10 Property Management Tips for Pakistan Real Estate Market

Anyone who has worked in the Real Estate Market understands how competitive it is. It necessitates a wide range of abilities that newcomers may not anticipate. It entails everything from dealing with evictions to negotiating contracts for waste collection, grounds maintenance, and janitorial services.

Aside from being an exciting and lucrative career, the road to success in the property management industry is a long and winding one. You must be well-versed and prepared for the drive if you want to get to your goal. It understands the difference between being a property manager in Pakistan and being a consistently successful property manager in Pakistan.

Consider these ten property management pointers to assist you in dealing with various challenges and scenarios in Pakistan.

Skills in Organizing:

The ability to organize is the first and most crucial talent required of a property manager in Pakistan. It includes talking with tenants, maintaining a complete record of each property, and keeping track of any forthcoming duties on a to-do list. It necessitates the competent and efficient management of obligations. In Pakistan, a property manager’s job requires handling many jobs simultaneously, necessitating excellent organizational skills.

Establishing Protocols and Policies:

To avoid miscommunications and potential difficulties with tenants, property managers in Pakistan must have policies and procedures in place. All regulations for tenants should be written down and supplied at the time of lease signing. Similarly, property managers must have protocols in place for a variety of situations.

Understand the law:

In Pakistan, a property manager must check the state’s fair housing legislation on a regular basis. Property managers may be required to have real estate licenses in some states, while others may demand different certificates or licenses.

He must keep up to date and ensure that he follows all regulations; if he has any legal questions, he should see a property lawyer or an attorney. To avoid any rental troubles, use a search engine to look up the regulations for the state in which you plan to manage properties.

Check out your Tenants:

Many experts stressed the importance of selecting the correct tenant and that there is no substitute for a thorough screening procedure. In Pakistan, it’s critical to ensure that your tenant screens are as thorough as possible so that you can distinguish between excellent and unreliable tenants. The most significant tenants are individuals who can pay on time, take care of the property, and have no criminal history.

Attempt to Resolve Disputes Without the Need for Lawyers First:

Meeting with the renter and addressing the issue helps resolve many tenant conflicts. Before threatening eviction and bringing in a lawyer, follow all property protocols. Noise violations, late rent payments, and management’s inability to enter the flat to undertake repairs are among the most typical complaints in Pakistan.

Abilities in Finance:

Because you may be responsible for negotiating lease agreements, collecting rent and utility payments, paying vendors, and tracking daily spending as a property manager in Pakistan, you must have a thorough understanding of financial management. As a result, you may utilize a search engine to look up different accounting software applications and rapidly produce reports, as well as keep an updated spreadsheet to track your earnings.

Marketing Skills:

Marketing abilities are one of the most undervalued aspects of property management that are often overlooked but are equally vital. Marketing is necessary to advertise vacant apartment units and to be able to write compellingly about them.

Knowing how to write a professional property description, take high-quality images, and create exciting video tours may help you showcase the most significant features of the homes you manage and pique potential tenants’ interest.

Maintain Thorough Digital Records:

Physical mounds of paper are significantly more challenging to sort through and file than digital records. You don’t need to waste time digging through your files for something specific, like a maintenance receipt or contact with a tenant, to find that the records are inaccurate or missing.

Make use of the Internet:

The usage of the Internet is expanding in tandem with the country’s advancement. The Internet is used for various tasks in today’s society, ranging from marketing to corporate administration. As a result, instead of fighting the times, it is wiser to evolve with them. A few examples are creating online ads for your vacant homes, finding tenants online, and researching the best maintenance companies.

Keep Regular Office Hours:

It may appear to be Pakistan’s most basic property management idea, but your renters must know when the management office staff is available for non-emergency issues. Tenants may quickly notify property management when a maintenance call is needed, rather than putting it off and letting the condition in their apartment deteriorate, perhaps resulting in costly repairs.

Conclusion:

Property management in Pakistan is a 24-hour-a-day job that requires constant attention. Property management may be both fascinating and profitable, but it requires both time and money. It’s a fast-paced, fiercely competitive market. As a result, it’s critical to have skills and abilities that allow you to stay ahead of the competition. These habits, along with self-discipline and drive, will benefit both your professional and personal lives.

Watch this space for more information on that. Stay tuned to Feeta Blog for the latest updates about Pakistan Real Estate Market.

10 Property Management Tips for Pakistan Real Estate Market

Best Real Estate Investment Opportunities In Karachi

For best Real Estate Investment Opportunities In Karachi, Karachi is the financial center of Pakistan and owning a property here is like owning a piece of gold in an otherwise volatile real estate market. The prices are always increasing and new societies with updated facilities and international standards of living make the investment in Karachi a fruitful destination.

The prices of real estate in Karachi are always increasing – one of the main reasons behind this is the difference between the demand and supply of the market. However, the real estate market in Karachi is doing better than the rest of the country due to the high business volume and rate of return on investment.

Let’s take a look at the real estate investment opportunities in Karachi:

Real estate investment in Karachi:

As the world emerges from the nagging shadows of the coronavirus pandemic, like everything else, real estate has also witnessed economic uncertainty and a slow market, but now people are looking for investment options that will benefit them in the long run.

When it comes to investment, there is no better option than property. Real estate investment in Karachi comes with countless options.

You’ll find condos, apartments, condos, farmhouses, and even penthouses in the high-rises that are popping up in posh areas of this fast-growing city.

Here are some important factors that you should consider before investing in real estate in Karachi:

Factors to Consider:

Look at these factors before making an investment in real estate in Karachi.

- Do a market survey: Before making a final decision, always do a thorough market survey. For example, the residential plots are in high demand, but the commercial properties always give higher returns, so take the decision wisely that will benefit you in the long run.

- Legal aspects of the property: Always pay extra attention to the legal aspects of the property you are going to buy. There are many land problems in Sindh and you don’t want to suffer later. Always check the legal documents thoroughly and verify them before investing.

- Check amenities and facilities: Always check the neighborhood where you plan to invest to know if the price tag is really worth it or not. Areas with facilities in the vicinity such as schools, commercial areas or hospitals will always be a property worth investing in.

Investment opportunities in Karachi:

As mentioned above, Karachi is the business center of Pakistan, and property prices are always on the rise. We have compiled a list of the best investment opportunities in Karachi to benefit you, take a look.

These are the top three investment opportunities in real estate right now. They provide you with high quality living and offer all the basic amenities along with satiate your desire for luxurious living. The locations are prime and these locations also offer customized investment plans for the ease of the investor.

Conclusion:

Real estate is often referred to as gold and there is no doubt about it. We’ve rounded up the best real estate investment opportunities in Pakistan’s largest metropolis. I hope they benefit you when deciding to invest.

Stay tuned to Feeta Blog to learn more about the Real Estate Investment Opportunities in Pakistan.

Best Real Estate Investment Opportunities In Karachi

- Published in Real Estate Trends

The best real estate investments in 2021-2022

Best Real Estate Investments:

The real estate investments has shown phenomenal growth in the year over the past 14 months. Most people seem confused because prices in most areas have already gained 60 to 70% and in some places even more than 100%.

Investing in the same areas that have gained so much lately seems like a risky investment and this raises the question of what are the best real estate investments you can make in 2021-2022?

While diversification is important, diversification is not. I don’t agree that in order to make money, you have to invest in every new property that appears on the map.

No one really has the time to study and analyze dozens of societies and observe them all the time. It is best to choose two or three best options and keep your focus.

This will eventually help you manage your assets in a better way and earn much more profit than investing anywhere and anywhere.

Real diversification is not about buying plots of land in different societies, but about investing in different types of real estate. Plots, Buildings and rental properties are the main areas you need to diversify your investments.

DHA Multan

While just like other areas DHA Multan quite a bit has been gained in the last year, yet the prices of the plot have not yet reached their peak. Although it may not show big gains in the coming year, the possibility still exists.

A realistic estimate of 1 Channel plot in DHA Multan should be 17 to 20 Million and in the coming years DHA Multan will slowly move to its target price.

It’s only a matter of time, as prices continue to rise wherever DHA Much begins to develop.

Keep your focus on blocks that are less developed and you will gain a good amount. The problem is that you will have to pay development costs amounting to 2.3 Million, let’s see how it will most likely play out.

The example below is just an expectation of an average transaction and a return on investment in DHA Multan.

Price of plot since October 2021: 110 Lacquers

Transfer expenses and commissions: 5 Lakes approx

Development costs: 2.3 Million approx

Total investment: 138 Lacquers

Expected Plot price in 2 to 3 years: 200 Lacquers

Sales expenditure and commissions: 3 Lacquers

Return: 59 Lacquers

ROI: 14.25% per year approx

Although it is more likely that prices will remain stable for a year or more, it is one of the best and safest investments for a 2 to 3 year cycle in the real estate market from now on.

Construction Projects

Over the past few years, construction projects especially luxury apartments have been hugely successful in Lahore property market.

This is the evergreen segment of real estate and has shown very high gains even between 2016 to 2020, when most people thought that real estate is declining, but in fact, only Plots, files etc have declined. Learn more about construction opportunities here

One thing to consider is the choice of the construction project. That’s why you need to study, analyze and carry out all the research just as you do when you invest in societies.

Projects are much easier to analyze and research and do not involve complex and lengthy procedures. In addition, if you search, you will easily find a cost-effective and valuable project that will give you very good profits over the years.

To make a forecast we will use an investment in the Sixty6 Gulberg apartment building. Imlaak did all the due diligence on the said project which was analyzed and recommended for investment.

Expected investment and return on Sixty6 Gulberg will most likely look like this:

Apartment size: 556 square feet

Price per square foot since October 2021: 23000 per square foot

Total Price: 128 Lacquers (Paid in installments in 3 years)

Transfer expenses and commissions: Zero

Development costs: Zero

Total investment: 128 Lacquers

Expected price in 3.5 years: 40000 per square foot

Total price after 3.5 years: 222 Lacquers

Sales expenditure and commissions: 5 Lacquers

Return: 90 Lacquers approx

ROI: 20% per year approx

DHA Gujranwala

DHA Gujranwala announced the Election on October 8, 2021, the file price of 1 Channel plot has already increased by 1 crore. Although this could be a bit of a risky game if purchased at a higher price.

However, if prices do not rise after Election, it may be a good time to look for an opportunity to buy. Although much will depend on DHA Gujranwala’s master plan and how it continues its future development, the market will respond positively to the vote due to overall positive market sentiment.

There are two possible scenarios, or the prices will jump immediately after voting, as the market sentiment is very positive and this is the most likely scenario or the prices will remain stable or crash a bit.

The second scenario, where prices remain stable or slightly crash due to selling pressure, is more suitable for investment. I believe the plot prices will reach between 17 to 20 Million in the next 2 to 3 years.

In many ways, the gain is similar to that of DHA Multan. However, DHA Multan remains my first priority from now on as it is ahead in the evolutionary progress.

If you are stuck between both DHA Gujranwala and DHA Multan, I would recommend DHA Multan and if you have the investment for more than 1 plot, then 1 each in both will be a good choice. However, a detailed analysis is only possible after a vote and it is not very far off.

Gwadar

Last but not least on this list is Gwadar, it’s like a wild card that can be played at any time. The risks are great but also the rewards, if you are one of those who like to double or triple or quadruple their money, then you can look at it.

The next two years may offer you a very good time to buy at very good prices, if the prices don’t go up earlier, they will eventually do so in the next 2 to 3 years.

The possibilities are endless, but I will only offer to invest in Sangar and New Town and strictly refrain from investing in other societies. We have all seen this happen in the last investment cycle.

The next cycle can take place anywhere from 2021 to 2024 and you may see at least a 100 to 150% gain. This makes it very difficult to predict the exact ROI so I will not go into that detail.

Conclusion

In the end, it all depends on your personal preferences because one size fits all.

However, overall, I feel that because plots and files have increased by almost 100% in about the last year or so, construction projects are the best available option offering the highest yields in the next two years. The investment priority would be as follows:

- Construction Projects

- DHA Multan

- DHA Gujranwala

- Gwadar

Stay tuned to Feeta Blog to learn more about Pakistan Real Estate.

The best real estate investments in 2021-2022

- Published in real estate financing, real estate goals, Real Estate Guide, real estate industry, real estate industry of Pakistan, real estate investing, real estate investment, Real Estate Investments, real estate market, Real Estate Market Analysis, real estate market trends, real estate marketing, Real Estate News, Real Estate Trends

BroadWay Heights Bahria Orchard

Broadway Heights Bahria Orchard

PAYMENT PLAN

BROADWAY HEIGHTS 1

______________________________________________________________________________

OFFICES

Property Area Total Price 30% Down 24 Month 20% On Property

Type (sq. Ft.) (PKR) Payment (PKR) Payments (PKR)

| Office | 325 | 2,600,000 | 780,000 | 54,167 | 520,000 |

| Office | 500 | 4,000,000 | 1,200,000 | 83,333 | 800,000 |

| Office | 540 | 4,320,000 | 1,296,000 | 90,000 | 864,000 |

PAYMENT PLAN

BROADWAY HEIGHTS II

______________________________________________________________________________

Apartments

Property Area Total Price 30% Down 24 Month 20% On Property

Type (sq. Ft.) (PKR) Payment (PKR) Payments (PKR)

| Studio | 327 | 2,750,000 | 1,375,000 | 45,833 | 550,000 | |

| Apartment with 1 bed | 510 | 4,250,000 | 2,125,000 | 70,833 | 850,000 | |

| Apartment with 1 bed | 579 | 4,825,000 | 2,412,500 | 80,417 | 965,000 | |

| Apartment with 1 bed | 582 | 4,850,000 | 2,425,000 | 80,833 | 970,000 | |

PAYMENT PLAN

BROADWAY HEIGHTS III

______________________________________________________________________________

Apartments

Property Area Total Price 30% Down 24 Month 20% On Property

Type (sq. Ft.) (PKR) Payment (PKR) Payments (PKR)

| Apartment with 1 bed | 450 | 3,375,000 | 1,012,500 | 70,313 | 675,000 | |

| Apartment with 1 bed | 452 | 3,390,000 | 1,017,000 | 70,625 | 678,000 | |

| Apartment with 1 bed | 512 | 3,840,000 | 1,152,000 | 80,000 | 768,000 | |

| Apartment with 1 bed | 639 | 4,792,500 | 1,437,750 | 99,844 | 958,500 | |

| Apartment with 1 bed | 643 | 4,822,500 | 1,446,750 | 100,469 | 964,500 | |

| 2-bed apartment | 697 | 4,897,000 | 1,463,700 | 101,646 | 975,800 | |

| 2-bed apartment | 761 | 5,327,000 | 1,598,100 | 110,979 | 1,065,400 | |

| 2-bed apartment | 764 | 5,348,000 | 1,604,400 | 111,417 | 1,069,600 | |

| 2-bed apartment | 785 | 5,495,000 | 1,648,500 | 114,479 | 1,099,000 | |

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

BroadWay Heights Bahria Orchard

Gold Crest – Time to move in

Introduction:

Gold Crest is the height of luxury shopping and entertainment, right in the heart of DHA. It’s more than a collection of stores. It’s a lifestyle choice; a ‘shopping entertainment’ experience where you can browse the latest clothing, chat over coffee, dine with friends, grab the latest craze and let the kids explore their own fun area. With 252,000 square feet of retail space, its air-conditioned luxury creates a cool and peaceful oasis of indulgence in our contemporary world.

Gold Crest Mall DHA Lahore is an optimal opportunity for real estate investment in DHA, Phase 4, Ghazi road, Lahore. Offering high-end luxury apartments for sale according to a flexible part plan. To further enhance the investment benefits in Gold Crest we offer a lot of investor friendly contract terms that very few real estates in Pakistan can bring to the table.

- DHA Joint Venture Project

- 24/7 Power backup

- Flexible payment schedule

- 7-8% Annual rental production

- Parking – 4 floors

- Al Fatah store

- Shopping shops – 2 floors

- Multilevel – 2 floors

- Gymnasium

- Luxury cinemas

- Restaurant

- Children’s play area

- Grocery stores

- 2 Separate Prayer Areas

Main Place

1- Gold Crest Mall DHA Lahore offers an ideal location for brand stores to attract customers

2- Located in DHA, the commercial center and chic area of Lahore

3- In close proximity to all phases of DHA, Lahore and Phase 3 DHA commercial

4- Fast and easy drive to Cantonment, DHA, Model Town and Ferozepur road

5- Great place to live for shopkeepers and socialites

Apartments are ready to move.

As our commitment to our valued customers, we always deliver on what we promise.

Apartments on 5th and 6th floors are almost ready. you can see the updated details in our recent video.

7th and 8th a floor will be ready in the next month and another floor will be ready very soon. So pack your bags to enjoy a new lifestyle at Gold Crest.

Apartments and Shops are available for resale.

For more information on the real estate sector of the country, keep reading Feeta Blog.

Gold Crest – Time to move in

The Ultimate Guide to Selling Property in Pakistan

Selling and Transferring Property in Pakistan is a regular occurrence in the country, where hundreds and thousands of people sell and transfer property. For those familiar with the process, the transferring procedure might just be a piece of cake. But for people who are new and confused about where to start, you’ve come to the right place.

Before we jump into the tricky aspect of this process, let’s clear the air about what exactly transferring property means and why it is an essential aspect of buying and selling property in Pakistan.

What do we mean by transferring property?

As per the law, any individual who owns a property should have the land or property verified under their name. The land should be under the designated ownership; only then can they sell the property to themselves. This is the basic requirement of selling a property.

In Pakistan, the transfer of any property generally consists of the owner transferring the title of the land from one person to the other. Transferring property can occur in multiple ways for various reasons, such as a mortgage, gift deed, inheritance, lease, exchange, etc. All such explanations are why transferring is an essential legal procedure.

Who is eligible to transfer property?

All individuals who can sign a contract are authorized to transfer property ownership in Pakistan. According to the Contract Act 1872, a contract is claimed as a binding agreement between two parties, meaning that it is a legally binding document for any sale and purchase of land in the country.

There are a few exceptions for people who are not eligible to transfer a property:

- Minor: Anyone under the age of 18 is a minor and therefore cannot carry out the process.

- Unstable Individuals: Someone who cannot understand the consequences of their actions, for instance, that of a mentally ill person. Other reasons can be permanent or temporary physical disability such as a Coma etc.

- Legally Barred Individuals: Someone barred from signing contracts cannot transfer property in Pakistan.

What are the steps involved in transferring and Selling a property in Pakistan?

The transferring process, although time-taking, is a simple and easy process with not many legal proceedings. We’ll break down the process into different steps to help you better understand.

Token (Bayaana)

This is the very first step of selling after you’ve successfully secured a client. This involves the buyer giving approximately 1 / 4th of the total price. If not the exact percentage, there is an agreed amount between the buyer and the seller to indicate an agreement from both sides of the party.

The Token (Bayaana) is given by the buyer with a series of negotiations and based on a contract, in which all details are specified. After this, the seller holds negotiations with any other potential buyers.

Usually, a specified period is set and written in the contract for the full amount to be paid. If the sale falls through, the token is returned. But if the full amount is not paid in the specified time, the seller has no obligation to return the token, even if the sale doesn’t go through.

What is a Property Sale Agreement and how can we get it?

A sale agreement contract is a set of required documents that include all information related to the seller and buyer involved in the transfer process. In Pakistan, these are the required documents that are attached with the Bayaana form:

- Complete details of the property with the property owner’s verified name

- Terms of sale for the property

- The total amount of money which the property is being sold for

- Final date for the buyer to pay the remaining sum of money

What is the complete list of documents required?

To carry out the transfer process smoothly, you need to collect the following documents organized. You’ll need:

- Recent Passport Photos of both parties involved (Buyer and Seller)

- Photocopies of National Identity Cards of both parties

- Original Purchase Deed of the Seller (From the time they purchased the property)

- The original ‘Sale deed’ which is the agreement contract between both parties

This list of documents can also include some more documents depending on the province, region, area, etc. (A lot of documents, we know, but verified property takes tough measures!)

- A ‘Record of Rights’ also known as Fard-e-Malkiat, is a form that can be obtained by the seller from the property registration office. This guarantees that the property is under the name of the seller.

- You’ll need a Non-Demand Certificate (NDC), a document that shows you don’t have any fine due on the property. Depending on the location, you can get this from the local development authority’s office.

- For properties in private housing schemes, there is the need to request a letter from a particular society to carry out the property transfer. This can be used in place of the Fard-e-Malkiat document.

Possession of Stamp Paper and Tax Payment

Source: Pinterest

This is one of the essential and final steps of the transfer process. You’ll need a stamp paper to draft the deed for the sales; that will be the contract for the sale. You can choose. Buyers; will be required to pay stamp duty and taxes during this step.

Let’s take a look at this easy breakdown of the tax duty involved:

- Stamp Duty 3%

- Capital Value Tax 2%

- District Council Fee 1%

- Fixed Registration Fee PKR500 (Can differ as per govt. Order)

Drafting the Sales Deed

In Pakistan, the sales deed is usually recommended to be drafted by a property lawyer or a property agent aware of the bylaws and the rules involved in the process. This is a particularly safe option to avoid any complications that might arise in case you are doing it yourself.

Although, people who are selling and buying property as a business have become familiar with constructing the ideal draft for this deed, which can be done easily with the help of the internet. However, the common practice and recommendation are to take the help of a lawyer to avoid any future complications that may occur.

What do we do after drafting the Sale Deed?

Source: Freepik

Finally, after a long process, you’ve reached the last step. You can take the sales deed (inscribed stamp paper) along with the required documents to the registrar’s office. From here, the sub-registrar will call both parties simultaneously and hear their verbal agreement for the trading of property.

You’ll need to sign the documents and put in your fingerprint to verify the final sale and complete the transfer process. Once this is done, the official will register the sale deed successfully, then the transfer process is complete, and the property is now successfully transferred to the buyer.

How much is the Commission for the Property Dealer Involved?

If you’re wondering what the person who helped you secure a client and help you proceed with the sale and transfer of the property is, there is a commission that the dealer/agent gets from the client. Although there are no specific laws to govern and record the work of real estate agents and dealers in Pakistan, the general practice remains a constantly changing variable and experiences changes from time to time.

Usually, the commission of property agents comes to around 1% of the total value of a property. This 1% of the value is each from the buyer and seller as the commission to the dealer. If the buyer and seller both have different agents, then both agents get to keep a 1% commission each from their own clients. Sometimes, property agents will ask for as high as 2% of the property value, or even lower than 1%. The amount varied according to the success, reputation of a property dealer, or property value.

Suppose you’re looking to learn more about the legal aspects and procedures involved in property buying and selling. In that case, you can stay connected with our blogs at Feeta.pk, where you can easily find comprehensive information to guide you through the real estate market.

The Ultimate Guide to Selling Property in Pakistan

- Published in Housing Schemes, Infrastructure, International, Property Business In Pakistan, Property Consultant, Property In Pakistan, Property Laws, Property News, property sell in pakistan, property selling, Real Estate, real estate business, real estate buyer sales, real estate financing, real estate goals, Real Estate Guide, real estate investing, real estate investment, Real Estate Investments, real estate market, Real Estate News, Real Estate Trends, USA

Key Property Inheritance Principles

These are the Principles of Property Inheritance That You Need to Know:

A legal heir is defined as an individual who is entitled to a share in the assets of a deceased person. These may include real estate properties, insurance amounts, bank account holdings, stocks, bonds, shares, etc. As per the inheritance laws of Pakistan, which are based on the Islamic Sharia law, the legal heirs of the deceased can only include the spouse, parents or children.

Feeta.pk has compiled the key highlights of the process, laws and rights of succession in Pakistan to help you navigate through what is otherwise a convoluted affair.

The purpose of a legal heir certificate

Once the death certificate of the deceased has been obtained, only the successors are eligible to apply for a legal heir certificate. The legal heir certificate is a document required for recognizing the legal heirs of a deceased person. It can be used for the following purposes:

- For claiming insurance

- For processing the family pension of the deceased employee

- To receive two such as provident fund, gratuity etc. from the government

- To receive salary arrears of the deceased

The purpose of a succession certificate and how to obtain it

On the other hand, a succession certificate is issued to transfer both movable and immovable properties of the deceased to his / her legal heirs. The letter of administration grants the right to administer the estate of a deceased person.

Any one of the legal heirs can apply for a succession certificate. The Succession Act 1925 governs all the procedures related to succession certificates in Pakistan. In case of multiple legal heirs, each party can apply for the succession certificate individually and the court can issue it to them according to their share in the property. Another alternative is that all legal heirs can file a joint application in favor of one legal heir who can distribute the property among other heirs afterward.

The Government of Pakistan also introduced a secure online portal in 2021 that provides letters of administration and succession certificates within 15 days, as opposed to the previous timeframe of 2-7 years. This was developed by the Succession Facilitation Units of the National Database Restoration Authority (NADRA) with the aim of removing any unnecessary delays and hassle during the process.

This is especially an advantage for overseas Pakistanis, who would not be required to make an appearance at courts anymore to receive the succession certificate.

The digital certificate has several security features, including a real-time verification facility. The process to obtain it can be completed in just a few, simple steps:

- Initiating the application:

The successor has to provide his / her national identity number and the death certificate of the deceased. - Recognizing the legal heirs and assets:

The applicant has to give relevant details of the legal heir (s) along with information related to the deceased’s moveable and immovable properties. - Verifying the legal heirs:

All the legal heirs mentioned in the application have to visit Nadra’s registration center for biometric verification. - Advertising:

NADRA will publish a notice in newspapers to ensure there is no one who has any objections against that particular application. - Printing & delivery:

If no opposition comes forward within 14 days of publication, the letter of administration/succession certificate will be issued to the applicant.

It is important to note, however, that each province has its own conditions for which documents are necessary for initiating the succession certificate procedure.

Laws of inheritance in Pakistan

There are two laws that protect the rights of inheritance in Pakistan:

- The Muslim Family Laws Ordinance (1961), gives effect to certain recommendations of the commission on marriage and family laws.

- The West Pakistan Muslim Personal Law (1962), consolidates and amends the provisions of the application of Muslim Personal Law (Shariat).

A few additional things to note are:

- There is no inheritance tax in Pakistan.

- The last domicile of the deceased also dictates the division of inherited property.

- If the deceased gifted a property to another party in their lifetime, it cannot be contested in court after their death.

- Legal heirs can only distribute properties if the outstanding debts of the deceased have been settled.

- If a legal heir passes away before the distribution of inheritance, their share will be divided among the other heirs.

- It is highly advised to hire a lawyer for the distribution of inherited property.

Women’s rights of inheritance in Pakistan

There are many cases where female heirs, especially in Pakistan’s rural areas, lose out on their share of inheritance in favor of male family members. This is mostly due to their lack of awareness of women’s legal property rights. The Enforcement of Women’s Property Rights Bill was passed in 2020 to ensure their rightful inheritance.

According to Section 498A of the Prevention of Anti-Women Practices Act (2011), it has also been termed illegal to deprive women of their inheritance in any manner. Any violation of this act will be punished with imprisonment of 5-10 years or with a fine of Rs. 1 million or both.

The inheritance rights of women have been outlined below:

- The wife of the deceased will receive 1 / 8th of the inherited property if she has children. If she does not have any children, she will own 1 / 4th.

- The mother of the deceased will 1 / 6th of her son’s property. If the deceased had no parents or children though, the mother will receive 2 / 3rd.

- If a female has one or more brothers, she will receive half of their share after their father’s death.

These can still vary in cases of special circumstances.

For more details on property inheritance, visit Feeta blogs.

Key Property Inheritance Principles

- Published in International, property, Property Laws, Real Estate, Real Estate Guide, Real Estate News, Real Estate Trends, Zillow

Government Plans 9 Housing Developments Abroad

The Ministry of Abroad Pakistanis and Human Resource Development (OP&HR) has put up nine residential complexes throughout Pakistan to house overseas Pakistanis. The Phase-1 Lahore Overseas Pakistanis Foundation (OPF) Housing Scheme, Phase-1 expansion, and Phase-II OF Farmhouses in Larkana, Dadu, Peshawar, Gujrat, Chitterpari Mirpur AJK, and Zone-V Islamabad are all under development, according to an official source. He said that such programs gave overseas Pakistanis millions of acres in attractive localities including Islamabad, Lahore, Gujrat, Peshawar, Dadu, Larkana, and Mirpur.

The federal government has decided to start developing nine housing developments for Pakistanis abroad all around the country, according to the Ministry for Abroad Pakistan & Employment.

Lahore Overseas Pakistanis Foundation Housing Scheme Phase One, OPF Farm House Phase One Expansion Plan and Phase Two Construction, Larkana, Dadu, Peshawar, Gujarat, Mirpur Jammu & Kashmir, and Zone Five are among housing projects mentioned by ministry authorities. Housing projects are planned in Islamabad.

The federal cabinet has received an update from the Interior Ministry on the issue and will make a decision soon. This apartment complex would be built on Park Road Zone Four in Islamabad, according to the source. The research will benefit around 40,000 individuals, with 6,000 housing units included.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Government Plans 9 Housing Developments Abroad

5 Tips To Increase Rental Property And Maximize Income

The appearance and functionality of your rental property have a direct correlation to the rental income it can produce. By investing in the right improvements, you can charge your tenants more. This can result in higher rental income in the long run.

However, there is a fine line between improvements that allow you to increase rental income and those that are unnecessary or superfluous. You need to determine who is who so that you don’t end up paying for expensive renovations that do nothing to your rental property.

Here are five simple but effective improvements that can increase your property value and, eventually, enable you to earn more rental income:

1. Improve The Exterior Of Your Property

The exterior of your property is very visible, and how it looks can create an impression. You find it difficult to attract tenants and encourage them to live on your property if your exterior looks poorly maintained.

One of the easiest ways to enhance the value of your rental property is to take care of your exterior. As a landlord, you should put in the time and effort to make sure your exterior is in pristine condition. You can achieve this goal by:

Pressure to wash your exteriors:

Hire professionals to take advantage of their press wash services to remove dirt, dust and other debris from your exterior. Pressure washing also removes mold, keeping your rental farm cleaner and healthier.

Painting your front door:

The front door attracts the attention of tenants and sets their expectations on what they can see inside the property. Increase their excitement by painting your front door in bold color. If your exterior is painted in nude shades, go for light shades of red, blue, yellow or orange for your door.

Pay attention to the landscape:

Check the general condition of your landscape and remove weeds and dead branches. If your outdoor space allows, you can plant more flowers and invest in a water feature, such as a pond or fountain.

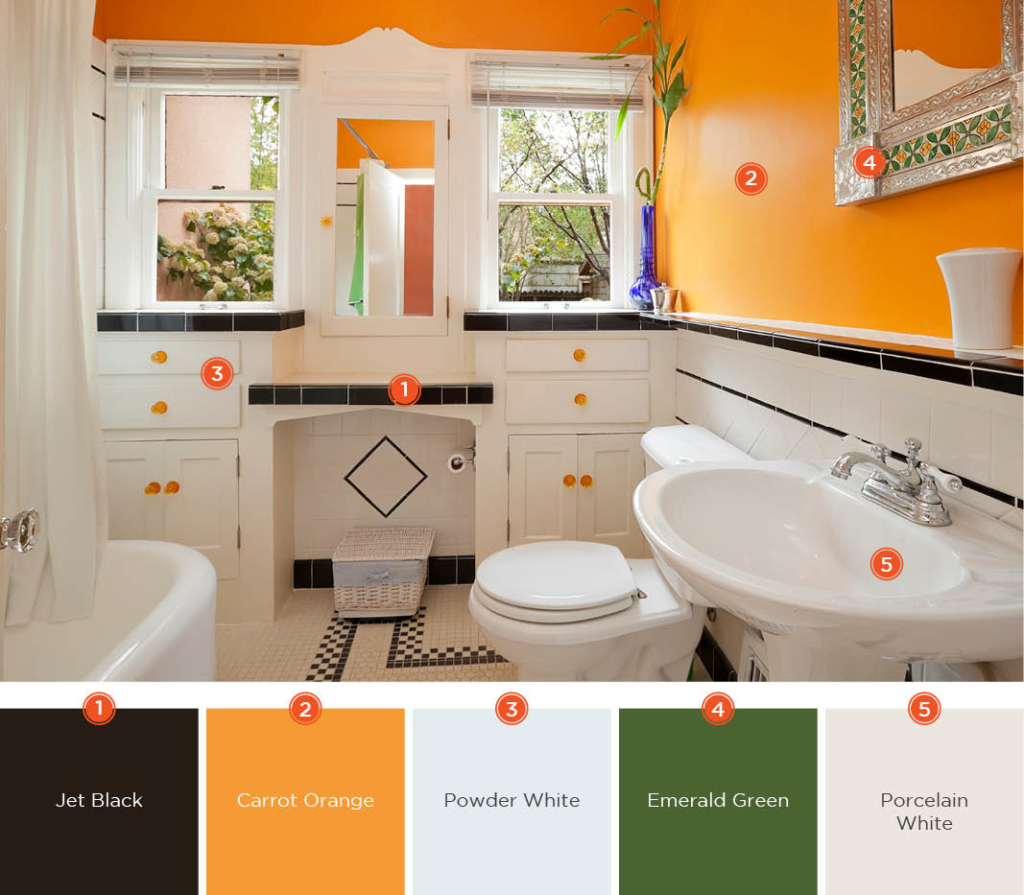

2. Refresh The Bathroom

How the bathroom looks and works can significantly affect a person’s mood throughout the day. Can you start the day in a positive mood if the bathroom looks dirty? How can you enjoy your bath or shower if the bathroom lacks essential amenities? Tenants will probably feel the same way, so make sure to upgrade your bathroom.

You don’t need to break the bank just to improve your bathroom. Here are some cheap bathroom renovation ideas that will definitely make the space look and feel new:

- Mess up to make the space look bigger and feel cleaner.

- Experiment with bathroom wallpaper.

- Invest in stylish storage, such as an open shelf and the use of wicker baskets.

- Swap expensive floors for affordable materials.

- Raise old bathrooms by adding new paint or upgrading hardware.

3. Work On The Kitchen

Many tenants will choose to pay more, provided they get the most functional and attractive kitchen. In addition to cooking and preparing meals, tenants were more enthusiastic about the kitchen, as here they would entertain guests and even hold parties.

Contrary to popular belief, you don’t need to spend thousands for a successful kitchen renovation. Like the bathroom, there are inexpensive kitchen improvements that can change the overall look of the space, such as:

- Adding artwork to the walls to create focus

- Adding more seating furniture

- Change the lighting fixtures

- Changing your cabinet doors and hardware

- Instead of replacing kitchen floors, paint them with a neutral shade

4. Add New Living Spaces

The more housing your rent has, the higher the rent you can pay your tenants. This will allow you to earn more income in a shorter period of time.

Evaluate the layout of your property and see if it can still support another place to live. For example, if your wolf property has a separate dining room, consider converting it into another bedroom, or if it’s a large room, split it into two bedrooms.

5. Offer an Outdoor Recreation Space

Gone were the days when tenants only entertained guests inside the home. Today, more and more people would choose to hold meetings in outdoor spaces as these offer a change of scenery and a fresher atmosphere.

Another way to increase the value of your rental property is to offer an outdoor recreation space to your tenants. Depending on the space available, you can add a deck, beauty or some outdoor furniture and BBQ. All of these updates are sure to attract tenants and make your rental property more valuable.

Upgrade Your Rental From Today

The housing market worldwide is full of thousands of wolf holdings. Fortunately, there are many ways for yours to stand out, namely by following the tips presented in this article. These tips are enough to make sure your rental property meets modern standards and attracts as many tenants as possible.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

5 Tips To Increase Rental Property And Maximize Income

Required NOCs and Approvals for CDA Jurisdiction Housing Projects

The Capital Development Authority has published a comprehensive list highlighting all approvals and Certificates Without Object (NOC) required for the process of investment and development in Pakistan’s real estate market.

Feeta.pk brings you a list of required documents for NOC / approvals for a project in a plot of approved housing. It is as follows:

- Ownership Documents:

- Grant Letter or Certificate

- Possession Letter

- Demarcation Certificate

- NOC and Approved Layout Plan of Housing Scheme.

- No Object Certificate (NOC) by the authority to Process the construction Plan approvals in CDA.

- Approved Layout Plan.

- Letter of approval from Project Control Committee (DVC).

- Approved Letter of Construction Plans.

- Approved Construction Plans controlled by the Competent Authority.

- Certificates for third exams:

- Certificate of Control Structural Project

- Mechanical, Electrical and Plumbing (MEP Certificate)

- Fire Extinguishing Certificate

- Access Road Approval (In case of CDA main avenues & Astride Roads).

- Approved letter from National Highway Authority (NHA) (In case of GT road).

- Altitude of Free Certificate of Civil Aviation Authority (if in the vicinity of Airport or to reach maximum altitude).

- Useful Connection Approval:

- Approval letter from Sui Northern Gas Pipeline (SNGPL)

- Letter of approval from Islamabad Electric Supply Company (IESCO)

- Letter of approval from Water Supply System

- Approval letter for Fire System.

- NOC / Environmental Approval of Pakistan Environmental Protection Agency (PakEPA).

- Construction Complete Certification.

For more information on the real estate sector of the country, keep reading Feeta Blog.

Required NOCs and Approvals for CDA Jurisdiction Housing Projects

Real Estate Investing: Still a Smart Move?

Billionaire industrialist Andrew Carnegie once said that 90% of all millionaires earned their wealth by owning real estate. Real estate investing continues to be one of the best ways to make money and grow wealth.

Tax benefits, appreciation, diversification and protection against inflation are just a few reasons that people invest in real estate. Many like to own tangible assets instead of stocks or bonds.

For investors, there are many options, including single-family real estate, commercial real estate and Real Estate Investment Trusts.

There are properties available across a wide range of budgets. For example, a home mortgage in Virginia Beach, A VA with an average home price of $ 310,000 will be significantly less than a home in Ventura, California, where the average price exceeds $ 700,000, or in San Francisco, which now has an average sale price of $ 1.3 million.

Let’s take a look at the different types of real estate investing, check the current state of markets, and hear what some experts have to say for everyone.

Investing in Single Family Properties

Domestic values in the United States have exploded over the past year. The average selling price for a home in May 2021 was just over $ 350,000 and the average selling price was up 23.6% more than a year ago, according to the National Association of Real Estate Agents (POMEGRANATE).

With mortgage rates still at some of the lowest levels in the past 50 years and charged demand after a year of life with the threat of COVID, most experts predict at least another year and a half of rising prices.

Not everyone agrees. A recent survey revealed that 41% of respondents predicted the house market bubble is created sometime in 2021 and will start pricing along with the downward slide. More than a quarter thought low prices would not occur until 2022 and 13% did not predict another housing market.

The economy that caused the housing crisis in 2008 was significantly different than in today’s market. In 2008, the housing crash was caused by subprime mortgages, which were written in record numbers, then put together and resold at an astonishing rate. The industry has learned a lot since then and is more cautious about lending. The government is also more experienced in protecting the housing market, such as the tolerance and market modifications it has made during the pandemic.

Investing in Commercial Real Estate

The commercial real estate market is recovering more slowly and has not yet reached pre-COVID levels, according to the NAR.

Performance for large-scale commercial real estate decreased by 28% year-on-year after 1 2021. Transactions for portfolios exceeding $ 2.5 million decreased for all types of real estate except hotels. For smaller commercial real estate portfolios of less than $ 2.5 million, transaction volume decreased by only 1% year-on-year.

Prices are also falling, as average real estate is up 6% less than a year ago.

Experts expect the market to continue to recover, but fear that employment trends could impact some sectors of commercial real estate. With companies shrinking and increasingly allowing employees to work from home, there are some concerns that organizations will need a smaller footprint. The Wall Street Journal, for example, reported on this 42 million square foot of office space was marketed in Q2 and Q3 of 2020.

Real Estate Investment Trusts (REITs)

There is also growing activity in Real Estate Investment (REIT). REIT is backed by a company that uses investment funds to buy and exploit income real estate. They are bought and sold in the market like stocks. These have also become attractive to investors who want to include real estate in their portfolios but do not want to make a traditional property.

REITS, in essence, works similarly to dividend-paying stocks. They have to pay 90% of their taxable profits in the form of dividends to maintain their REIT status, which allows them to avoid paying corporate income tax.

REIT shares buy and own buildings. Mortgage REITs provide real estate and may include mortgage securities.

While REIT decreased by more than 5% in 202, according to the FTSE Index Nareit All Equity REIT, many fund managers have a positive outlook for REITS in 2021.

Is Real Estate Investing Right For You?

Currently, high valuation rates and negative yields of many government bonds are not aimed at attractive bids. Interest rates, expected to remain low at least until the end of the year, will continue to make real estate investment attractive options for many business borrowers.

Investors should always compensate for any investment against other potential opportunities. Every investment is subject to risk.

Whether real estate investing is right for you and your investment portfolio will depend on the totality of your finances, risk tolerance and investment goals.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

Real Estate Investing: Still a Smart Move?

Factors That Govern the Real Estate Market

Pakistan’s real estate market has gained momentum over the past decades now. Investors see it as a great new horizon to invest and make profits, making the market more attractive to new investors both medium and long term. Investing in the real estate market is not easy. There are many factors that affect the market, and it is essential to gain knowledge before making any move to invest. To understand the fluctuation, we need to study the factors individually. Although there are many elements including, demographics, economic growth, affordability, laws and policies, and so on.

Here are a few that mainly change the game.

1. Location

The first and most essential element is the location of the property. The better the place the higher the price. Therefore, the real estate in the city center is more expensive than the real estate in the surrounding area. Location controls many other factors including, commuting, and access to facilities. Proximity parks, schools, facilities and proximity to the city are all great additions; therefore control the price of the property.

If you are buying property, the location should be very considerable. In Karachi, the most notable regions are, DHA, Clifton, PECHS and SMCHS and so on. Similarly, if you are shopping in Islamabad, places like DHA, I8, Bahria etc should be considered. Lahore on the other hand is famous for Cantt, Model Town and DHA.

No matter if you are investing in a business or buying a house, location is the first consideration. Although this will cost more than the others, this is a factor that needs serious consideration before making any decision.

2. Physical state

The second in line is the state of the property. Sometimes the state of the property is zero and the only money involved is for the location and size of the plot. To invest in real estate, conditions play a vital role. If you are interested in buying a newly built house, you may have to pay more than buying an old building. It is always preferable to buy a well-maintained or new property instead of investing in a property in a poor state.

The condition of the property includes the interior and exterior. Critical and intentional inspection of the property is essential. Before concluding the deal, check for everything from murals to appliances and furniture arrangements; each plays an important role in access to the state of the property. You don’t need a house that needs a lot of repairs and maintenance if you pay a quick sum of money.

You can negotiate the price once the condition of the property is accessed. The price is negotiable if you find problems with the condition of the property. Anything damaged or broken can help you in negotiation. This negotiation will save you some money to raise the status of the purchased property.

3. Limit Appeal / Surroundings

The main element that adds value to the physical condition of the property is the quality of its surroundings. If the property is surrounded by low-valued shops like mechanics etc, the value will be low. The surroundings can be improved and this improvement will add value to the property price. The overall appearance of the property makes it more expensive.

A good car garage, a plantation outside the property, a decorative driveway and lights can multiply your profit. This is one aspect that can be worked on at any time. If your house looks good from the outside, you can always ask for more price resulting in more profit.

4. Government Laws and Policies

Policies about where you live or intend to purchase property also have a big impact on its valuation. A change in policy causes a price fluctuation. For example, the recent change in the law on share buying has caused a decline in the price of shares.

When buying any property, you need to check the policies currently in force.

5. Facilities and Installations

Ease of living in the new standard of modern society and place. And usually, all newly built properties, whether apartments, built-in communities or corporations, all compete to provide customers with everything that can be arranged.

Generators, elevators, community halls, gyms, swimming pools, parking, electricity, and water supply are all part of facilities and facilities. Most people

prefer PECHS instead of DHA only because of the constant water supply. Older communities and properties where such high-tech facilities are lacking often cost less.

Access to Public Transportation is another advantage to property taxes. Other facilities include supermarkets, hospitals, and parks, which all add value to the properties in the vicinity.

6. Security

No one is willing to buy property in an area where security is an issue. Everyone expects a safer and safer environment. Location and security go together. Because security primarily depends on the location of the property.

Inbound communities and societies are a new cart. The 24/7 security of these built-in communities is a valuable addition that cannot be ignored. The addition of guards, CCTV, and a high-tech security alarm further enhances the property.

7. Demand and Supply of Property

As the world changes, so do the choice of people. The trend to buy an apartment with a picturesque view in a tall building has increased the demand for such kind of property and therefore the prices are higher.

Most people are interested in buying property in urban centers, creating a superior demand. According to the economic rules, the higher the demand the higher the price. Meanwhile, in places where property abounds available and less demand the prices are lower. On the other hand, if prices are too high, demand falls resulting in an imbalance of supply and demand.

It is imperative to study the demand and supply of real estate before buying one.

The above-mentioned factors are the basic ingredients of real estate but are not limited to these. There are many factors that govern the price of the property. It is important to study every factor before making a big decision to invest in property. This article is written to educate people about property valuation. We intend to help everyone with future property issues.

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

Factors That Govern the Real Estate Market

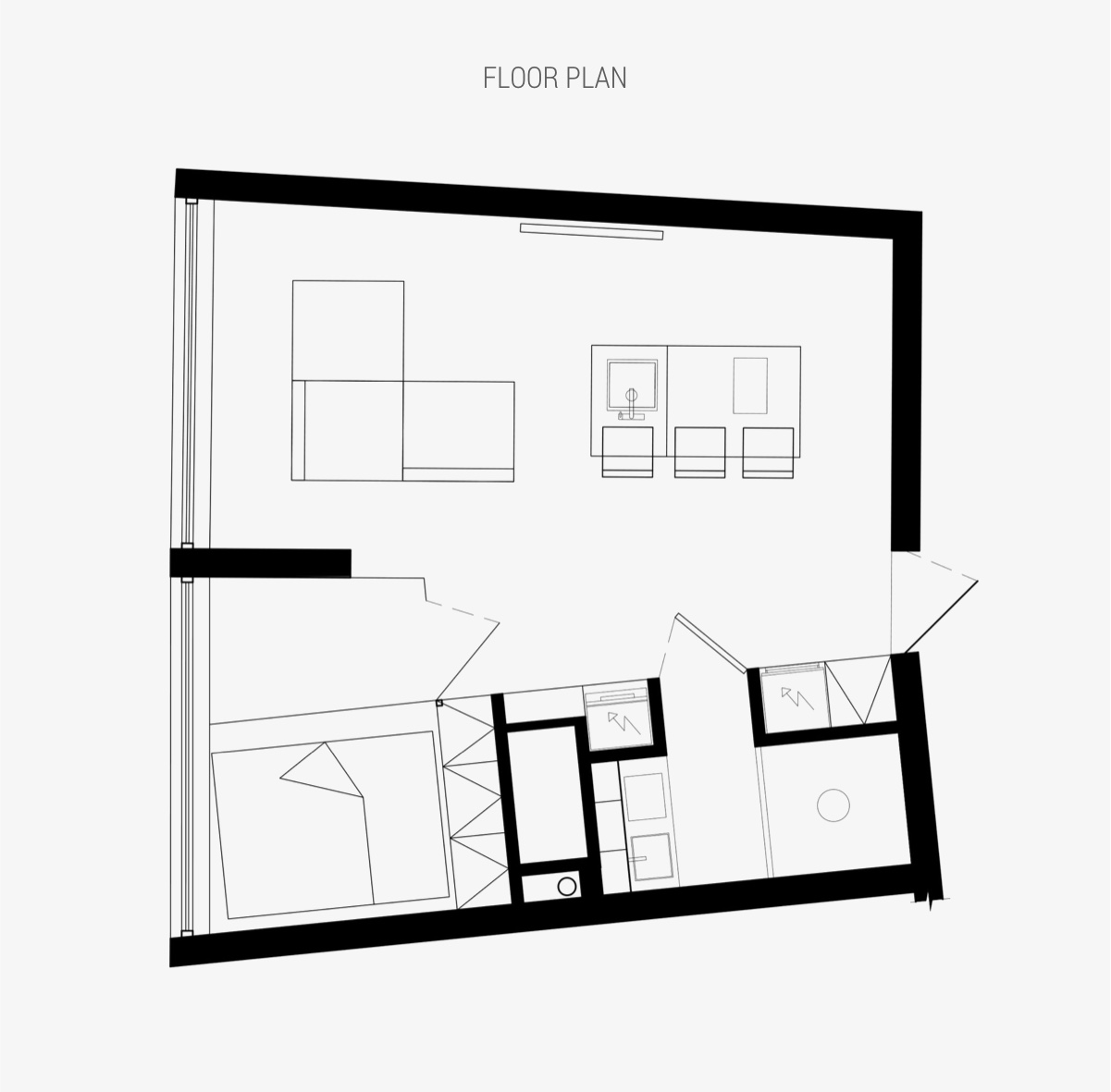

Portraying Personality In Interiors Under 40 Sqm (Includes Floor Plans)

Do you like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

Each measuring just under 40 square meters, these three apartment interiors in Odessa, Ukraine, inspire three different personality types. Our first tour takes us to a sophisticated home with a bronze framed glass wall design, unique modern furniture ideas and an unquestionably luxurious kitchen project – despite its small proportions. Our second stop is made at a simple, young and sturdy apartment interior, designed for tenants, with another glass wall project that lends light to a multi-purpose living room. Color seekers may like our final prominent interior, where rich color accents add a touch of the unexpected. Floor plans included at the end of each tour.

Minimal amounts of furniture, a hollow decor and a limited material palette allow emphasis to fall on the remaining high-quality elements and sea view. Thanks to the glass wall, the ocean panorama flows unhindered throughout the width of the apartment, creating an immediate factor entering the home.

- 19 |

- Designer: aesthetic design

- Display: Dmitriy Li & Anna Prokhorova

Our third small home tour in Odessa, Ukraine, takes place in a 35-square-meter apartment. The customers asked for a subtle monochrome decoration scheme but short colored moments made the final cut. Burgundy softening visually warms the small living room, and sets it apart from the nearby dining room.

Did you like this article?

Share it on some of the following social networking channels below to give us your vote. Your feedback helps us improve.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

Portraying Personality In Interiors Under 40 Sqm (Includes Floor Plans)

- Published in #architecture, #interior design, architectural wonders, Architecture, build, building, building plan, Design, Design Gallery, Designs by Style, designs that stand out for all the wrong reasons, Featured, financial model, Furniture Design, General, home, home building, Home Decor, house, house decoration, house design, House Tours, interior, Interior Decoration Ideas, Interior Design, International, Real Estate Trends, Trends, under 40sqm

DHA Lahore Real Estate Market Analysis May – June 2021

From time to time I emphasize that DHA Lahore real estate market is speculated by the introduction of Amnesty plan by the Pakistani government to raise taxes with more cash flow in this market whether it may be black money or ex-flats buying for their homes, who lost their businesses and jobs due to the Pandemic.

An amnesty plan gave this market a parabolic run, but theirs was also of real interest also from the emigrants and smart money prevented their money from this relentless inflation on a daily basis.

What needs to go up has to be a general phenomenon of almost every market, although it assures me that when the market often shows a very sharp position without any basic fundamental reason and general economic strength, it usually reverses to its previous year’s highs. Admittedly my opinion of the market often contradicts the general herd or real estate, because of being in Feeta.pk, I have always followed the principles of my mentor Captain Shahnawaz, who is to inform the client about the real situation of the market instead of trapping them in speculative behavior of the market.

Feeta.pk has always wanted to make well-informed decisions based on research and development on which we always consider many different issues that feed the real estate market, the very basic reason for Pakistan’s speculative behavior in the real estate market. the dollar index and we have been following a dollar index for many years and that is why our forecasts for DHA Lahore real estate market have always been targeted.

To see what the Dollar index predicts now.

Dollar Currency Index breaking

Well, the dollar favors the real estate market in Pakistan because what is the chart says it is a huge weakness in the dollar which means people would not like to hold the dollar and everything related to the dollar will appreciate whether it is about precious metals or real estate market but on the other hand, where will there be a stop?

Rising inflation and all economic factors make me curious that there is more counterproductive action coming to the real estate market, but there is only one disadvantage that I think buyers should consider, and that is not a further extension of an amnesty plan that presents a huge. risk if buying the highest market, so be very careful. Buy in less risky places like High Buildings ie Sixty6 Gulberg or LAHORE SMART CITY.

An artificially pumped market is often very risky because it fails badly and on the other hand natural growth remains longer and presents less risk for landfills.

So let’s understand what the difference is between natural growth and artificial growth.

Now let me explain the Golden Diagram for the general understanding of what impulse runs in any market and can bring sharp corrections at any time.

When you look at the chart, you clearly see that while gold had a healthy top behavior, suddenly by the end of 2007 an implosive move gained the appeal of major players around the world, so it went from almost $ 500 to almost $ 1900 in just 4 years. which is almost 3X and then after that sharp impulsive move Gold almost made a correction to $ 1000 in the next 5 years.

The common behavior of all markets is related to each other, but they only differ in time because some markets are unstable and they correct sharply, while others need time, but they are often similar in behavior.

I personally feel that Dha Lahore real estate market may not have seen the top yet, but it is very close and may take some time but the correction will come so the smart investor will always make smart decisions and be the only seller while everyone buys.

The secret to our success is the loyalty and trust we share with our investors, we win when you win.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

DHA Lahore Real Estate Market Analysis May – June 2021

Things to consider before purchasing a property

When choosing a house, you must take into account the physical condition of the property to the legal aspects that will allow you to know if the home of your dreams compares to or is identified with your lodging needs and spending plan.

Purchasing a house or condo is speculation that ought not to be trifled with. For this reason, it is so necessary to take into account certain aspects before becoming the owner of your own house or apartment.

So here is the list of things that you should keep in mind before buying a property:

Be minimalist when choosing a home

The process of looking for a house is very exciting; it is easy to get carried away by the most significant properties, those with the best decoration, the best floors or the best furniture. Those shine a lot brighter than small properties with simpler finishes.

The fact of the matter is, you will pay more for that additional room and for the conveniences. The proposal is that you begin visiting houses with costs that are near what you have saved. If you prefer to see it differently, start from the bottom and work your way up in case you can’t find something that stands out or, as the properties meet your needs and fit your pocket.

When you start your search in reverse, that is, visiting and idealizing the largest and most luxurious houses, those that are often out of the budget of a first-time buyer, you run the risk of biasing against tiny houses or apartments. Your base of comparison will be that dream home that is not necessarily a good investment since buying it would mean a tremendous financial weight and not a step in the formation of your wealth.

Keep an eye on the mortgage you take

Buying a house or apartment through a mortgage loan is the best option, but paying it off before 15 years is ideal. Choosing to finance for a term of fewer than 30 years allows you to pay less interest in the financial institution. This is because the 15-year mortgage is not only much shorter (which means you will be paying more principal each month), but you will also have a lower interest rate.

Do not exceed 40% of your salary in the payment of a property.

This is a good rule of thumb for financial health when buying a home or apartment. The first thing you should consider is the monthly payments of your existing doubts; then, you will have to add the monthly payment of a mortgage with a term of 15 years. If the total adds up to more than 40% of your monthly salary, then you are risking living on a tightrope, financially speaking, so you will have to reconsider or discard the purchase of that property.

If you exceed that percentage, we suggest you continue saving to buy that property or try to find properties with a lower price. Do not forget that there are expenses when buying a house or apartment that you must pay on your own even when you are granted a mortgage loan, for example, the deeds, the payment of taxes, the fees of the notary public and the real estate agent.

Furnish with the basics

Unless you buy a semi-furnished or fully furnished property, you will have to spend a good amount of money to purchase basic furniture and appliances.

One of the first things you will discover in the first days you spend in your new home is that it can look a bit empty and austere. The temptation to fill it as soon as possible will be latent. However, it is best to cover those gaps with second-hand or cheaper furniture. That way, you will meet your needs instantly, and you can update them eventually.

Doing this little by little will protect your pocketbook. Of course, avoid buying furniture on credit so as not to increase your debts and, much less, risk your savings or your emergency fund.

It is essential that you buy a house for the right reasons.

It is expected that if you reach a certain age, get married or have your first child, family or friends begin to ask you when you will buy a house. Social Pressure can be solid, and the assumptions of others can impact your choices. Make sure that it really is a personal desire and that you live the circumstances that make you feel secure about that vital acquisition.

To become the owner of your own home, you need to be financially and emotionally ready. Not only can home provide you with security and a sense of accomplishment, but it can also help you be financially successful.

Payment methods

Define how much of what you have saved you can use, since banks or housing support institutions only lend on average up to 80% of the property’s value, so you must have that 20% previously to give the down payment and 5% more to cover the initial costs (appraisal, insurance, deeds, notary, the opening of credit, etc.).

The location

If you are going to invest in a property, look for you to have the communication channels or services that you require, such as education, health, shops, security, transportation, recreation and supply. Avoid risk areas! What’s the significance here, that the property isn’t under high voltage lines, gas tanks, underground pipelines, close to gorges or territories in danger of flooding?

Meanwhile, if you want to read more such exciting lifestyle guides and informative property updates, stay tuned to Feeta Blog — Pakistan’s best real estate blog.

Things to consider before purchasing a property

How To Enrich Interiors With Textural Decor

Do you like Architecture and Interior Design? Follow us …

Thank you. You have been subscribed.

![]()

Textured walls bring intensity to a modern home interior and a soul of touching depths. Textured background enriches even the simplest furniture arrangements, and adds an interesting essence to the simplest palette. These three stylish home projects each have a different texture decorating scheme to inspire unique spaces. We do our first tour in a cool white pictured home where roughly brushed stucco surrounds walls, ceilings and decorative cavities to complete minimal spaces. Smooth plaster warmly envelops our second featured home, adding complementary curves to round furniture silhouettes. Cool concrete wraps the collection in a beautifully complex housing bound with elegant industrial inspiration.

Did you like this article?

Share it on any of the following social networking channels to give us your vote. Your feedback helps us improve.

How To Enrich Interiors With Textural Decor

Everything You Need To Know About Real Estate Investment In Pakistan

We often hear that real estate investing has a bright future in Pakistan – but sometimes it can cost you a huge fortune in the form of scams and frauds.

We know that in Pakistan real estate and real estate are spreading through many regions. Although each area is distinguished by its investment offerings and options, Karachi, Lahore and Islamabad are the three main cities in the country for real estate.

This article has all the important details about real estate in Pakistan, the investment benefits and factors related to real estate.

What You Need To Consider Before Making A Real Estate Investment In Pakistan

The following things should be considered:

Real Estate Investment Information

Sufficient real estate education is essential for real estate investors. The income from real estate investing needs to be well understood to you. Take a long time to get to understand every aspect of the property. In Pakistan, it is a growing industry and has a fast pace.

The design of a property must be high quality and smooth. It is important to have a realistic awareness of all the current developments in the real estate market in order to keep this unpredictable rate and become a profitable investor.

You can read about real estate for free from too many newspapers. Some mass media are most frequent:

- Newspapers

- Real estate YouTube channels

- Real estate books

- Real estate podcasts

- Real estate blogs

- Real estate television programs

Both of these resources are easily accessible and convenient. Take advantage of them and try to learn from them as best you can.

Follow Strategy

It’s no joke if we conclude that real estate is definitely possible for a lifetime cash flow. You just need a workable approach.

Spend some time planning an integrated plan for your investment in the property before you spend your hard earned money.

Would you like to invest in all kinds of assets or just stay in a niche, for example? Do you want to spend as an exclusive owner or do you want to participate? Would you like to develop your investments locally or would you like to grow your investment in other cities?

Such financial decisions will make or break your investment in your home. You will receive a decent income within a limited period of time if you have a good plan in place.

Select Redeem Properties

The fate of the draw is not to get the best property. For the perfect property, you need to be diligent and polite. Before buying real estate, ask about the land, rates in the area, country styles such as whether to buy in the apartment, house or store, details of facilities and the area.

Above all, make sure that it is accepted by the municipal planning authorities. Check the property carefully to make sure all property papers are accurate and complete, keeping your eyes open for any defects.

Buy Your Property

Once the preliminary research has been completed and your real estate investment options in Pakistan have been limited, it is time to buy your house. Consider all legal aspects and advise reviewing the accompanying transition and sales articles.

Furthermore, remember your plot or home location and construction level. These variables significantly influence how fast property prices rise. Often buy property authorized by the relevant government authority so that in some legal matters you do not miss out on investments.

Things to Consider For A Better Return On Real Estate Investment

Here are some moves you can make to achieve the highest investment speed and return:

Don’t rely on one resource

Don’t rely on just agents or insecure portals to create your buying or selling cost. Browse Zameen.com’s listings for the region of the property to see the latest trend in prices. Also, contact some agents to get the trading pressure and see what prices they offer.

Make sure your property is worth it

It takes some pretext to make this move. Contact one or two agents from the buyer’s point of view and ask for the cost for your preferred home. Call one or two additional agents from the seller’s point of view or ask about pricing. The fair market value is among the listed prices, as the purchase prices are usually higher than the sellers.

Go to the previous stages for token capital

If a contract has been terminated, the buyer collects symbolic money. This is the customer’s promise that the property is purchased and binds all parties to the contract. Sign money is usually a very small percentage of the total value of the land, preferably between 50,000 PKR and 100,000 PKR.

The receipt of a sign includes the full details of the property and shows whether a conflict occurs.

Less Volatile

Real estate portfolios do not face sudden changes such as the trading of stocks and bonds. Real estate is also very stable and rates are smoothly priced. This means that failure is less possible internally.

If you want to build your capital smoothly in a risky person, the investment in real estate is right for you.

Try to meet the other party face to face

If you are a buyer or seller, it will help facilitate the process by seeing each other face to face. You will also reliably confirm the ownership status and legal status of the property in this way.

If you are buying a home, make sure the assignment or transfer letter is reviewed by the owner’s NIC.

Double benefits

You may receive many benefits from a house or apartment. You can rent/lease your place, put your room on Airbnb, use it for your own home, and as the cost of the property grows, you can sell it. How incredible is it?

If you are looking for a great investment option in Pakistan, real estate is the ideal alternative for you.

Better Returns

Real estate offers you a reliably strong income. You can earn a monthly return of up to 20% on average. For example, you can sell it for RS.560.000 next month if you buy a property for RS.500.000 without doing anything as well. Staying at home, you get an additional Rs.60,000.

Tax Benefits

Investors usually earn property tax exemptions. You will, for example, get mortgage interest deductions. This is generally done by politicians to promote additional spending.

Possession

holding house representing home ownership

The complete ownership of the asset is one of the most significant and desirable factors inland. You will be wholly owned and no one will take your property from you when you buy a house, and you have all the legal rights to it.

You do not have perceptible assets and ownership of other types of investments such as bonds, mutual funds, and vice versa. That said, immobilization helps you rule your land.

Everything You Need To Know About Real Estate Investment In Pakistan

Rental Laws in Sindh: Comprehensive Guide for Landlords and Tenants

So, if you are renting or planning to rent your property sign a rental agreement in Karachi, Hyderabad or any other part of Sindh, today we will discuss everything you need to know about the rights and duties of both. parties in accordance with provincial laws.

Rentals in Sindh

In Sindh, tenancy laws are under the umbrella of Sindh Leased Places Ordinance 1979. This ordinance defined the regulations on rental agreements to protect both the interests of tenants and landlords in almost all situations to avoid disputes and conflicts.

So let’s find out what our law covers about the official documentation and issues related to rental contracts in Sindh.

Rental agreement between country and tenant

Rental lease agreement form on an office desk.

The rental agreement between landlord and tenant must be made in writing. The agreement must be signed by both parties and it must be attested by an official seal of the relevant authority associated with the jurisdiction where the property is located. You can also get this document certified by a First Class Judge or by any Civil Judge. These are the necessary conditions for the validity of a lease.

By law, the lease agreement must be renewed annually, otherwise, it would be considered invalid in court. The landlord is entitled to review the terms of the lease (within legal limits) and monthly rent after the renewal of the contract.

About the conditions related to Rent

The landlord must charge the rental amount, which has been mutually decided by both parties and clearly mentioned in the agreement. Although there is no specific date as the deadline for rental fees, however, according to general practice, tenants must be paid no later than the 10th of each month in Sindh.

The rental laws in Sindh ensure that the rental prices would be fair for tenants as well as for landlords. The laws protect the rights of both parties. According to the laws in Sindh, the rent of real estate cannot be increased by more than 10% annually. In addition, if the fair rent has been determined, it cannot be increased for a period of three years.

Here are some of the main points on the basis of which a fair lease of any particular property is determined.

- The rough analysis of the monthly rents for similar real estate located in the same or adjacent neighborhood.

- The increase in construction costs, repairs and maintenance costs.

- If there is any new tax after the start of the lease.