Note: Access to the full article is limited to paid subscribers only. If you are already a paid subscriber, please login here. Otherwise, you can choose to purchase a subscription package below as little as Rs 275 / month:

17 Benefits Of Investing In Student Housing

Taking a leap to decide to invest in real estate is something to pat yourself on the back—good job for bringing the risk to gain high returns. Student housing investment is an excellent asset class that has proven to be resilient to economic fluctuations. It has been known as one of the stable investment opportunities. The current coronavirus pandemic and the most recent economic recession have proven this point of merit.

Some investors note that investing in student housing could be pretty risky and scary. With possibility of students thrashing the place, it’s no wonder why some people feel this way. However, the reality is that student housing is an authentic component of real estate.

Nowadays, many companies are building their business models around student housing because of its growing business potential and high returns. Putting money for building and maintaining college apartments, like sunrisevillageapts.com, is a great investment move to take advantage of today.

If you are having doubts until now, read more of the benefits of investing in student housing:

- High Enrollment

Despite the raging tuition fees among many countries worldwide, the demand for undergraduate and graduate degrees is increasing. Student enrollment is rising continuously, and parents continue to send their children to college. The need for education is still huge.

When it comes to real estate, the typical factors in perceiving and considering are job growth and demographics. But, in this case, high enrollment is the primary indicator for student housing. Applications and their continuing processes indicate that a specific area, especially if it’s near a university, will be populated with students.

- High Demand

If you have tried being an in-house university student, you’ll agree that most schools promote or offer housing on campus only to first-year students. This is because they can’t keep up with the high demand.

Starting when universities stopped sustaining these increasing demands among students, third-party real estate investors and developers have started coming in to take advantage of this business opportunity. Purpose-built establishments and apartments are now constructed just outside of campuses. This real estate trend is witnessed all across the country and even overseas too.

The number of students pursuing further education has reached 2.28 million in the school year 2015-2016. This data alone proves why there is a vast pool of demand for student accommodations.

- Turnkey

Many student housing investments are turnkey, so all you need to do is find student tenants. You don’t need to shell out money for remodeling or home improvements for your property investment. Many developers nowadays buy out large apartment complexes or condominiums and have each unit rented out. Sometimes, they sell these units too.

When such opportunities arise, you can purchase a smaller unit from that large complex and have a turnkey investment where they will be the ones to manage it. This is a convenient way for you to make money, as you don’t need to do anything.

- Recession-Proof

It’s natural to hear the term ‘recession-proof,’ which is often claimed by many business analysts. Although they may be valid, sometimes they’re not. Nonetheless, student housing is an investment that is genuinely resilient to the economic downturn.

In reality, when a local crisis happens, the opposite effect on student housing happens. In contrast to what other real estate properties experience, more students or an increasing number of people apply for student housing. The reason is that they believe that an undergraduate degree will give them more possibilities to land a job when the labor market has collapsed or is impossibly competitive. People do their best to afford college, and those who finished a bachelor’s degree would think that a master’s degree is an even better solution.

Hence, the demand does not change, even during a recession. People never stop going to school, even when the economy is suffering.

Another critical phenomenon is the online learning alternative due to the COVID-19 pandemic. Although it has affected many student housing properties, they managed to reopen since many universities announced their intention to go back to on-campus learning. This scenario serves as an example of how resilient a student housing investment can be.

- Marketability

When your student housing property is located in one of the vibrant places in your city or town, you won’t need to market it to increase occupancy manually. These locations usually already have nearby restaurants, art galleries, malls, and nightlife, so these establishments become magnets for students to rent your housing unit.

Say goodbye to posting advertisements everywhere to seek out tenants. Let the tenants reach out to you. These college town properties usually sell themselves, so you have very minimal effort for promoting them.

- Guaranteed Rent

Although some real estate owners have a negative judgment regarding students not paying on time or difficult tenants, students are actually responsible payers most of the time. The best thing about student housing is that they are usually good tenants or have a parental guarantor, which ensures no problem with rental collections.

- Students Could Be Long-Term Tenants

Many students either study for associate degrees that last for two years or an undergraduate degree that lasts up to five years. They may even extend their housing terms if they plan to proceed to higher education, like master’s or doctor’s degrees. Due to the duration requirements for college, this would mean that students are long-term tenants.

Most landlords that aren’t in the student housing industry may have a hard time listing their rental properties, but not with student apartments because they usually stay until they graduate from college.

- No Need for Car Space

Since most of your tenants are living close to the university, they won’t need to drive a car. Some may not afford a car, either. This will be an advantage on your end because you won’t have to provide car space.

- No Chance for Losing All Income

Investing in student housing has a 100 percent chance of not losing your entire income. Unlike other rental business models, you get to retain some income source because there will always be enough students occupying your property.

It’s a big swing for some private property owners who rent the entire home to a family. When the whole family leaves, there will be zero income for you.

The good thing about a student apartment is that even if some students leave and stop renting, there will still be some income left due to the other students renting continuously. It may not be ideal to have some vacancy, but it sure is better than losing your total income.

- Less Delinquency

Although there is nothing like a guaranteed investment, student rentals can be one of the closest things. Even when you encounter irresponsible students and run from their financial obligations, you will always have guaranteed income through your parents. It’s not uncommon to have the parents sign guarantees, so your payment will be protected.

Also, a large majority of students are responsible for their finances. This means some hand out their rent fees on the first of the month to ensure that they have secured their housing expenses already paid. This makes the student rentals have lesser delinquencies than other areas in real estate.

- International Student Tenants

Since your student housing property is located in a college town, you can expect many international students seeking out to rent. Universities in America are very active in attracting students from other countries. There will be a high demand for your property, and in turn, you will be left with no risk of having zero income.

- Concrete Structures

Most student rentals are built for comfort, so they usually come in concrete and high-quality construction materials. Students could not create considerable damage, unlike with other properties that may have used light materials.

The concrete structures also become more attractive for students to live in. This becomes a selling point for you to market. Young people always prefer to stay in a living space made of concrete because it gives them an impression of safety and security.

- Price Appreciation

Student housing properties usually have a good prospect for price appreciation in the future. Since many other investors will be interested in buying a property around this high-traffic area, the properties will increase in value almost every year. If you plan to sell and make more money through asset sales and profits, you can do so by buying now when it’s still affordable.

You may buy a purpose-built property now and have it rented out for some years. When the time is right, and the real estate has boomed enough, then you can sell your assets and make big profits.

- Maintain Market Rents

Some states in the country implemented rent control prohibiting property owners from raising rents until they get a new tenant. Unfortunately, this could be a real pain for them, especially if the existing tenants have no plans of moving out. Because of this policy, you are not entitled to ‘mark to market.’

However, when it comes to student rentals, you have the chance to do this simply because you will have an opportunity to attract a new crop of students every two years or so. This will not be a downside for you even when your property falls under a state that implements rent control.

You will always have new students come into your property because they will soon move out after finishing their undergraduate studies. Most of them often transfer and find a different place to live, which might be closer to where they’re going to work soon.

- Managed Property Investment

If you invest in custom-built student accommodation, it usually already includes property management. This allows you to entrust the administration to experts like the university itself or building administrators. This is intelligent investment management that is active and proactive.

On another note, you may also reach out to third-party real estate property managers who can do all the tasks that involve your property.

- More Significant Returns

The best advice to take when investing in student housing is to spread out your investments into a few stable properties with credible operators and, at the same time, take a risk to invest in new properties around some areas that have the potential for growing demand. Doing so will create a more balanced portfolio, so even if one property suffers from unpredictable circumstances, your overall investment will still balance out.

If you invest in a diversified and concentrated single asset, your returns are secure and sure. On the contrary, if you invest in several acquisitions, there are also opportunities for good returns with minimal risk.

Hence, the key is to spread out your student housing investment as much as possible because this will be a surer way to generate your desired returns.

- Student Accommodation Is Attractive

The amenities and facilities present in purpose-built student accommodation are already secured. These benefits are imperative for the daily lives of students and occupants in the building premises. For example, they can enjoy communal areas, high-speed Wi-Fi, and study areas. All these amenities become available and attract many student tenants.

One of the best features that your student housing can have is when the location is near to their university or close to shops, cafes, local nightclubs, and workplaces. When you choose to invest in student housing, you will benefit from higher yields and shorter void periods. This entails the certainty and security that many investors are looking for.

Conclusion

Student rentals, in summary, are a significant investment. Depending on the area you choose, you will indeed have the best returns, especially when it’s near a university, coffee shops, restaurants, and workplaces. Like any investment, though, there are always risks involved. What you need to do is to lessen the risk and contain it.

When you think about the trouble of managing a student housing unit or apartment, feel free to ignore this because you can always find a third-party real estate management company that can take over all the operations for your property.

Take advantage of investing in student rental properties if you are familiar with an area where it’s booming with students and lots of traffic. Invest now and wait for your returns to generate.

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

17 Benefits Of Investing In Student Housing

- Published in International, Real Estate, Real Estate Investments, Student housing

Why Software Engineers Should Invest in Real Estate?

You cut your teeth as an engineer, developing everything from simple applications to complex distributed systems used by millions of users. Maybe you work for one of the FANG companies (Facebook, Amazon, Netflix, Google), and make six figures. You’ve been thinking about investing in real estate for some time, but you’ve held off because you believe there’s a high barrier to entry. Software is your world. You don’t have extensive knowledge of real estate.

What’s more, you work 60+ hours a week, and because of the amount of work, you don’t have time to study all the various ways of achieving financial freedom. So, you end up investing in stocks or crypto – and here lies a waste of capital allocation for software engineers.

Let’s face it: You didn’t land where you are today because you’re incapable of learning something new and complex. In fact, your expertise, attention to detail, and higher-than-average income make you the perfect candidate for real estate investing.

I decided to write this article to help techies like myself achieve financial freedom through real estate investing. And not only techies. This article is definitely one to read if you’re an engineer, product manager, designer, investment banker, sales manager, or another high-income earner.

Are you playing baseball in golden handcuffs?

What do baseball and golden handcuffs have to do with software engineers getting into real estate? You may not realize it, but most high-income earners like you are in a very sticky situation.

Employees stay with the same company for a variety of reasons. Exciting work. Thrilling challenges. Industry prestige. But of course, the main reasons they stay are the benefits: excellent base salary, stock, health insurance, and matching retirement plans.

All these exceptional benefits are “golden handcuffs.” They’re the juicy perks that encourage high-income employees to stay right where they are instead of seeking new opportunities.

Here’s where software engineers, golden handcuffs, and baseball players collide…

In large tech companies, software engineers can count on multiplying their total compensation by 1.3 every time they’re promoted to the next level. Let’s say you work for one of the FANG companies where compensation is pretty high:

- A junior engineer (SDE 1, E3, fresh grad) makes a $125K base salary + $100K in stock for total compensation of $225K per year.

- A mid-level engineer with 3-4 years experience (SDE II, E4), makes about $165K+ base salary + 130K or more in stock.

- A senior-level engineer (SDE, E5, 5+ years of experience) can easily reach $420K, $200K from base salary.

- Then there are E6s, who constitute approximately 10% of the engineers at FANG companies. E6s earn up to $550K in total compensation. About 5% of E6 Facebook engineers make $700K-$1MM+.

Their salary increases sublinearly by about 10% from one level to the next. Stocks rise superlinearly about 50% from level to level. Now, the stocks that these engineers hold have also increased in value by about 8-10% annually over the last few years. As a result, they contribute to the $700K-$1MM high earners for folks in their late 20s and early 30s.

Don’t get me wrong, being an E6 at Facebook or Amazon is tough. It takes a lot of skill to reach this level. Most E6s have natural technical talent and graduated at the top of their class. These are true “high performers.”

But if you’re an E6 who’s coding, mentoring, providing technical vision and strategy, and leading your entire team’s technical charter – you end up working 60+ hours per week. Can you continue to meet such high demands for the next 5, 10, 15 years?

The younger techs can.

Paul Peebles from Old Capital calls this phenomenon the “baseball player effect.” Fresh tech grads earn almost the same amount of money as lower league baseball players. Plus, their careers peak in the mid-30s. After that, they compete with the “fresh blood” who eagerly churn out 60+ hour weeks without issue.

It’s the same for software engineers. Once you’re in the mid-30s, you hit the peak in your career. Then, your career and compensation stop growing at the same rate as before, eventually coming to a standstill.

You have an exact window of time to distribute your resources wisely so you can afford early retirement and comfortable life without depending on an employer.

When it comes to investing, time is of the essence.

If you work and live in California, like most techies, you pay the government up to 50% of your income. As a result, even if you make $800K a year, you’re left with only $400K.

Most California-based techies live in shiny houses, costing $2MM on average. With a 20% down payment, you then pay $10K for the monthly mortgage. You’re now left with $23K per month for all other expenses.

Now add the family, kids, expensive cars, and vacation to the equation. All of this can cost up to $10K per month, leaving you with only about $150K per year to invest. Talk about lackluster!

And what if you only earn $500K annually? If your career and income peak in your mid-30s, you’ll need to allocate your funds wisely (while you still can) in the growth stage.

But here we are again: Working 60+ hours per week with no time to explore investment options. Let’s talk about how to change that.

Real Estate vs. Stocks

We can’t go into a head-to-head comparison of real estate vs. stocks because it’s like comparing apples to oranges. The factors that affect stocks or real estate values and returns are very distinct.

But, here are some thoughts I’d like to share with you on this topic:

It’s safe to say that most techies invest in the stock market because they think it doesn’t require that much research or money. When you buy stocks, you own a piece of that company. Consequently, you make money with value appreciation and dividends.

Then there’s real estate investing…

There’s a massive misconception that real estate investing requires a substantial initial investment and tons of time researching the market.

However, the ways you make ROI on stocks vs. real estate are entirely different. That’s why portfolio diversification is paramount.

With real estate, you acquire physical property. One of the most popular and sustainable ways to make money from real estate is by collecting rent. Another way is through appreciation – capitalizing on increased property value. Lastly, you can pay down your loan principal.

The advantage of real estate is that it is a tangible, diversifiable asset that you can control. In addition, real estate investing offers you some substantial tax benefits. Despite not having similar liquidity as the stock market, it provides long-term cash flow and passive income to help you retire early.

Real estate returns vs. stocks

Most syndications offer 6-8% cash on cash return and 10-12% total annualized return. It’s certainly better than the stock market, period. Yes, you could argue that real estate can take a hit during economic recessions. But this applies to the stock market too.

Here is a comparison of the total returns of the SPDR S&P 500 ETF (SPY) and the Vanguard Real Estate ETF Total Return (VNQ) for the last 17 years:

Image by Sabrina Jiang © Investopedia 2020

Should you syndicate your own deal?

Real estate syndication consists of two parties. One group is the syndicators, who do all the work for you, such as finding and evaluating deals, getting the property under contract, hiring and overseeing the property management company, executing the business plan, and finally disposing of the property. The other group is the passive investors – they don’t do any work but invest $50K, $100K, or $150K. They do this so they can buy a large piece of real estate that they cannot buy otherwise individually. Syndicators make extra due to their sweat equity.

There are 2 types of people out there. Knowing which one you are will help you decide if being a real estate syndicator is right for you:

- First, there are high-income earners who believe they don’t have the time or interest to invest in real estate syndication. While that may be true, it’s problematic because not investing in real estate is a waste of capital allocation.

- Second, there are low-income earners who believe syndication is the way out of their situation. This is problematic because the quality of syndication is not that high.

I am a real estate syndicator myself and have invested in more than 1,500 units. I’m also a lead syndicator on two deals totaling 580 units. Let’s explore the pros and cons of becoming a real estate syndicator.

Pros and cons of being a real estate syndicator

Have you been visualizing yourself traveling the world while the income keeps rolling in from your investments? That might be your goal, but here are other benefits of real estate syndication:

Pros

- Steady wealth building. Although it often starts at a slow pace ($50K per year), once you buy your 400 and 500-unit properties, you may be able to replace your current income in as little as 3-4 years. However, these initial years do require a fair amount of work.

- Invaluable skills. The experience and skills gained by syndicating your deals are hard to acquire elsewhere. You learn asset management, how to stay in the game, and how to build a strong network of multifamily vendors, such as brokers and lenders. Even if you decide to buy multifamily independently without doing syndication, these skills are invaluable. However, make sure you enjoy the day-to-day of being a real estate syndicator.

- Great retirement is more than possible. When you commit to syndication and managing your assets, early retirement for your high-income lifestyle is within reach and sustainable.

Before you make a decision, here is a list of reasons why syndicating while having a high-income job is not necessarily worth it:

Cons

- Initial ROI vs. time spent. A sponsorship team makes around $1K per unit a year. The cash on cash ratio vs. property appreciation ratio is approximately 2:1. For example, if you purchase a 150-unit multifamily property, the sponsorship team earns around $150K per year. So, if you have 3 people on the team, you each end up with $50K per year, including appreciation. Without appreciation (only cash flow and asset management fees), it’s $33K per person annually. Those looking to replace their after-tax income from a W2 job will need 1,000 units to make $1M/3 = $333K a year in a 3-person sponsorship team.

- Risk and responsibility. Imagine being responsible for that much equity under management while only making $333K per year. Is it truly worth it? Take a moment to consider this before making a decision!

The bottom line: Real estate syndication is not rocket science. It’s mostly hard work, a little bit of research, and 5th-grade spreadsheet skills.

How to passively invest in real estate

If you’re a high-income earner and don’t have enough time to do research, passively investing with real estate syndication is your way to go.

It surprises me that while syndication provides an excellent resource for passive income, I’ve hardly met any FANG engineers in real estate syndication mentoring groups. It’s unfortunate because real estate syndication offers high-income techies an opportunity to diversify their portfolios and enjoy early retirement.

You don’t have to “work your way up” or spend a lot of time becoming a syndicator or general partner yourself. Passively invest in syndications!

Here’s an example of what that looks like:

I work in the tech world (engineering manager at Lyft). A few of my friends invest in my real estate deals. I take care of their tax filings, so I may have to call them from time to time.

While I’m doing all the paperwork, they’re out in Hawaii just surfing and enjoying life. Sometimes I get jealous. Why am I doing all this for them while they’re not working for any of the money that’s coming in?

That’s the power of passive investment in real estate. The return on your time equals infinity – especially if you have someone like myself doing the work for you.

A roadmap for software engineers looking to diversify into real estate

Diversifying your portfolio into real estate doesn’t have to be complicated. Here’s what to do:

- Dive to blogs and podcasts to learn about real estate syndication. I’ve put together a list of real estate investing podcasts and a list of real estate syndication blogs.

- Buy your first rental property. Use it as a learning curve before investing in syndication. Once you experience being a landlord you’ll value all the effort that goes into keeping a rental property operating smoothly.

- Buy a house-hacking home. It will help you save a lot of money on mortgage payments and invest it into real estate. If your spouse doesn’t want to share the house, go for something that doesn’t cost $2MM.

- Passively invest in syndication, but check the syndicator’s background and track record. With Cash Flow Portal, we take care of this for you. On our platform, you can easily talk to them, check their references – even connect to meet for coffee! Make sure they are responsive, confident, and experienced. Check online reviews of the syndicator.

- Network with syndicators. Cash Flow Portal offers a simple way to connect with syndicators, vet them, and passively invest in their deals.

Author Bio

Perry Zheng is the founder and CEO of Cash Flow Portal, a real estate syndication software. He lives in Seattle, where he owns six single-family properties. Perry started real estate syndication three years ago. Today, he has more than 1500 units, raised over $16M, and is a lead syndicator on two deals totaling 580 units.

His goal is to help other syndicators succeed and overcome common challenges like raising capital and finding deals even while having full-time jobs. Perry is also a full-time engineering manager at Lyft. He worked at Twitter and Amazon before that.

1 person found this helpful

0 people did not find this helpful

Why Software Engineers Should Invest in Real Estate?

9 Things To Check Before Buying Investment Property

The real estate industry has seen impressive development over the past few years, thanks to the growing number of prospective homeowners. Today, you can find all sorts of investment properties to purchase, whether it’s vacant land, a commercial structure, or a residential building.

One thing about many of these for-sale properties, however, is that they may seem impressive from the outside, but the interior is wanting. For instance, there are those that might require repairs or termite treatment before you can move in, which could easily hurt your budget.

That’s not to say every stunning building has a set of hidden issues, but it’s better to be sure before investing your hard-earned money. So, what are some of the things to check keenly in an investment property before accepting your next deal? Read on to learn more.

- Pest inspection

Pests can be quite destructive to structures, especially those with several wooden designs. Unfortunately, not every homeowner takes the idea of pest control seriously, which is why you should prioritize it in your home inspection process.

Of course, it’s almost impossible to determine such issues with your naked eye. As such, it’d be prudent to hire a professional expert to carry out the inspection in all the rooms. After the process, they’ll give you a full report and whether there are any signs of a future pest infestation.

You might be wondering how such an inspection will be beneficial to you. Well, for one, it’ll save you any future regrets. It can be quite frustrating to move into a house only to realize later that it’s infested with termites and other creepy crawlies.

Another advantage is the fact that it helps in uncovering any other hidden issues. For instance, pests might have messed up with the building’s structural design, which can easily go unnoticed.

With all these in mind, you’ll have the upper hand during negotiations. Of course, the help of a real estate agent might come in handy, especially when trying to estimate the final value of the property.

- Well water

Most residential properties have a private well which is the main source of water within the home. If your target property has this, it’d be wise to have it inspected thoroughly before going ahead with the purchase.

It’s a no-brainer that contaminated water can pose a risk to the health of its users. Well, water can be easily polluted depending on its location and the design of its seal. In fact, the latter should be your first warning sign as you commence the inspection process.

Again, it’s important that you hire an expert to test the well water and ascertain the condition of the well itself. Oh, and don’t forget to check the flow rate and pressure.

Drilling a new well can be very expensive. Therefore, you need to be sure that the available one is still useable; otherwise, it could come back to haunt you.

- Plumbing

Is the plumbing system still in good shape? This is another critical question that will need answers before you can invest your money in any given property. It doesn’t matter if it’s a commercial or residential property; poor plumbing can always lead to a lot of frustrations.

Is the plumbing system still in good shape? This is another critical question that will need answers before you can invest your money in any given property. It doesn’t matter if it’s a commercial or residential property; poor plumbing can always lead to a lot of frustrations.

So, where should you start with the plumbing inspection? The aesthetics can be very appealing to the eye, but that doesn’t guarantee a fully functional plumbing system. Therefore, most of your checks here should focus on the operation rather than the appearance—although that’s another aspect.

One way of inspecting this section of the building is by checking the pressure of the water. Hook up a pressure gauge to the hose faucet in one of the rooms and turn it on when the rest of the sections aren’t in use. The recommended pressure is always anywhere between 30 and 80psi. If yours doesn’t meet this threshold, then there must be an issue with the plumbing system.

You can also get a miniature camera and drop it into the sewer line. Inspect for blockages and any noticeable damages along these sections. Remember, failure to carry out such inspections could leave you with repairs amounting to more than USD$5000, depending on the size of the building.

- Beware of any room fresheners

The easiest way to know whether there are some issues within the property is when there is an unpleasant smell. Of course, the sellers already know this and might decide to mask the smell with a room freshener rather than dealing with its root cause. As a buyer, if you’re not careful, the beautiful smell from these fresheners could fool you.

Take, for example, a house that was previously owned by a smoker. Of course, the tobacco odor rarely goes away immediately. If fresheners are used, it might be difficult for you to realize, but once you’ve moved in, it won’t take you long to notice the smell of tobacco. Apart from creating an uncomfortable environment, it could also lead to some health complications.

- Floor condition

Uneven floors may not seem much of an issue at first, but they can be quite frustrating for you as a new homeowner. For instance, if the living room has an uneven floor, it’ll be quite difficult to organize your furniture. For one, you might need to use some supporters to stabilize your tables, seats, TV stand, and other furniture.

So, how can you avoid such an experience? Well, it’s all about how you inspect the house. It’s always recommended that you bring a marble during the inspection and place it around various areas of the floor in every room you visit. This will show you any defects in the floor design.

Keep in mind that this isn’t proof of poor construction, especially if the house is quite old. Some houses can settle aggressively, and this will create a hump in the middle. Without inspection, some owners may not be aware, while others might want to play it down.

However, the fact of the matter is that this could be quite costly. The solution to deflections in floors may demand that you rip out the entire existing floor. In other words, you’ll need to reconstruct the floor from scratch; otherwise, you might have some unpleasant patches all over. Therefore, realizing this before taking the deal can save you a lot of money in the long run.

- Condition of the walls

Another very important factor you should open your eyes to is the condition of the walls. This is something that you can’t run away from because it determines the aesthetics of your home. For instance, no matter how organized your living room is, poorly designed walls will always drag your efforts back.

Some defects like worn-out paints and other naked damages are quite easy to trace. Remember, there is no ‘negligible’ damage when it comes to home inspection. For instance, there could be some stains left behind due to the tobacco residue in case you’re buying from a smoker. The yellowish-brown stains can be quite costly to get rid of as they’ll require a lot of scrubbing and two or more coats of paint. Therefore, be sure to record everything that you think requires attention before you can commence the negotiations.

There are, however, some issues that aren’t easy to notice. For instance, some people conceal water damage by painting over them. In the process, moisture is trapped beneath these paints, which can easily lead to the growth of mold. Black molds, generally, pose a threat to your health when you breathe in that odor.

So, how will you determine such issues? The biggest culprits when it comes to water damage are areas under the drawers, sinks, or beneath the tubs and toilets. In fact, if you come across warped sheetrock, that’s an indication that there might be some leaks, which could also mean that there is some water damage around the area.

Of course, the sellers are always required to disclose this information to their prospective buyers. If you happen to realize these issues during your inspection but aren’t mentioned in the package, then that could say a lot about the seller. In such a scenario, you have all the reasons to back out because you don’t know what else they’re hiding from you. In fact, depending on your state laws, the sellers might be forced to reimburse you for any costs incurred during the inspection.

- Are the walls soundproof?

Now that you’re impressed with the condition of the walls, it’s time to find out if they’re soundproof. This is quite important because of many things. For one, you will definitely need your privacy at some point, and when you have friends over or children around, it can be difficult if the walls aren’t soundproof.

Also, if you’re working from home, then we can’t stress how much this aspect is important. You wouldn’t want to be distracted by the noise from the living room while you’re busy with work in your home office. Of course, it can be difficult to tell with empty rooms, but you can still test it by playing music in other rooms while the door to your office is shut.

- Roofing

This is the first thing that you see the moment you enter that gate. This is a vital part of any home, and its condition should be confirmed before you can sign the deal. There are several things that you’ll need to check.

This is the first thing that you see the moment you enter that gate. This is a vital part of any home, and its condition should be confirmed before you can sign the deal. There are several things that you’ll need to check.

Here is part of the checklist;

- Broken or missing shingles

- Worn-out rubber boots supporting the vent pipes

- Damaged or missing chimney cap

- Cracked caulk

These are some of the factors to consider during the inspection. In addition to these, you might also want to check the design and see if it resonates with your needs. Some might be too old for a modern house, which means you’ll be forced to make a few changes—and that’ll be costly. It goes without saying that you’ll need to hire a professional roofing inspector for you to get the best results.

If there are some repairable defects, you can give the current homeowner some time to do the necessary. However, if it needs a lot of redesigning, then be sure to communicate the same and see if you can come to an agreement. Of course, if you don’t find common ground, then it’d be wise to move on to the next candidate.

- Ownership history

Knowing the condition of the house is one thing, but understanding its ownership history is another. So, why is this aspect vital? Inasmuch as it might not necessarily mean something, a house with high turnover should signal a red flag. Of course, people move out for various reasons, but when you have three people moving out within a space of 10 years, then that says a lot about the home itself and the neighborhood.

Knowing the condition of the house is one thing, but understanding its ownership history is another. So, why is this aspect vital? Inasmuch as it might not necessarily mean something, a house with high turnover should signal a red flag. Of course, people move out for various reasons, but when you have three people moving out within a space of 10 years, then that says a lot about the home itself and the neighborhood.

It’s worth noting that even in areas with the lowest average homeownership length, it’s estimated that most people hold on to their homes for at least eight years. Therefore, if several people are moving out within that period, then that means the house could have some hidden issues.

Unless you can find out these issues from a trustworthy source, it’d be wise to reconsider your options. There are high chance that you might be frustrated and end up listing the house within the first few years. The disadvantage, however, is that this will worsen the ownership history, and you might struggle to find the next buyer.

Conclusion

Many people end up regretting their purchase simply because they didn’t pay enough attention during the property inspection process. It doesn’t matter whether it’s a commercial property or your home. Inspecting it before finalizing the transaction is quite important. Checking the roofing, floors, walls, and plumbing system can save you a lot of money in the long run.

It’s worth noting that some repairs like uneven floors might require a total redesigning, which could be very expensive. Therefore, be sure to consult an expert before moving to the next step to avoid any unnecessary frustrations.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

9 Things To Check Before Buying Investment Property

- Published in International, Real Estate, real estate investment, Real Estate Investments

5 Tips To Wholesaling Real Estate With Technology

If you’ve been around the real estate industry long enough, you might be familiar with the phrase ‘real estate wholesaling.’ It’s one of the best investment options for someone who’s low in cash but still wants to try their luck in this field. However, just like any other business, beginners tend to struggle due to competition and lack of a reliable buyer network.

However, that doesn’t mean you should give up on your dream. There is, of course, a wide range of solutions you could try, and you can always find one that works best in your situation. One of those options is virtual wholesaling.

Technology has become the magic bullet for just about any business-related problem. It most certainly has played a significant role in the growth of the virtual real estate wholesaling market. As a virtual wholesaler, you can do your advertisements on social media and various real estate websites.

So, how can you leverage the benefits of technology and improve your real estate wholesaling project? This article compiles a list of must-read tips for anyone looking to venture into this business.

What is real estate wholesaling?

Before going any further, it’s important that you understand the meaning of real estate wholesaling. Inasmuch as it’s a common phrase, many beginners still don’t get what it really means. It’s simply a short-term strategy employed by investors to generate significant profits within a short period.

You might confuse it with retail wholesaling, but the two aren’t related in any way. When dealing with ordinary goods, a retailer purchases items from a wholesaler in large quantities and then sells them to consumers at a higher price. That’s basically how retailers make profits from their businesses.

However, real estate wholesaling is totally different because, for one, it doesn’t involve bulk goods. Instead, the wholesaler, in this case, signs an agreement with a homeowner looking to sell their home. The wholesaler then looks for potential buyers and assigns the contract to the best candidate available.

It’s worth noting that the goal in real estate wholesaling is to find the right buyer before the contract signed with the original owner expires. In other words, money is only exchanged between the parties involved once a suitable prospective homeowner is found. (1)

In the past, it was necessary for the relevant parties to meet face-to-face before any deal could be made. However, with the advent of technology, most of the tasks can be done using phone call applications. Call Cowboy, for instance, is a modern dialing platform that’ll allow you, the wholesaler, to interact effectively and even hold remote voice meetings with potential buyers.

Tips for virtual real estate wholesaling

Now that you understand what it all means to virtually wholesale houses, how can you use technology to meet your needs? Well, for one, the process isn’t as complicated as you might believe. As mentioned earlier, though, wholesaling real estate is a short-term investment that requires you to find a buyer within the shortest time possible. Therefore, you need to have a working strategy prior to stepping into the market.

Here are a few tips to keep in mind:

Do your research

The first step towards a successful real estate wholesaling project is conducting rigorous research. With the modern real estate market and any business for that matter, the more effort you put into your preparation, the higher your chances of success. Knowing the basics of real estate is one thing, but familiarizing yourself with the whole process of wholesaling is another. (2) So, as a prospective wholesaler, you need to understand how things work.

You can search through the internet for resources that’ll give you vital information necessary for any beginner in the industry. Google and YouTube, for one, are ideal technological platforms that’ll come in handy in this process. Also, in your research, make sure you look into all the legal requirements to avoid unnecessary frustrations in the future.

Of course, reading materials online will be of great help, but it would be wise to consult someone who has seen it all in the market. Remember, real-life experiences give you the exact feel of what to expect.

Find the right marketing techniques

Every business needs proper marketing strategies for it to rise above the competition and generate the desired profits. Real estate wholesaling is no exception in that regard. It’s worth noting that your primary goal in this business is to make profits, and that can only happen when the home is sold. So, the more people you advertise to, the higher your chances of finding a buyer who meets your needs and those of the original homeowner. (3)

So, which are the most effective marketing techniques in today’s environment? The main marketing approach in the modern world of business is social media networking. This is because almost everyone today has access to the internet and is registered to at least one social media platform.

Based on this, it’s safe to say that there’s a huge consumer base for any business on these social sites. You can, therefore, leverage this statistic to grow your outreach and build a network of potential buyers. Facebook, for instance, has an open marketplace where you can post your advertisement and wait for interested parties to contact you. Real estate and auction websites are another set of options that you might want to consider.

It’s worth noting, though, that even with the growth of internet marketing, phone calls and text messaging are still quite effective. Drop Cowboy ringless voicemail and other similar applications, for instance, can boost your outbound marketing by allowing you to deliver pre-recorded messages to the voicemail boxes of your potential buyers. The advantage here is the fact that you can send these marketing messages at any time of the day without being a nuisance to the other party.

Find motivated sellers

Whether you’re a beginner or a seasoned investor, the next step is to find motivated sellers. After all, you’ll need someone who’s willing to sell their house for you to get into business. But how do you go about this phase? Well, unfortunately, this is where many beginners start going wrong and end up being frustrated during their first sale.

Fortunately, nowadays, one can easily access a wide range of information in the real estate industry on their mobile device with a click of a button. You can use such features to your advantage when looking for motivated sellers. Rather than going around looking for listed properties, you can just use online tools to find houses on sale and check important seller data.

Some of the information you’ll be able to access are pre-foreclosure data, any important details about the property, and the seller’s contact information. As such, you can contact the original homeowner if you’re interested in whatever you’ve seen and start making offers.

Do your due diligence

But before you make an offer to the seller, you must make sure that whatever you’ve seen on the pictures meets your needs. As a beginner, it can be quite challenging to evaluate the market value of a given property while keeping in mind the cost of repairs and other expenses since you don’t have enough experience in the field. Therefore, once you’ve determined the location of the property, you can start by researching the average value of similar houses within the area.

Again, you can easily access these important pieces of information online. Just visit a reputable real estate website and make the comparison. There are also many repair estimate tools that you can use to do your calculations, allowing you to come up with a competitive offer to your seller.

If this seems like a difficult task, then your alternative option would be to network with other investors and agents, especially those working within your selected location. Find someone you trust in your network and consult them about the deal and you should go about it. Any professional will advise you according to the current market climate, which should give you an idea of where to start with your offers.

Once you’ve crunched the numbers up, it’s time to present your bid to the seller. Again, make sure whatever you’re offering will cater to all the repairs and still leave enough room for you to make a profit. It’s always recommended that you find a sweet spot somewhere between the highest and lowest possible valuation of the house. Remember, if you go too low, you might scare away the seller, and if you go too high with your bid, you’ll struggle to find a buyer.

Consider building a website

Finding motivated sellers and advertising their houses on social media platforms is a great way to start your real estate wholesaling business. However, once you’ve started gaining popularity, this method may no longer be sustainable. So, what’s your next step once you get to this stage? The best step you can take here is to build a business website where every operation related to your wholesaling venture will take place.

As mentioned, social media platforms are the most visited sites. However, having an engaging website can attract a portion of these online visitors. Adding videos on the website to bring properties to life can go a long way in attracting more users and potential buyers. Apart from pages where you’ll be posting new deals, you can add sections to your website for testimonials, blogs, and user engagement.

Advantages of real estate wholesaling

As mentioned earlier in the article, the real estate wholesaling business is constantly growing in popularity. But why are many people opting for this form of investment? What benefits does it bring to the investor? Here are a few insights:

Easy to learn

One advantage is that real estate wholesaling is friendly to beginners, hence anyone looking to have a taste of the real estate industry can start here. For one, it doesn’t require any license, and you don’t need a college degree to join the market. Is your account running low? Fortunately, the investment needed in wholesaling is negligible as compared to other real estate strategies. As such, you’ll be able to hit the ground running without too much hassle.

If you’re still learning the ropes in the industry, then this strategy is for you. It’s very simple to understand, even for someone who has never closed a deal before. All you need to know is how to find motivated sellers, advertise the property to potential buyers, and reassign the contract to the most suitable candidate. With proper guidance, you can end up closing multiple deals every month.

Quick returns

If you compare the amount of time it takes you to gain returns from new construction and a wholesale deal, the latter emerges as the clear winner. Depending on your level of expertise, you can close wholesale deals within a few days. In fact, those people who already know their way around the market can do so within hours.

Independent of your location

Another amazing fact about real estate wholesaling is that you can do this business from anywhere. With the growth of virtual wholesaling, you can literally sell a house based in a different country and time zone without physically visiting the place. In most cases, you only need a phone and a laptop to finalize a deal.

Conclusion

Real estate wholesaling is one of the most popular strategies in the industry. It involves a wholesaler whose responsibility is to find motivated sellers and buyers, quote two different prices for a given property to both and make profits from the difference. If you’re looking to join the rest of the industry, the best way to start is by doing enough research.

Once you’ve understood everything, you can start looking for sellers, assess the properties on offer, and make a bid. After agreeing with the seller, you can now start marketing the property using various technological platforms, like social media and real estate websites. Building your own website will also accelerate your growth in the market since people will know where to find you.

References

- “Five Things To Know About Real Estate Wholesaling”, Source: https://www.forbes.com/sites/forbesrealestatecouncil/2020/03/17/five-things-to-know-about-real-estate-wholesaling/?sh=373c9edf70a3

- “Eight Steps To Start Virtual Wholesaling Successfully”, Source: https://www.forcom/sites/forbesrealestatecouncil/2019/11/21/eight-steps-to-start-virtual-wholesaling-successfully/?sh=1fec9edf7d58

- “What is the Goal of Real Estate Wholesaling?”, Source: https://www.investopedia.com/ask/answers/100214/what-goal-real-estate-wholesaling.asp

5 Tips To Wholesaling Real Estate With Technology

- Published in International, Real Estate, real estate investing, Real Estate Investments, wholesaling

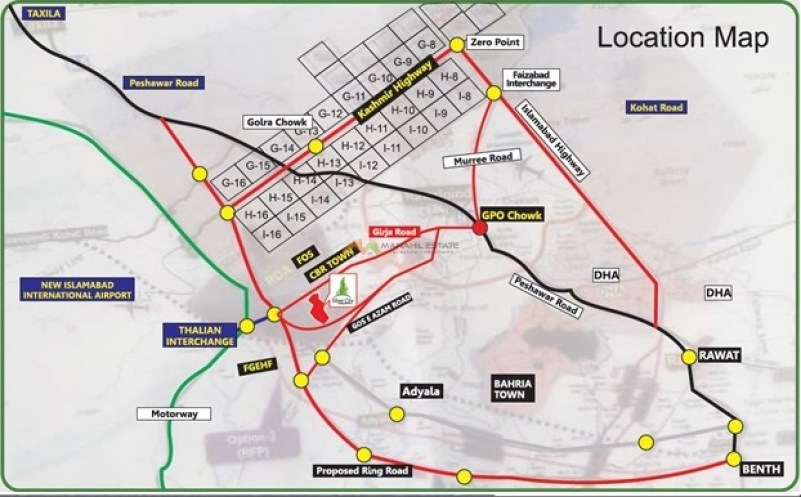

The best real estate investments in 2021-2022

Best Real Estate Investments:

The real estate investments has shown phenomenal growth in the year over the past 14 months. Most people seem confused because prices in most areas have already gained 60 to 70% and in some places even more than 100%.

Investing in the same areas that have gained so much lately seems like a risky investment and this raises the question of what are the best real estate investments you can make in 2021-2022?

While diversification is important, diversification is not. I don’t agree that in order to make money, you have to invest in every new property that appears on the map.

No one really has the time to study and analyze dozens of societies and observe them all the time. It is best to choose two or three best options and keep your focus.

This will eventually help you manage your assets in a better way and earn much more profit than investing anywhere and anywhere.

Real diversification is not about buying plots of land in different societies, but about investing in different types of real estate. Plots, Buildings and rental properties are the main areas you need to diversify your investments.

DHA Multan

While just like other areas DHA Multan quite a bit has been gained in the last year, yet the prices of the plot have not yet reached their peak. Although it may not show big gains in the coming year, the possibility still exists.

A realistic estimate of 1 Channel plot in DHA Multan should be 17 to 20 Million and in the coming years DHA Multan will slowly move to its target price.

It’s only a matter of time, as prices continue to rise wherever DHA Much begins to develop.

Keep your focus on blocks that are less developed and you will gain a good amount. The problem is that you will have to pay development costs amounting to 2.3 Million, let’s see how it will most likely play out.

The example below is just an expectation of an average transaction and a return on investment in DHA Multan.

Price of plot since October 2021: 110 Lacquers

Transfer expenses and commissions: 5 Lakes approx

Development costs: 2.3 Million approx

Total investment: 138 Lacquers

Expected Plot price in 2 to 3 years: 200 Lacquers

Sales expenditure and commissions: 3 Lacquers

Return: 59 Lacquers

ROI: 14.25% per year approx

Although it is more likely that prices will remain stable for a year or more, it is one of the best and safest investments for a 2 to 3 year cycle in the real estate market from now on.

Construction Projects

Over the past few years, construction projects especially luxury apartments have been hugely successful in Lahore property market.

This is the evergreen segment of real estate and has shown very high gains even between 2016 to 2020, when most people thought that real estate is declining, but in fact, only Plots, files etc have declined. Learn more about construction opportunities here

One thing to consider is the choice of the construction project. That’s why you need to study, analyze and carry out all the research just as you do when you invest in societies.

Projects are much easier to analyze and research and do not involve complex and lengthy procedures. In addition, if you search, you will easily find a cost-effective and valuable project that will give you very good profits over the years.

To make a forecast we will use an investment in the Sixty6 Gulberg apartment building. Imlaak did all the due diligence on the said project which was analyzed and recommended for investment.

Expected investment and return on Sixty6 Gulberg will most likely look like this:

Apartment size: 556 square feet

Price per square foot since October 2021: 23000 per square foot

Total Price: 128 Lacquers (Paid in installments in 3 years)

Transfer expenses and commissions: Zero

Development costs: Zero

Total investment: 128 Lacquers

Expected price in 3.5 years: 40000 per square foot

Total price after 3.5 years: 222 Lacquers

Sales expenditure and commissions: 5 Lacquers

Return: 90 Lacquers approx

ROI: 20% per year approx

DHA Gujranwala

DHA Gujranwala announced the Election on October 8, 2021, the file price of 1 Channel plot has already increased by 1 crore. Although this could be a bit of a risky game if purchased at a higher price.

However, if prices do not rise after Election, it may be a good time to look for an opportunity to buy. Although much will depend on DHA Gujranwala’s master plan and how it continues its future development, the market will respond positively to the vote due to overall positive market sentiment.

There are two possible scenarios, or the prices will jump immediately after voting, as the market sentiment is very positive and this is the most likely scenario or the prices will remain stable or crash a bit.

The second scenario, where prices remain stable or slightly crash due to selling pressure, is more suitable for investment. I believe the plot prices will reach between 17 to 20 Million in the next 2 to 3 years.

In many ways, the gain is similar to that of DHA Multan. However, DHA Multan remains my first priority from now on as it is ahead in the evolutionary progress.

If you are stuck between both DHA Gujranwala and DHA Multan, I would recommend DHA Multan and if you have the investment for more than 1 plot, then 1 each in both will be a good choice. However, a detailed analysis is only possible after a vote and it is not very far off.

Gwadar

Last but not least on this list is Gwadar, it’s like a wild card that can be played at any time. The risks are great but also the rewards, if you are one of those who like to double or triple or quadruple their money, then you can look at it.

The next two years may offer you a very good time to buy at very good prices, if the prices don’t go up earlier, they will eventually do so in the next 2 to 3 years.

The possibilities are endless, but I will only offer to invest in Sangar and New Town and strictly refrain from investing in other societies. We have all seen this happen in the last investment cycle.

The next cycle can take place anywhere from 2021 to 2024 and you may see at least a 100 to 150% gain. This makes it very difficult to predict the exact ROI so I will not go into that detail.

Conclusion

In the end, it all depends on your personal preferences because one size fits all.

However, overall, I feel that because plots and files have increased by almost 100% in about the last year or so, construction projects are the best available option offering the highest yields in the next two years. The investment priority would be as follows:

- Construction Projects

- DHA Multan

- DHA Gujranwala

- Gwadar

Stay tuned to Feeta Blog to learn more about Pakistan Real Estate.

The best real estate investments in 2021-2022

- Published in real estate financing, real estate goals, Real Estate Guide, real estate industry, real estate industry of Pakistan, real estate investing, real estate investment, Real Estate Investments, real estate market, Real Estate Market Analysis, real estate market trends, real estate marketing, Real Estate News, Real Estate Trends

BroadWay Heights Bahria Orchard

Broadway Heights Bahria Orchard

PAYMENT PLAN

BROADWAY HEIGHTS 1

______________________________________________________________________________

OFFICES

Property Area Total Price 30% Down 24 Month 20% On Property

Type (sq. Ft.) (PKR) Payment (PKR) Payments (PKR)

| Office | 325 | 2,600,000 | 780,000 | 54,167 | 520,000 |

| Office | 500 | 4,000,000 | 1,200,000 | 83,333 | 800,000 |

| Office | 540 | 4,320,000 | 1,296,000 | 90,000 | 864,000 |

PAYMENT PLAN

BROADWAY HEIGHTS II

______________________________________________________________________________

Apartments

Property Area Total Price 30% Down 24 Month 20% On Property

Type (sq. Ft.) (PKR) Payment (PKR) Payments (PKR)

| Studio | 327 | 2,750,000 | 1,375,000 | 45,833 | 550,000 | |

| Apartment with 1 bed | 510 | 4,250,000 | 2,125,000 | 70,833 | 850,000 | |

| Apartment with 1 bed | 579 | 4,825,000 | 2,412,500 | 80,417 | 965,000 | |

| Apartment with 1 bed | 582 | 4,850,000 | 2,425,000 | 80,833 | 970,000 | |

PAYMENT PLAN

BROADWAY HEIGHTS III

______________________________________________________________________________

Apartments

Property Area Total Price 30% Down 24 Month 20% On Property

Type (sq. Ft.) (PKR) Payment (PKR) Payments (PKR)

| Apartment with 1 bed | 450 | 3,375,000 | 1,012,500 | 70,313 | 675,000 | |

| Apartment with 1 bed | 452 | 3,390,000 | 1,017,000 | 70,625 | 678,000 | |

| Apartment with 1 bed | 512 | 3,840,000 | 1,152,000 | 80,000 | 768,000 | |

| Apartment with 1 bed | 639 | 4,792,500 | 1,437,750 | 99,844 | 958,500 | |

| Apartment with 1 bed | 643 | 4,822,500 | 1,446,750 | 100,469 | 964,500 | |

| 2-bed apartment | 697 | 4,897,000 | 1,463,700 | 101,646 | 975,800 | |

| 2-bed apartment | 761 | 5,327,000 | 1,598,100 | 110,979 | 1,065,400 | |

| 2-bed apartment | 764 | 5,348,000 | 1,604,400 | 111,417 | 1,069,600 | |

| 2-bed apartment | 785 | 5,495,000 | 1,648,500 | 114,479 | 1,099,000 | |

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

BroadWay Heights Bahria Orchard

Avoiding the Real Estate Wealth Trap in Pakistan

Beware, this article will change your mindset and real estate investments, so read it carefully while we reject the false rich trap of real estate in Pakistan. Read this carefully and if you have any questions please comment and ask.

After nearly 10 years of going through various cycles of real estate myself, I’ve realized that most of us don’t create any real wealth. Do we live in a paradise of fools and amass false wealth? This prompted me to do some research and analysis of the previous 15 years of investment cycles to find out what exactly we are doing wrong.

During our search for the truth about real estate, we learned that there is a huge difference between returns in USD and PKR. While you may think you made money in PKR, this may not be true for USD. Eventually, almost every other thing in your life and your purchasing power depends on the USD and not on PKR. This means that if your wealth does not grow by the USD, then you are not actually getting richer.

USD is therefore one of the most important factors of wealth creation. This is especially true for foreigners who invest in USD and expect to take their returns in USD.

The Dollar vs. PKR and Real Estate Investments

Just to understand how important this aspect was, we will choose Phase 6, 1 Channel plot in DHA Lahore as an example and compare its price in various years since 2005 in USD. Most real estate investments follow a similar pattern with small variations.

Year 2005

1 x USD = 60 PKR

Average price of DHA Lahore Phase 6 in 2005 = 9 Million ($ 150,000)

Year 2010

1 x USD = 80 PKR

Average price of DHA Lahore Phase 6 in 2010 = 6.6 Million (USD 82,500)

Year 2013-2014

1 x USD = 100 PKR

Average price of DHA Lahore Phase 6 in 2013 = 15 Million ($ 150,000)

Year 2016

1 x USD = 105 PKR

Average price of DHA Lahore Phase 6 in 2016 = 24 Million (USD 228,571)

Year 2019

1 x USD = 160 PKR

Average price of DHA Lahore Phase 6 in 2019 = 28 Million (USD 175,000)

Year 2021

1 x USD = 172 PKR

Average price of DHA Lahore Phase 6 in 2021 = 42 Million (USD 244,000)

Long Term Business

Looking at the USD chart for Phase 6, 1 Channel plot is very clear that long-term trading is almost worthless. I know a lot of people who have kept plots in these phases for over a decade and although you may have overcome inflation or PKR depreciation, you have not created significant wealth.

Most people have this idea that the longer they keep a plot or file, the more fruitful it is. Unfortunately, I hate to report this bad news, which is not the case. At least the property in Pakistan does not adhere to that law. In 2005 the plot which was at USD 150000 is only USD 244000 today. Even buying it in 2019 gives you a much better ROI instead of buying it 14 years earlier in 2005.

Actually buying the phase 6 plot in 2010, then selling it in 2016 and buying it again in 2019, and selling it again now in 2021 would be really quite lucrative.

The reason that devalues a long-term business is that someone who has held the same property for 15 years earns much less money than someone who has held the same property for 10 years. This same aspect makes long-term trading riskier, which can eat away at your wealthy creative endeavors like a termite.

Business Plots and Files in Speculative Cycles

The speculative trading cycles are the next option that most investors choose. It’s a really good choice but with just two big problems:

- You never know what the future holds. So everything you do is based on either guesswork or information that may not work exactly the way you want it to. It’s much easier to just look at the past data and see where you should have invested but planning it for the unknown future is not for everyone.

- If you can’t execute or the market doesn’t work as you hoped, you may be sucked in for a very long recession period.

Speculative trading is much easier said than done and it wasn’t until 2016 when the recession hit the real estate that investors realized what they were doing wrong. A considerable portion of investment has stalled in some areas because some investors felt it was worth trying to wait and hold on. These areas included Broadway Phase 8 commercial, residential plots in various places such as Phase 7, 8, and 9 of DHA Lahore, Malikpur, Shivpur 4 marl commercial files of DHA in Phase 8 ex Park View, and later on Gwadar.

As a result with a huge share of investments stuck in recession, investors have failed to seize new opportunities that have emerged from 2017 to 2020 such as indigo highs, Goldcrest Mall, DHA Peshawar, Downtown Mall and DHA Multan.

Although the return on investment was much better than long-term trading, but still not very impressive, as it included long periods of recession with zero to negative growth.

keyboard_arrow_leftPrevious

Thenkeyboard_arrow_right

What does the data say?

For an argument, let’s assume that everything went well and being the smart guy who is Mr. X, he kept money safe in the bank from 2005-2010 and then invested in phase 6 plots in 2010, then took an exit in 2016, and then took entry again in 2019 and has taken an exit now when the average plot price is at 42 Million.

To achieve this, Mr. X needed to make seven decisions during these 16 years. These included selling in 2005 and then investing in reliable locations to earn at least 10% a year. Taking an exit from wherever your money was and then reinvesting in 2010 in real estate. Repeating the same thing again from 2016 to 2019 and then finally taking an exit in 2021.

The location for an error is almost nil, if Mr. X had taken an exit in 2013, it could have gone awry. Similarly, if Mr. X could not take an exit in 2016 the results would be different.

Finally, it was also important to carry out a profitable business during the recessionary periods between 20015-2010 and then in 2016 to 2020. Timely exit from these investments and regaining entry into real estate should be surgically accurate.

How many of you are confident that you can read the market and do this type of business in the future?

The Good Old Rental Income

Rental income has always been considered a very essential and important source of income. However, not many people believe that it can enrich you as a speculative business. Some general problems you may encounter with rental income are:

- If you do not invest in the right rental property, your capital gains may suffer.

- Houses in Pakistan are the worst form of rental income due to huge depreciation and only 3 to 4% rent per year.

Choosing a rental property that would give you at least a 6% rental yield and some good capital gains over the years can be a challenge, but it is much easier to execute than a speculative business. In addition, you now have the option to invest in real estate that can offer an 8 to 10% return on annual rent above your initial investment.

Rental cash flows may seem minimal when you start, but over time they build up and give speculative traders a run for their money. It won’t be wrong to say that slow and steady wins the race because you have a much better chance of being rich if you invest in rental properties instead of plots of land.

What does the data say?

Now for the sake of argument let’s say, Mr. A, who is not as wise as Mr. X and was not sure if he can pull off that miraculous 16-year cycle with such precision. That’s why he decided to buy a property that gave him regular cash flows and average capital gains.

Mr. A has invested € 9 million in wolf ownership, which has given him an average of 10% in annual capital gains and 6% in rental income, which has increased by 10% a year. Ultimately, he invested his rental income in assets similar to where Mr. X kept his money during recessions to make 10% profits a year on them and the results will surprise you.

YES, it is quite true that Mr. A made almost the same amount of money as Mr. X and without ever having to go into the complications and risks that Mr. X took.

The magic actually happened because of the compounding effect on the rental income, this is one factor we never consider when we discuss rental properties.

The 16 years of rental income, which started at just 540000 a year, ended at 4 crores when accumulated and put together at only 10% a year. This is where most of you do your math wrong and only calculate the rental income and do not consider the impact of profits on your rental income.

keyboard_arrow_leftPrevious

Thenkeyboard_arrow_right

The way forward

The speculative business cycles of real estate and rental income are almost equal when creating real wealth. Renting is an easier and more stable way to secure your success compared to speculative trading. You can certainly mix them both or opt for rent alone, but I would never recommend just opting for a speculative trade.

Lesson learned

- Rental projects are always green investments that will give you good profits in almost any market.

- Rental properties are the backbone of your real estate investment.

- Plots and files should be invested only for speculative business cycles.

- Long-term keeping of plots and files is counterproductive in general and has not rewarded investors in the last 15 years.

- For better chances of success, rent is much more effective than any other investment in real estate.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Avoiding the Real Estate Wealth Trap in Pakistan

The Ultimate Guide to Selling Property in Pakistan

Selling and Transferring Property in Pakistan is a regular occurrence in the country, where hundreds and thousands of people sell and transfer property. For those familiar with the process, the transferring procedure might just be a piece of cake. But for people who are new and confused about where to start, you’ve come to the right place.

Before we jump into the tricky aspect of this process, let’s clear the air about what exactly transferring property means and why it is an essential aspect of buying and selling property in Pakistan.

What do we mean by transferring property?

As per the law, any individual who owns a property should have the land or property verified under their name. The land should be under the designated ownership; only then can they sell the property to themselves. This is the basic requirement of selling a property.

In Pakistan, the transfer of any property generally consists of the owner transferring the title of the land from one person to the other. Transferring property can occur in multiple ways for various reasons, such as a mortgage, gift deed, inheritance, lease, exchange, etc. All such explanations are why transferring is an essential legal procedure.

Who is eligible to transfer property?

All individuals who can sign a contract are authorized to transfer property ownership in Pakistan. According to the Contract Act 1872, a contract is claimed as a binding agreement between two parties, meaning that it is a legally binding document for any sale and purchase of land in the country.

There are a few exceptions for people who are not eligible to transfer a property:

- Minor: Anyone under the age of 18 is a minor and therefore cannot carry out the process.

- Unstable Individuals: Someone who cannot understand the consequences of their actions, for instance, that of a mentally ill person. Other reasons can be permanent or temporary physical disability such as a Coma etc.

- Legally Barred Individuals: Someone barred from signing contracts cannot transfer property in Pakistan.

What are the steps involved in transferring and Selling a property in Pakistan?

The transferring process, although time-taking, is a simple and easy process with not many legal proceedings. We’ll break down the process into different steps to help you better understand.

Token (Bayaana)

This is the very first step of selling after you’ve successfully secured a client. This involves the buyer giving approximately 1 / 4th of the total price. If not the exact percentage, there is an agreed amount between the buyer and the seller to indicate an agreement from both sides of the party.

The Token (Bayaana) is given by the buyer with a series of negotiations and based on a contract, in which all details are specified. After this, the seller holds negotiations with any other potential buyers.

Usually, a specified period is set and written in the contract for the full amount to be paid. If the sale falls through, the token is returned. But if the full amount is not paid in the specified time, the seller has no obligation to return the token, even if the sale doesn’t go through.

What is a Property Sale Agreement and how can we get it?

A sale agreement contract is a set of required documents that include all information related to the seller and buyer involved in the transfer process. In Pakistan, these are the required documents that are attached with the Bayaana form:

- Complete details of the property with the property owner’s verified name

- Terms of sale for the property

- The total amount of money which the property is being sold for

- Final date for the buyer to pay the remaining sum of money

What is the complete list of documents required?

To carry out the transfer process smoothly, you need to collect the following documents organized. You’ll need:

- Recent Passport Photos of both parties involved (Buyer and Seller)

- Photocopies of National Identity Cards of both parties

- Original Purchase Deed of the Seller (From the time they purchased the property)

- The original ‘Sale deed’ which is the agreement contract between both parties

This list of documents can also include some more documents depending on the province, region, area, etc. (A lot of documents, we know, but verified property takes tough measures!)

- A ‘Record of Rights’ also known as Fard-e-Malkiat, is a form that can be obtained by the seller from the property registration office. This guarantees that the property is under the name of the seller.

- You’ll need a Non-Demand Certificate (NDC), a document that shows you don’t have any fine due on the property. Depending on the location, you can get this from the local development authority’s office.

- For properties in private housing schemes, there is the need to request a letter from a particular society to carry out the property transfer. This can be used in place of the Fard-e-Malkiat document.

Possession of Stamp Paper and Tax Payment

Source: Pinterest

This is one of the essential and final steps of the transfer process. You’ll need a stamp paper to draft the deed for the sales; that will be the contract for the sale. You can choose. Buyers; will be required to pay stamp duty and taxes during this step.

Let’s take a look at this easy breakdown of the tax duty involved:

- Stamp Duty 3%

- Capital Value Tax 2%

- District Council Fee 1%

- Fixed Registration Fee PKR500 (Can differ as per govt. Order)

Drafting the Sales Deed

In Pakistan, the sales deed is usually recommended to be drafted by a property lawyer or a property agent aware of the bylaws and the rules involved in the process. This is a particularly safe option to avoid any complications that might arise in case you are doing it yourself.