolio:

Salesforce

Clients usually do not trust the real estate agents in the market. Instead, they trust personal references from people they know or the other investors in the market. Secondly, they believe in the quality of projects in a realtor’s profile.

Hence, providing your clients with testimonials and past projects in your portfolio will help you gain their trust.

Providing testimonials will:

- Build credibility and trust in the market

- Establish an emotional draw

- Help during effective marketing

- Generate buyer leads

- Maintain permanent customers

Build Partnerships:

The real estate sector is connected to several industries. It is essential to expand your network in all allied industries. Building partnerships will help you and everyone connected in the loop in enhancing business.

The following are some industries where real estate agents can form profitable partnerships:

- Professional renovation firms

- Insurance companies

- Personal bankers

- Commercial lenders

- Title companies

- Property managers

- Cleaning services

Advertise Through Traditional Media:

Apart from all the strategies that involve technology, traditional advertising campaigns can also help in reaching out to more potential clients. For example, billboards and brochures can promote word-of-mouth among those who do not use social media.

By using these strategies, realtors can close more sales from their deals. To get more information about generating leads in the real estate business, visit Feeta Blog.

How to Generate Buyer Leads in Real Estate

How Rich People make easy Money | Rental Income Solution

How Rich People make easy Money | Rental Income Solution

I’m sure you’ve often wondered how some people seem to succeed in life with minimal effort. And to some, it seems like a constant struggle. Well, unless you’re lucky enough to be born into a billionaire family, most people spend their lives working hard just to succeed. So why do some people always seem to get rich in life while others spend a lifetime chasing after their wealth ?.

Right now, you’re probably trading time for money. Most people’s jobs involve being paid for their time at work, trading expertise in exchange for a salary. Think about all the time it takes to build a business, the time in the office, the hours to answer calls, strategic meetings, networking, chasing customers. It is exhausting and labor intensive.

Why do the poor stay “poor”

So, we all know what poverty looks like when people can’t cover their basic expenses for life. They have difficult choices just to pay their rent or their bills. They spend their lives chasing money like a rat in a cage. Instead of investing in themselves and trying to improve their situation, they are reluctant to take risks and seize an opportunity because they are worried about the future. But the truth is most people don’t feel equipped to face challenges and so can often vent their frustrations by blaming others – politicians, bad luck, and so on. The poor want wealth, but they don’t know how.

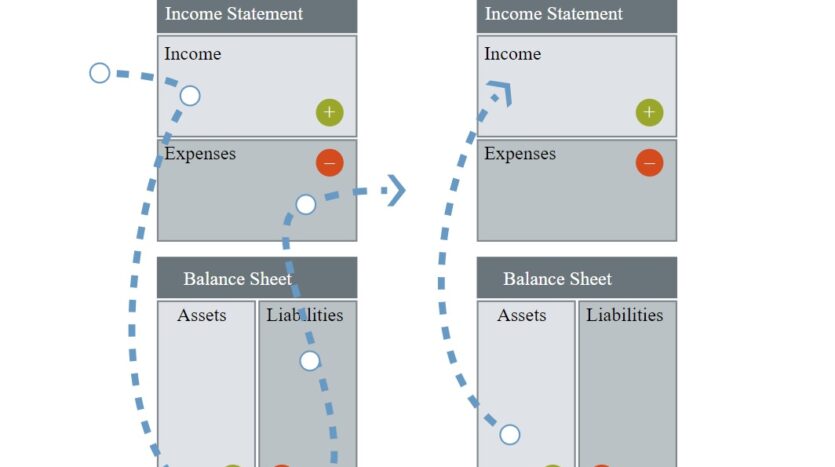

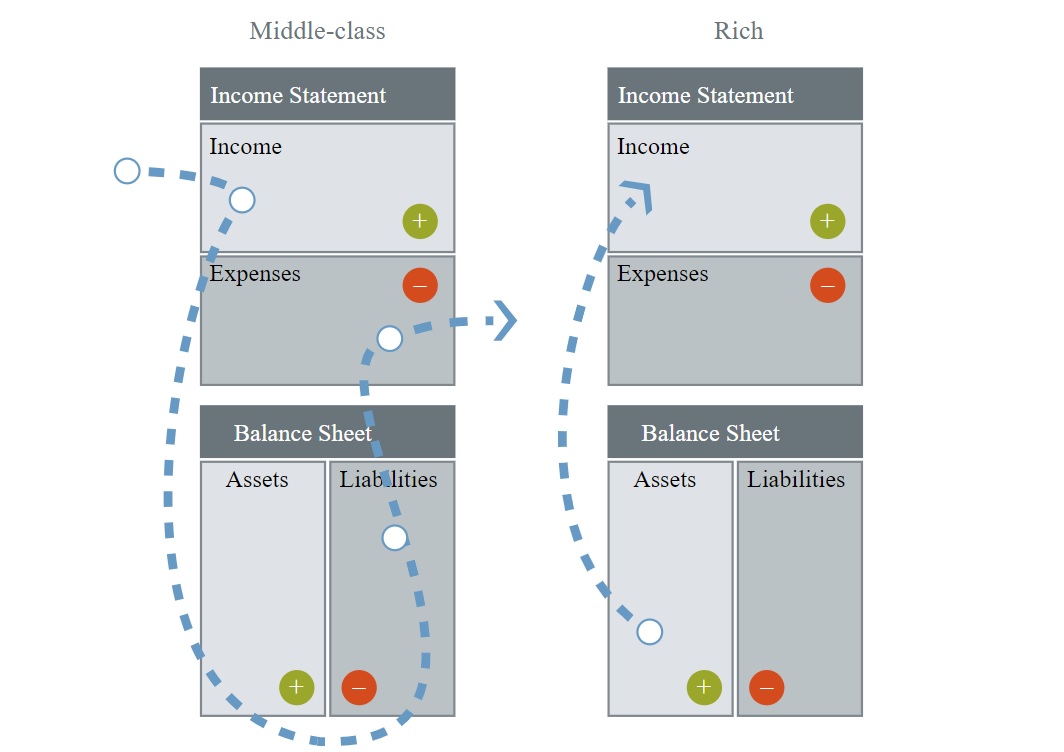

Why the middle class remains “poor”

And then there’s the middle class. They have disposable income and savings. They work hard and aspire to be rich. But they often never quite reach that next financial level.

Imagine. You have a monthly income available. So you buy the latest technology, a new car or a vacation to indulge yourself. And that’s where you make a mistake that costs you the opportunity to get rich.

When things lose their value, that’s called depreciation. And that’s what drags you down. The technology will quickly become obsolete. That beautiful watch is worth less than half as soon as you walk out of the store. The car will quickly lose its value. The holiday will be a distant memory. These are not good investment choices. You are caught up in a cycle of working harder and harder just to keep things as they are.

For short-term gain, you lose the opportunity to enter the next financial bracket and become really rich. The car needs repairs. The technology needs to be replaced. You feel pressured to maintain or even outdo your lifestyle. This lifestyle costs you more and more money. When things cost you more in the future, it’s called responsibility.

So how do you get rich?

Rich people make their money work for them, while the poor work to make money. Wealthy people learn to invest wisely in assets that are going to make them appreciate and give them a positive cash flow.

Paul Getty, the world-famous billionaire, famously declared,

“The key to wealth is learning how to make money while you sleep.”

So, what is he talking about? Sounds like a fairy tale. Not at all. It’s a smart way to make money, and it’s called “passive income.”

Passive income is a smart way to make money and free up your time. It is the gain of wolf ownership, limited partnership, shares, stock or other business in which a person is not actively involved.

Definition of asset and liability according to Robert Kyoski

As Robert Kyoski explains in his book “Rich Dad, Poor Dad,” the biggest mistake most middle-class people make is that they continue to gain compensation by believing that these are assets.

La asset it’s something that increases in value and puts money in your pocket every month, giving you a regular cash flow.

Responsibility it’s something that takes the money out of your pocket.

Your house, for example, is not an asset but a liability by Roberts definition the plots and files you have purchased are passive also. You will pay for its maintenance, taxes, development costs, non-construction penalties. Only if you are able to sell it profitably will it become an asset or if they are paid for with your passive money. Until then, although they may increase in value over time and give you capital gains, which is not always the case, you pay for them and that classifies them into liabilities.

Conversely, rental property can be valuable if you do your due diligence correctly and are able to collect more rent than you have monthly costs. The difference between the rent and the expenses is the net operating income, and it is a cash flow that flows into your pockets every month. Therefore, it is a valuable asset.

I can tell you that cash is king. Assets do not pay bills; cash does! Robert K’s definition of an asset is not accurate from an academic point of view, but to define the types of assets to focus attention on, he is correct.

So, really, you can call yourself rich only if your assets pay off your liabilities, expenses and also generate capital for you to get more assets. Now you don’t have to work for money but your money works for you.

That’s why if you continue to collect assets that are passive, you will continue to pay for them until you die and while it seems your net worth is rising, it can’t pay for your monthly expenses or your lifestyle, and the profits are only realized when you sell. it.

The safest investment property

Partnerships can be sour. But real estate tends to rise steadily and can provide two streams of income: rent and capital growth. If the market is stagnant, you can always rent a property and continue to make money “while you sleep”.

And what kind of passive income has the least risk? Lua Farm, of course.

So the safest way is to invest in real estate. As the old saying goes, ‘Nothing is as safe as houses. With some expert help in choosing an investment property, you can double your money. How? Because you can rent the property while it is constantly increasing in value. So you literally make money while you sleep. And even better, you can invest your rental income from your assets and invest after the next investment opportunity.

This is how the rich move up and up. They make easy money rental income, see how their carefully selected property is also valued in value, and then move on to the next project. Such an investment is called ‘passive income ‘– where there is an initial cost but then the income stream does not require you to spend time enslaving it every day. It leaves you free to spend your precious time in an easy life, or look for the next opportunity,

Work Wiser NOT Harder

You can’t help it if you weren’t born with a silver spoon in your mouth. You may have a ‘comfortable’ lifestyle but wonder how you can become really rich. The lesson is that you need to actively take calculated risks. No one will offer it to you on a silver platter. You need to put in some initial time, money and research and then sit back and enjoy the results. Invest in a property that will not only be worthwhile but will also earn you rental income. You can use your assets to continue your next project.

And then you can enjoy what it really means to be rich.

Time is precious | Lua income solution

It’s not about working 50 years of your life during a few years of retirement. Have the constant stress of being tied to your desk, to the phone, juggling investments, and constantly watching the stock market returns.

Time is the only thing we can’t buyback. Passive Income is about saving time. It’s about making smart investments that work for you in the background .; quietly earning income. So you can spend your precious time earning more money if you wish. Or enjoying your life to the fullest for as long as Allah wills.

For more information on the real estate sector of the country, keep reading Feeta Blog.

How Rich People make easy Money | Rental Income Solution

- Published in Learn the game, Real Estate, real estate business, real estate buyer sales

The Ultimate Guide to Selling Property in Pakistan

Selling and Transferring Property in Pakistan is a regular occurrence in the country, where hundreds and thousands of people sell and transfer property. For those familiar with the process, the transferring procedure might just be a piece of cake. But for people who are new and confused about where to start, you’ve come to the right place.

Before we jump into the tricky aspect of this process, let’s clear the air about what exactly transferring property means and why it is an essential aspect of buying and selling property in Pakistan.

What do we mean by transferring property?

As per the law, any individual who owns a property should have the land or property verified under their name. The land should be under the designated ownership; only then can they sell the property to themselves. This is the basic requirement of selling a property.

In Pakistan, the transfer of any property generally consists of the owner transferring the title of the land from one person to the other. Transferring property can occur in multiple ways for various reasons, such as a mortgage, gift deed, inheritance, lease, exchange, etc. All such explanations are why transferring is an essential legal procedure.

Who is eligible to transfer property?

All individuals who can sign a contract are authorized to transfer property ownership in Pakistan. According to the Contract Act 1872, a contract is claimed as a binding agreement between two parties, meaning that it is a legally binding document for any sale and purchase of land in the country.

There are a few exceptions for people who are not eligible to transfer a property:

- Minor: Anyone under the age of 18 is a minor and therefore cannot carry out the process.

- Unstable Individuals: Someone who cannot understand the consequences of their actions, for instance, that of a mentally ill person. Other reasons can be permanent or temporary physical disability such as a Coma etc.

- Legally Barred Individuals: Someone barred from signing contracts cannot transfer property in Pakistan.

What are the steps involved in transferring and Selling a property in Pakistan?

The transferring process, although time-taking, is a simple and easy process with not many legal proceedings. We’ll break down the process into different steps to help you better understand.

Token (Bayaana)

This is the very first step of selling after you’ve successfully secured a client. This involves the buyer giving approximately 1 / 4th of the total price. If not the exact percentage, there is an agreed amount between the buyer and the seller to indicate an agreement from both sides of the party.

The Token (Bayaana) is given by the buyer with a series of negotiations and based on a contract, in which all details are specified. After this, the seller holds negotiations with any other potential buyers.

Usually, a specified period is set and written in the contract for the full amount to be paid. If the sale falls through, the token is returned. But if the full amount is not paid in the specified time, the seller has no obligation to return the token, even if the sale doesn’t go through.

What is a Property Sale Agreement and how can we get it?

A sale agreement contract is a set of required documents that include all information related to the seller and buyer involved in the transfer process. In Pakistan, these are the required documents that are attached with the Bayaana form:

- Complete details of the property with the property owner’s verified name

- Terms of sale for the property

- The total amount of money which the property is being sold for

- Final date for the buyer to pay the remaining sum of money

What is the complete list of documents required?

To carry out the transfer process smoothly, you need to collect the following documents organized. You’ll need:

- Recent Passport Photos of both parties involved (Buyer and Seller)

- Photocopies of National Identity Cards of both parties

- Original Purchase Deed of the Seller (From the time they purchased the property)

- The original ‘Sale deed’ which is the agreement contract between both parties

This list of documents can also include some more documents depending on the province, region, area, etc. (A lot of documents, we know, but verified property takes tough measures!)

- A ‘Record of Rights’ also known as Fard-e-Malkiat, is a form that can be obtained by the seller from the property registration office. This guarantees that the property is under the name of the seller.

- You’ll need a Non-Demand Certificate (NDC), a document that shows you don’t have any fine due on the property. Depending on the location, you can get this from the local development authority’s office.

- For properties in private housing schemes, there is the need to request a letter from a particular society to carry out the property transfer. This can be used in place of the Fard-e-Malkiat document.

Possession of Stamp Paper and Tax Payment

Source: Pinterest

This is one of the essential and final steps of the transfer process. You’ll need a stamp paper to draft the deed for the sales; that will be the contract for the sale. You can choose. Buyers; will be required to pay stamp duty and taxes during this step.

Let’s take a look at this easy breakdown of the tax duty involved:

- Stamp Duty 3%

- Capital Value Tax 2%

- District Council Fee 1%

- Fixed Registration Fee PKR500 (Can differ as per govt. Order)

Drafting the Sales Deed

In Pakistan, the sales deed is usually recommended to be drafted by a property lawyer or a property agent aware of the bylaws and the rules involved in the process. This is a particularly safe option to avoid any complications that might arise in case you are doing it yourself.

Although, people who are selling and buying property as a business have become familiar with constructing the ideal draft for this deed, which can be done easily with the help of the internet. However, the common practice and recommendation are to take the help of a lawyer to avoid any future complications that may occur.

What do we do after drafting the Sale Deed?

Source: Freepik

Finally, after a long process, you’ve reached the last step. You can take the sales deed (inscribed stamp paper) along with the required documents to the registrar’s office. From here, the sub-registrar will call both parties simultaneously and hear their verbal agreement for the trading of property.

You’ll need to sign the documents and put in your fingerprint to verify the final sale and complete the transfer process. Once this is done, the official will register the sale deed successfully, then the transfer process is complete, and the property is now successfully transferred to the buyer.

How much is the Commission for the Property Dealer Involved?

If you’re wondering what the person who helped you secure a client and help you proceed with the sale and transfer of the property is, there is a commission that the dealer/agent gets from the client. Although there are no specific laws to govern and record the work of real estate agents and dealers in Pakistan, the general practice remains a constantly changing variable and experiences changes from time to time.

Usually, the commission of property agents comes to around 1% of the total value of a property. This 1% of the value is each from the buyer and seller as the commission to the dealer. If the buyer and seller both have different agents, then both agents get to keep a 1% commission each from their own clients. Sometimes, property agents will ask for as high as 2% of the property value, or even lower than 1%. The amount varied according to the success, reputation of a property dealer, or property value.

Suppose you’re looking to learn more about the legal aspects and procedures involved in property buying and selling. In that case, you can stay connected with our blogs at Feeta.pk, where you can easily find comprehensive information to guide you through the real estate market.

The Ultimate Guide to Selling Property in Pakistan

- Published in Housing Schemes, Infrastructure, International, Property Business In Pakistan, Property Consultant, Property In Pakistan, Property Laws, Property News, property sell in pakistan, property selling, Real Estate, real estate business, real estate buyer sales, real estate financing, real estate goals, Real Estate Guide, real estate investing, real estate investment, Real Estate Investments, real estate market, Real Estate News, Real Estate Trends, USA