FAQ on Rental properties in Pakistan / Passive income in real estate

Frequently Asked Questions – Pakistani Rental Properties / Passive Income

Earning a passive income from Rental properties in Pakistan is by far the safest and surest way to get rich. This FAQ will answer some of the basic questions you may have in mind.

Q-1 Rental properties are depreciating and therefore do not offer high yields.

Answer- The problem of depreciation only exists in houses, especially since they offer only 3 to 4% rental yield per year. Advertisements and shops can be like new after small renovations and some apartments offer up to 10% rent to offset any depreciation effect. As a general rule, rental real estate should give you an average of 15% earnings per year. In some value classes, rent can be more than capital gains and vice versa, but it’s good as much as you get 15% of the total earnings. In addition, the benefits you receive from your rental income will be value added over this 15% or will make up for any shortcomings.

At the end of the day, you have to be careful to find a rental property that gives you a nice return. That’s why you need an expert who can analyze and predict capital gains and expected rents for at least the next 5 to 6 years.

Q-2 Do rental properties need time to build and therefore cannot offer returns as shown?

Answer- When you buy a rental property in Pakistan, you need to look at both aspects of income which are capital gains and rental income. Normally, the already-built property will offer 6% rent per year. However, if you plan to build one or buy one that is still under development, what you lose in rentals during the time it is being built, you get capital gains. Those that need time to build, such as tall ones, are usually much cheaper while they are being built.

On average, a good high-growth project will add at least 60 to 80% in capital gains over the construction period, which lasts 3 to 4 years. This capital gain is usually more than 20% thus compensating for the lack of rental income during this period.

Q-3 In rental properties, can problems arise such as lower rents, which can decrease your ROI?

Answer- Like all investments, even rental property can change under certain circumstances. However, this change can be negative or it can also be positive. For research and analysis, target conditions must be ideal for both rental property investment and speculative business investment. Because the chances that speculative traders are wrong are much higher than the tenant investor losing a few months of the lease. Therefore, maintaining the ideal situation for both types of investors is important and is in fact more favorable to the speculative trader.

Q-4 Do houses or commercials give more capital gains than apartments?

Answer- Houses, commercials and apartments are three different asset classes and will not follow similar cycles. A gain in houses over time is due to a gain in plots, which calms down after the area matures, similarly, apartments will also slow down after the building matures. Later, many other factors will come into play to decide whether that property will grow further or not. Similarly, commercials have their own cycle to follow with their own risks because a very large number of commercials do not show much appreciation.

As long as you understand the different dynamics and act accordingly, all of this will yield very good capital gains. Therefore, capital gains will depend on many other factors than just the active class.

Q-5 Which is the best rental property among houses, apartments, commercials and shops?

Answer- Houses are not suitable for rentals, however, as for the other three, each property must be judged separately to identify who will give you optimal rental returns. It will be wrong to give any preference depending on the active class as such.

Ultimately, it all depends on your choice of individual property rather than its value class. A good housing project can outperform an average business in capital gains and conversely, a good commercial property can beat an average housing project easily.

Luxury serviced apartments in Gulberg Lahore for Air BnB rentals are a safer and safer bet than other types of real estate for rental purposes.

Q-5 ROI on rental income is slow, while plots can double their price in a very short period of time.

Answer- You must have heard the old saying. ” slow and steady wins the race“. Rental properties are that turtle that seems slow but never stops, thus giving you a more stable consistent income over the period.

The unpredictability in speculative trading is its biggest enemy. Although speculative trading gives an illusion of higher returns, the high failure rate balances it out. In addition, speculative trading is not suitable if you are an emigrant or a busy person who will not have time to look at the real estate markets constantly.

Our study has shown that both rental returns and successful speculative trading can make almost equal amounts of money in the long run. So renting property leads to being the safest and safest way to achieve your financial freedom goals.

Q-6 Rental properties usually only give 3 to 4% rental income per year.

Answer- That’s not true, only houses give 3% and we already consider them as lame wolf property. Apart from this, some commercial real estate does offer only 4% rental production, but this is usually because they are not yet fully mature and offer much more in terms of capital gains. So investors are happy with them considering that the combined gains are usually 15% or more.

Q-7 (Part 1) Suppose I invest 13 million in a 562 sq.Ft apartment. After 13 years will I get my capital back on 10% rent?

For example:

Hotel Apartment Sq.Ft: 562

Tariff (kv.Ft): 23000

Total Price: 12,926,000

10% Annual Income: 1,292,600

Annual Service Fees (Kv. Ft): 30 Rs * 562 = 202,320

Own tax: 50,000

Rent Tax: 60,000

Annual in Manluo: 980,280

Answer- The calculations we provide do not cover any taxes or liabilities, no matter if you are investing in speculative real estate or rental property in Pakistan. The impact of these taxes will be felt on both sides and will certainly affect ROI but is the bare minimum. For example, the service costs are not as high as 30 PKR and in some cases, they should not be paid by you but by the developer or tenant. In addition, after one or two years, a 10 to 20% increase in rentals will cover any debts without putting a big dent in your rentals.

Second, if the purpose of the question is to compare plots or files with wolf holdings, then similar duties apply to commercial plots as below:

a. Instead of annual service costs you pay a non-construction penalty on parcels and even sometimes development costs.

b. Property tax will be paid even if you also own land, so it is not only applicable to the wolf property.

c. You will pay capital gains instead of income tax because during trading you will sell plots mostly in less than 4 years.

Q-8 (Part 2) If rent is in between it can get my capital back in 11 to 12 years?

Answer- The mistake most investors make when it comes to this calculation is that they do not calculate the profit on rental income. In reality, it will take a maximum of 5 to 6 years for the repayment of capital investment, if you reinvest your rental income at 10% per annum. This could be even faster if you invest with Feeta.pk 1 crore challenge where we can get you up to 20% annual returns.

Take a look at the calculations below, based on a conservative analysis of the apartment in question. During the construction process, we expect 80% growth, then 12% for three years, and 10% later for capital gains. Similarly, the reinvestment of capital is only calculated at a conservative 10% per annum instead of 20%. You can clearly see that it will only take 6 years for the return of your capital after ownership.

Even if we calculate capital gains at 5% after the 3rd year, the value of your asset will still be close to Rs 4 crore. However, it can be said that the rent capital should grow by 15 to 20% rather than 10%, so realistic performance can vary and the calculations below are just to understand the concept of rental investment and the compounding effect.

Q-9 (Part 3) During this period If I want to sell my apartment to invest in some other area. I will be stuck in the apartment.

Liquidating Assets (housing) will be more difficult. You may be blocked for a longer period than plot Winding. Because Average Liquid Asset (plot/house) lasts 6-12 months on normal days.

Service Apartments are good for rental purposes. But for monetization, we may be stuck for a longer period of time. Because people prefer to book new apartments for a fee not 5-10-year-old apartments at full payment?

Answer- Selling a rented built property will take a little longer than a plot or file. However, rental property continues to give you cash every year, unlike a plot or file, which is in fact a liability because you will pay the non-construction penalty and other company charges as well as development costs in case of any plots and files.

So it all depends on how you define liquidity. a property that will sell out quickly or a property that will repay you 10% in cash each year and repay 100% capital in 5 to 6 years.

Ultimately, like any other property, how quickly your apartment will sell depends on the quality of the project rather than the value class. Not all projects will be the same and sales will vary depending on your choice today. Monotation is also much better in relation to wolf ownership because you will have full capital in 6 years which can be invested again in other places.

For more information on the real estate sector of the country, keep reading Feeta Blog.

FAQ on Rental properties in Pakistan / Passive income in real estate

5 Tips To Increase Rental Property And Maximize Income

The appearance and functionality of your rental property have a direct correlation to the rental income it can produce. By investing in the right improvements, you can charge your tenants more. This can result in higher rental income in the long run.

However, there is a fine line between improvements that allow you to increase rental income and those that are unnecessary or superfluous. You need to determine who is who so that you don’t end up paying for expensive renovations that do nothing to your rental property.

Here are five simple but effective improvements that can increase your property value and, eventually, enable you to earn more rental income:

1. Improve The Exterior Of Your Property

The exterior of your property is very visible, and how it looks can create an impression. You find it difficult to attract tenants and encourage them to live on your property if your exterior looks poorly maintained.

One of the easiest ways to enhance the value of your rental property is to take care of your exterior. As a landlord, you should put in the time and effort to make sure your exterior is in pristine condition. You can achieve this goal by:

Pressure to wash your exteriors:

Hire professionals to take advantage of their press wash services to remove dirt, dust and other debris from your exterior. Pressure washing also removes mold, keeping your rental farm cleaner and healthier.

Painting your front door:

The front door attracts the attention of tenants and sets their expectations on what they can see inside the property. Increase their excitement by painting your front door in bold color. If your exterior is painted in nude shades, go for light shades of red, blue, yellow or orange for your door.

Pay attention to the landscape:

Check the general condition of your landscape and remove weeds and dead branches. If your outdoor space allows, you can plant more flowers and invest in a water feature, such as a pond or fountain.

2. Refresh The Bathroom

How the bathroom looks and works can significantly affect a person’s mood throughout the day. Can you start the day in a positive mood if the bathroom looks dirty? How can you enjoy your bath or shower if the bathroom lacks essential amenities? Tenants will probably feel the same way, so make sure to upgrade your bathroom.

You don’t need to break the bank just to improve your bathroom. Here are some cheap bathroom renovation ideas that will definitely make the space look and feel new:

- Mess up to make the space look bigger and feel cleaner.

- Experiment with bathroom wallpaper.

- Invest in stylish storage, such as an open shelf and the use of wicker baskets.

- Swap expensive floors for affordable materials.

- Raise old bathrooms by adding new paint or upgrading hardware.

3. Work On The Kitchen

Many tenants will choose to pay more, provided they get the most functional and attractive kitchen. In addition to cooking and preparing meals, tenants were more enthusiastic about the kitchen, as here they would entertain guests and even hold parties.

Contrary to popular belief, you don’t need to spend thousands for a successful kitchen renovation. Like the bathroom, there are inexpensive kitchen improvements that can change the overall look of the space, such as:

- Adding artwork to the walls to create focus

- Adding more seating furniture

- Change the lighting fixtures

- Changing your cabinet doors and hardware

- Instead of replacing kitchen floors, paint them with a neutral shade

4. Add New Living Spaces

The more housing your rent has, the higher the rent you can pay your tenants. This will allow you to earn more income in a shorter period of time.

Evaluate the layout of your property and see if it can still support another place to live. For example, if your wolf property has a separate dining room, consider converting it into another bedroom, or if it’s a large room, split it into two bedrooms.

5. Offer an Outdoor Recreation Space

Gone were the days when tenants only entertained guests inside the home. Today, more and more people would choose to hold meetings in outdoor spaces as these offer a change of scenery and a fresher atmosphere.

Another way to increase the value of your rental property is to offer an outdoor recreation space to your tenants. Depending on the space available, you can add a deck, beauty or some outdoor furniture and BBQ. All of these updates are sure to attract tenants and make your rental property more valuable.

Upgrade Your Rental From Today

The housing market worldwide is full of thousands of wolf holdings. Fortunately, there are many ways for yours to stand out, namely by following the tips presented in this article. These tips are enough to make sure your rental property meets modern standards and attracts as many tenants as possible.

Also, if you want to read more informative content about construction and real estate, keep following Feeta Blog, the best property blog in Pakistan.

5 Tips To Increase Rental Property And Maximize Income

Selling Property with Occupying Residents

Selling a property can sometimes be a difficult task. If you have tenants who still live inside while you are trying to sell and give tours of the property, things can get even more difficult. An excellent level of diplomacy and care is required as you want to give a solid first impression of the property to potential buyers, but also the current tenants still need to live in the space and have access to their belongings. You will need to make sure that your tenants are taken care of and protected throughout the process. The following will explore some of the critical steps you can take to make it easier for everyone to sell real estate with tenants inside – you, the tenants, and potential buyers.

Understand The Rules

You have an absolute right to sell a property you own, even if tenants still live within it. The key factor in this process, however, is that certain ongoing rental agreements must be honored by the new buyer. This means that if your tenants have seven months of lease remaining when the property is transferred, the new owner must allow the tenant to stay for those seven months, paying what they previously agreed to pay. If there is no lease agreement, the tenants will have to agree to leave if the new owner wants them. If they refuse, the new owner will have to go through a traditional eviction process, and the tenants will be legally regarded as occupants.

Communication Is Key

Like relationships and other projects, communication is the core foundation on which this whole process will rest. You need to be completely upfront with your tenants about considering selling and what the process will mean for them. It is a good idea to explain the legal obligations of the next landlord to honor their current rental agreement. Explain what they can realistically expect when ownership changes hands and when their licensing agreement ends. Explain that there is a chance that the new owner will want to make changes or renovate the property and earn more in the future. The more honest you are, and the sooner you share this information, the better your chance that your tenants feel they have the time and information they need to navigate the new situation. If you have established faith, there are many more chances that your tenants will help when it comes to shows. Moreover, you want to be completely transparent about when shows will take place and warn people as much as possible. Everyone has bad weeks where they need a day to order before guests come.

Notice

If you have tenants who do not have a written lease (i.e., they pay rent monthly), you are legally required to give them at least one month’s notice of the sale so that they have time to relocate if the new owner demands it. As explained in this article at HBRColorado.com, if the tenants have been living there for more than twelve months, you must legally give them two months’ notice. As you probably know from your profession, one or two months is not always enough to comfortably find a new life situation. If possible, give your tenants more time than this. A high-level notice will also give them time to work out the emotions of leaving their home when they weren’t expecting and better increase the chances of a smooth transition for everyone without any problems.

Address Problem Tenants

If a tenant is very dissatisfied with your decision to consider a sale and threatens damage to the property or some other annoying reaction, you always have the option to convince them to leave when the property changes ownership. Legally prosecuting an eviction can be incredibly expensive and time consuming. Many landlords find it much easier to offer tenants money to relocate. Many people in this world would happily take a few hundred dollars and relocate without any problems. This is often the fastest and least frustrating way to change a rental, as some experienced landlords will tell you.

Planning Views

As stated above, if you have a good relationship with your tenants, viewing should be relatively easy to set up. Respect tenants’ schedules and requests. If they say you have to be out by 4:00 because they have to prepare the kids for football practice, do your best to be out by 4:00. Legally, a tenant must be informed of a visitor at least 24 hours in advance.

It is important to note that if a tenant has a written lease, it is in accordance with their legal rights to refuse to view. You may need to agree with your tenants to change their minds, including possibly paying for their time while the visitor is in their unit.

Selling With Tenants Can Lower The Sale Price

Considering the legal standards for when rent is allowed to increase and how much, it is possible to sell your property with tenants still tied up could result in a lower sale price. A potential buyer knows that they will not be able to increase the cost of renting until the tenants ’lease ends. Moreover, a potential buyer might feel that a tenant is happy or not about the change of ownership and may want to avoid the property if he or she feels that the tenants could be causing problems.

Work With a Real Estate Agent

If you own some real estate, you might be quite comfortable with the process of buying and selling real estate and tempted to sell on your own. Selling with tenants who have rentals that will need to be confirmed, a real estate agent could be a big help. An agent will know which buyers are looking for rentals for an existing easy cash flow (meaning people who are willing to have a rental unit not vacant) versus which buyers are looking to renovate and raise prices. With this information, a real estate agent can bring you the right potential buyers who will be willing to work with the situation in which you find yourself. An agent can also help you accurately assess the property depending on the tenant’s situation.

Clean Things

As with any real estate sale, cleaning things up before viewing and promotional images can be a big help. If you have a lot of tenants, there is often a greater chance that community areas will be less cared for (the tragedy of the commons is a whole economic theory that applies shockingly perfectly to rental properties). Take the time to clean up any trash or other debris like a dog skating in the grass. Give the hallways, washrooms, stairwells and all other places good refreshing cleanliness. Your tenants will probably enjoy this as well.

Do Inspection

It is especially important when you have tenants to do a new inspection when you are thinking of selling. People are usually not as gentle about the properties they rent as those they own, which means that since the last inspection there could be some fountain problems or other problems that could be dealt with before sale. This can save a lot of time due to contingencies later, especially if it turns out that the place is not as great as you previously thought.

Restrictive Appeal Is Essential

If you’re not sure what kind of trim you need to make to the property before selling, a wonderful rule of thumb is to work with the outside. Get lawns trimmed and trimmed. Repair holes in the driveway or parking lot. Give shutters fresh paint. La first impression when you sell a property is the most important impression. This is doubly true for real estate that someone will rent later, as potential buyers will think about the first impression their potential tenants will have when they arrive to view or browse photos online. Some more handy tips include:

- Add some fresh and lively greens.

- Consider painting the front door (many people have a strong emotional reaction to the front door, as this is symbolically their connection to the property).

- Make sure all the exterior lights are working, as you can bet that a potential buyer with some prudence will drive past the venue in the evening to get an idea of what the tenants and properties are like at night.

- Clean the drains.

- Replace rusted letterboxes and identification numbers.

- Power wash the outside if necessary. Over time, side and brick coat with dirt, but often that happens so slowly that you don’t really notice it, so you may not know how badly it needs to be done.

The above tips should help you understand the process of selling a property that has tenants tied to it. Again, maintaining honest communication is essential if you want this process to be smooth.

For more information on the real estate sector of the country, keep reading Feeta Blog.

Selling Property with Occupying Residents

Rental Properties: Complete Maintenance Supervisor

Good care of your rental properties ensures that you can have tenants everywhere as the property will remain attractive and appealing in the real estate market. You can do maintenance to fix some problems or upgrade some aspects of the properties to keep them updated with the current properties.

Booking wolves can be difficult if you are new to the real estate market. For example, the needs of your tenants may change from time to time. Additionally, property maintenance requires that you carefully monitor your property or that an administrator manages the property and informs you of areas to be cared for. If you don’t have an eye anymore to look at your rentals, things might fall apart. When you realize it, the cost of the repair could be already very high.

This article gives you a complete checklist that you can use to make sure your property is well maintained.

Check The Roof

A good roof in the right condition ensures that your tenants are protected from external conditions, such as storms, rain and the hot sun. It will also regulate the internal temperature.

Confirm that all tiles are in place and undamaged. Check if nails come out and if rays of light penetrate the roof. All of these are signs of roof damage and you need immediate action. Get a professional to perform your roof repair or contact the company that helps you preserve your property.

Inspect the Cellar

It is good to check the cellar once or more a year. Check if molds and pests intrude on your property. Often this area is forgotten. Leaving it unattended can make your basement ugly and can cause your tenants to start disliking your property.

Do Deep Cleaning

Deep cleaning of your rental property is important at least once a year. This keeps the property in good condition and prevents any dirt from accumulating on the property. Deep cleaning also causes reduced rent from tenants, which is your goal as a landlord.

Try Every Emergency Alarm

Installed carbon monoxide and smoke detectors are key to saving the lives of your tenants. The best time to confirm if they work perfectly is in summer and spring. Moreover, most alarms are equipped with a test button and the batteries are designed to operate for ten years. So try every device on your property at once.

Replace batteries that are already ten years old. You can replace them even if they are not yet ten years old. This optimizes the operation of the devices. If you own a multi-family farm, remember to try shared detectors.

Inspect The Outside

Maintenance not only for the interior of your house but also for the exterior. Check for water damage causing leaks. Also, check for blockage of the sewer lines and unblock them. Also, remove leaves from the drains. Consider doing this before and after each rainy season. Blocked drains can cause wastewater to seep into the storage tanks. Therefore any damaged drains need to be repaired or replaced.

Also, make sure the garden is in the right condition. Remove protruding roots that are likely to cause accidents. If there are branches broken and falling on the houses, you must carefully cut them so that they do not damage your property.

Change The Filters

In your checklist, remember to regularly change the dishwasher, AC and hood filters; you are expected to do this every three months. If you have any water filters, you should also replace them as well.

In the long run, doing these steps will save you money. This is because it will keep your devices in good condition for a long time and you will also avoid breaking down, making your tenants happy.

Inspect The Fire Extinguishers

Make sure the fire extinguishers you have on your rental property are good to use to avoid any kind of fire tragedy. Look at the expiration date and inspect for any signs of wear and tear on the package. Check to see if they are also located in places where they can be easily accessed.

Conclusion

Always make sure your tenants have a checklist that they can use to track everything, as your tenants can also help you identify areas that need your attention. Create a quick response mechanism whenever a problem arises to prevent it from getting worse. By following this checklist, you can keep your property in good condition for a long time, ensuring that your tenants are satisfied with your services.

Stay tuned to Feeta Blog to learn more about architecture, Lifestyle and Interior Design.

Rental Properties: Complete Maintenance Supervisor

Rental Laws in Sindh: Comprehensive Guide for Landlords and Tenants

So, if you are renting or planning to rent your property sign a rental agreement in Karachi, Hyderabad or any other part of Sindh, today we will discuss everything you need to know about the rights and duties of both. parties in accordance with provincial laws.

Rentals in Sindh

In Sindh, tenancy laws are under the umbrella of Sindh Leased Places Ordinance 1979. This ordinance defined the regulations on rental agreements to protect both the interests of tenants and landlords in almost all situations to avoid disputes and conflicts.

So let’s find out what our law covers about the official documentation and issues related to rental contracts in Sindh.

Rental agreement between country and tenant

Rental lease agreement form on an office desk.

The rental agreement between landlord and tenant must be made in writing. The agreement must be signed by both parties and it must be attested by an official seal of the relevant authority associated with the jurisdiction where the property is located. You can also get this document certified by a First Class Judge or by any Civil Judge. These are the necessary conditions for the validity of a lease.

By law, the lease agreement must be renewed annually, otherwise, it would be considered invalid in court. The landlord is entitled to review the terms of the lease (within legal limits) and monthly rent after the renewal of the contract.

About the conditions related to Rent

The landlord must charge the rental amount, which has been mutually decided by both parties and clearly mentioned in the agreement. Although there is no specific date as the deadline for rental fees, however, according to general practice, tenants must be paid no later than the 10th of each month in Sindh.

The rental laws in Sindh ensure that the rental prices would be fair for tenants as well as for landlords. The laws protect the rights of both parties. According to the laws in Sindh, the rent of real estate cannot be increased by more than 10% annually. In addition, if the fair rent has been determined, it cannot be increased for a period of three years.

Here are some of the main points on the basis of which a fair lease of any particular property is determined.

- The rough analysis of the monthly rents for similar real estate located in the same or adjacent neighborhood.

- The increase in construction costs, repairs and maintenance costs.

- If there is any new tax after the start of the lease.

- An increase in the value of the leased property on the basis of the government-imposed property taxes.

The owner cannot interrupt amenities and services

The law does not allow the landlord to discontinue any of the services and amenities including but not limited to service connections such as electricity, gas, or water unless this is announced in advance and decided with the tenant. However, the interim service providers may terminate such facilities on the basis of their organizational policy. Other relevant authorities may also terminate these amenities and facilities under any specific circumstance.

Maintenance is important

Repair and maintenance of the leased property is the responsibility of the landlord. However, if the owner is unable to do so for any reason, the tenant is entitled to perform the required maintenance.

In such a case, the landlord must pay the maintenance costs. The tenant may deduct it from rental costs if mutually agreed. However, the tenant pays documented proof of expenses incurred for the repayment.

Expulsion Laws in Sindh

Upon successful completion of the lease agreement, the landlord has the right to evict the tenant on the basis of legal eviction conditions. Eviction terms are almost identical across Pakistan. However, Sindh Rented Locises Ordinance 1979 has a number of additional clauses and requirements that must be met to avoid legal complications. The central idea of the additional clauses is listed below:

- The ownership of the leased property was transferred or sold to another person.

- If the tenant causes significant damage to the property, that could impact its property.

- If a major renovation became necessary for the area or reconstruction was forced by the modifications in the building regulations. However, once the reconstruction is complete, the tenant can re-apply for the assets.

- If the owner and their legal heirs want to use the site for their personal use, they are free to vacate the property after consulting the legal authorities.

- If the owner of the rented premises is a widow or orphaned minor or elderly person who is over 60 years of age. And this fact was evident when the property was rented, and the said clause for eviction became invalid.

- Always remember that whatever the cause of eviction, whenever a landlord wants to evict tenants, they must write a request to the relevant authorities in accordance with the law.

Rental Laws in Sindh: Comprehensive Guide for Landlords and Tenants

Private Property Financing Options: Lender’s Guide

Most real estate borrowers run to traditional lending institutions to finance the properties they are looking to buy and sell. Banks, government support housing, and insurance companies are usually the preferred companies for real estate.

However stringent requirements and the long waiting period have become the main obstacles for most borrowers. And, for buyers who are looking to buy a great property, time is of the essence. Alternative financial arrangements aim to stifle these challenges. With fewer rings to skip, real estate investor-borrowers are more than willing to take advantage of unconventional lending options.

If you are an inexperienced real estate investor, I need to get acquainted with other loans, especially if you have outstanding loans from traditional financial companies. Read on to know more about private financing and hard money lending, as well as the pros and cons for investor lender and investor borrower. You read that right. In private financing, the lenders and borrowers can both be considered as investors.

What is private real estate financing?

It takes a lot of money to invest in real estate. As an investor, you can turn to either conventional or alternative lending methods as it suits you best. Private financing is one of the ways you can secure an investment. Often, private financing depends on the relationship between the lender and borrower. Most often, however, private financing for real estate can be in the form of private equity funds.

The main drawback of private financing is its flexibility. It can be used to finance a variety of real estate; from buying rental property to investing in a home, or as additional financing for new real estate construction. Private lenders also usually require fewer documents and a more lenient control and approval process.

What is hard money lending?

As a type of private real estate financing, hard money lending is an alternative financing plan that allows borrowers to use property as a loan guarantee. This means that the property used as collateral can dictate how much the lender can borrow, rather than alternative lenders relying on the borrower’s credit history and other circumstances.

Which leads you to the question; do you get a difficult loan? The truth is that it may not be suitable for anyone. Hard money lending works best for investor borrowers who do not have impressive credit but own valuable property. Placing property as collateral allows a borrower to access loans typically limited to those with impressive credit ratings.

Similarly, a property owner at risk of having property foreclosed may also use this unconventional real estate financial plan.

As with other private financial methods, hard money lending allows investors to participate in the real estate industry even without going through the lengthy processes of buying homes, or keeping and maintaining a property to be included in their investment portfolio.

A private lender must set criteria for qualified borrowers, and like traditional lenders, you may also be turned down for a loan.

What are the benefits and risks of private real estate financing?

Using private money to lend to a real estate borrower comes with its risks and benefits. Below is a list of a few points:

Advantages for the private loan investor

It’s a great way to earn a passive income. You don’t have to go through all the hassle of finding, buying or managing rental properties and other types of real estate. You just need to raise money to lend to the borrower and collect regular payments.

Due to the more lenient approval process, high-risk borrowers are allowed access to additional financing. This means that higher interest rates are imposed on private cash loans compared to traditional lenders. Investors can also enjoy higher returns.

- Who can become a private financial lender?

Being a private financial lender is ideal for the following categories of people:

- A real estate investor who wants to expand their portfolio

- A professional who has a high income career

- An individual who has considerable money reserves

- Emeritus seeking passive income

Generally speaking, anyone who is able to raise good money can lend their private money to borrowers. If you want to become an investor, have someone you can trust, such as a family member, as your first borrower.

However, it is not without its drawbacks. For example, the borrower you have chosen to finance may not be as financially savvy as initially thought. And as a result, you may lose instead of making money.

Additionally, the time and effort you have left to find and maintain real estate should be dedicated to research on real estate investors, and other important factors on the loan process.

Benefits for the private lender

As mentioned, private lenders generally have more lenient examination and approval processes, allowing borrowers to have better access to real estate financing. And, while alternative private financiers have their own criteria for ideal borrowers, they are nevertheless less stringent than others.

- What type of borrowers can take advantage of private financing?

Additionally, a real estate borrower who is planning or in the middle of the following projects looks more attractive to private lenders:

- House fins: If you are a borrower-investor who buys cheap houses and repairs it to resell at a higher price, you will find that private lenders save lives. Conventional lenders usually do not consider outdated properties and require too much time before they can release the money.

- Rental investment investors: Investors who need additional financing to rehabilitate rental property can also access private money. Look for a lender who wants to have a steady stream of passive income.

- Developers: These types of investors-borrowers are looking for useless land where they can build residential or commercial real estate. Because time is money in construction, these types of borrowers may not be willing to waste the lost time and opportunity waiting for monetary release. A private financier is a very tempting proposition.

Risks for the borrower

Businessman halting the domino effect inserting his hand between falling and upright wooden blocks

The only foreseeable risk to taking advantage of private financing is that you may not be able to pay due to the high interest rates. However, if you need money quickly and for emergency purposes, such as when you face foreclosure, it won’t matter much.

Do you have private funding?

Miniature model house standing on a heap of dollar bills. Photo with clipping path.Some similar pictures from my portfolio:

Private financing is an alternative way to access finance for your real estate. The smoother and overall faster processing is tempting, but it can literally cost.

If you have a negligible credit record but need money for planned investment, quickly; consider asking lenders for private money.

For the latest updates, please stay connected to Feeta Blog – the top property blog in Pakistan.

Private Property Financing Options: Lender’s Guide

About Gutters: What You Need to Know

Gutters are often the most ignored parts of a rental house. Although they have simple designs, they help protect your property from any major water damage. So, with this important work, it is best to learn more about drains and how this system affects your house.

Basically, drains collect rain from the roof. Whenever it rains, the water rolls down the slope from the roof to the gutters. Like the rainwater pools, it travels through the drainage system from your rental home to your downstream, which carries water from the drains to the base of your property. Typically it is deflected to protect your foundation and basement from flooding and other water damage.

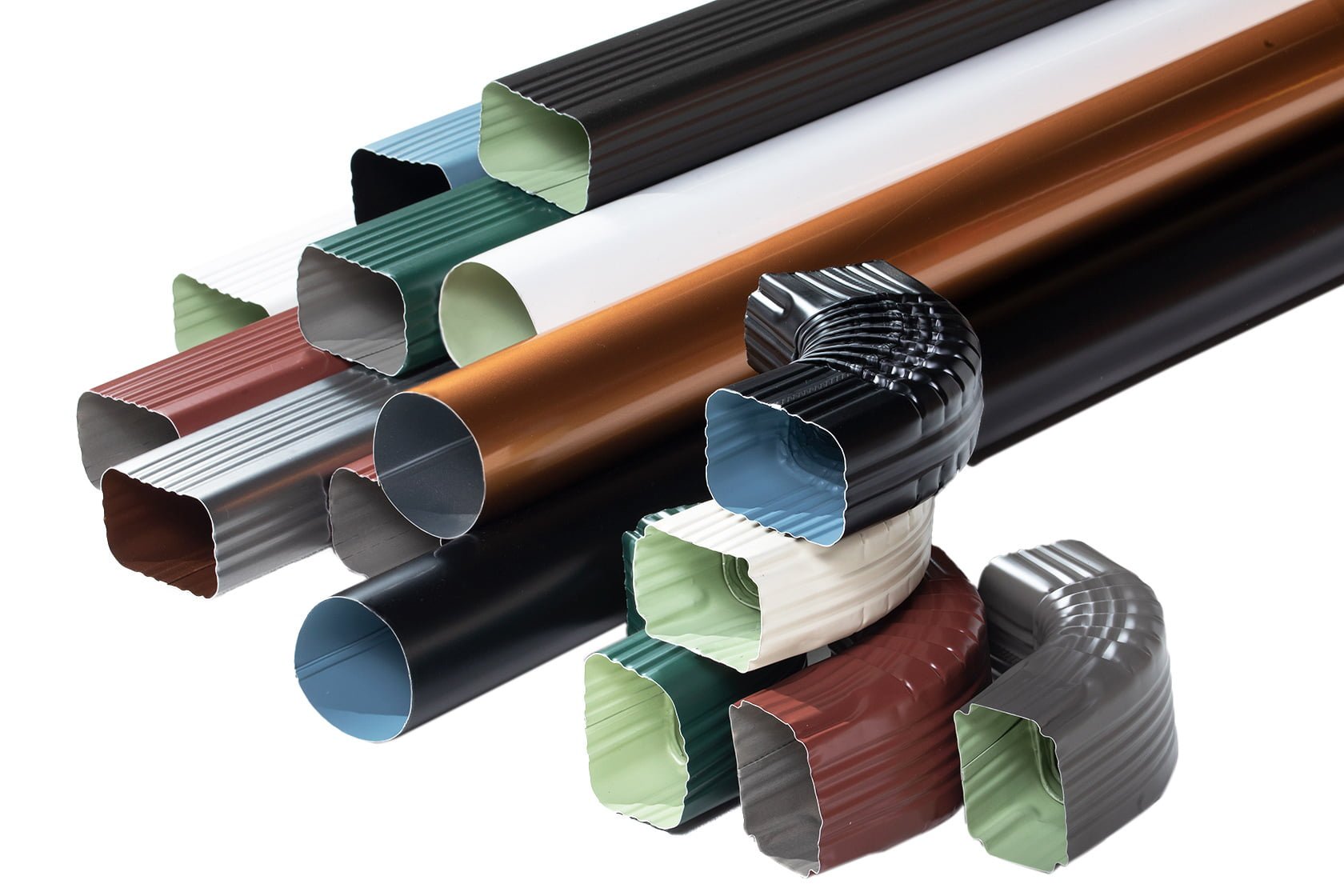

Drains Vary In Materials

Whether you are planning to install a new drain system or replace your current drains, one of the things you need to know is that drains have a variety of materials.

Some of the popular materials of which most drains are made of vinyl, copper, steel and PVC. Cast iron gutter is also a common option nowadays due to its affordability and durability.

To make the best decision on which materials are a good choice for you, you need to explore their pros and cons. This way you can make a well-informed decision about what kind you need to install in your rental property that would best serve your tenants. If you are still confused with the options available, never hesitate to ask for professional help.

Cleaning Your Flute is Important

No matter what your cleaning time is each season, cleaning your playground’s drain system should be one of your priorities. Don’t just rely on your tenants ’schedule or initiative to clean it up. Remember that keeping dirt or debris away from your drains is important to protect the structure of your property and prevent costly nuisances in the future.

There are other reasons why it is necessary to clean drains, especially if you own rentals. These include the following:

Reduce The Risk Of Cracked Foundation:

If you have clogged gutters, the water can build up around the foundation of your home, which can crack your foundation after it freezes and expands during the winter season. As a wolf owner, you don’t want something like this to happen because that would mean significant repair costs.

Save the Plagues:

Clogged street gutters with leaves can be a desirable home for birds, rodents and insects. If you want to keep the pests at bay to prevent them from damaging other areas of your rental, make sure your drains stay clean.

Protect Your Precious Roof:

When rainwater continues to flood, it can leave a leaky or rotten roof. Once your roof has suffered water damage, it may cost you a lot to repair it. So, if you don’t want to spend more for roof repair because your tenants have failed to take care of your drains regularly, be sure to include them in your cleaning routine.

Prevent Water Damage:

Once your showers and drains are blocked with debris and leaves, rainwater may not be properly suited. As the water overflows from the drains, it can result in water damage both outside and inside of your rental property.

Save Money:

Rain and runoff can help prevent costly and unexpected roof or runoff repair services. Taking some preventative measures can help reduce the likelihood of having to replace or repair your roof.

Protect the value of your rental property:

Drains are one of the parts of your rental home that will enhance the aesthetics of your property as they are easily visible. Poorly maintained drains can fall off, and the overflow can stain fascia boards. Such problems can diminish the integrity of your structure. In addition, clogged drains can decrease the rental price you can charge for your property. They will also cause problems if you intend to sell the house in the future.

Considering that reason, it’s important to clean your drains. Repairing them will improve how the roof looks, improving the potential rental prices of your rental home, overall value and brake appeal.

Should You Hire or Hire Professional Gutter Cleaners?

Because cleaning drains is a simple task and can be a part of anyone’s home care checklist, it is also a good idea to do it on your own, which can let you enjoy savings. However, if you have a busy lifestyle and hectic schedules like most wolf owners or investors, it would be best to hire professional street doctors.

The best thing about hiring experts is that they have the proper equipment and tools to properly clean your drains. They also have the knowledge and expertise to provide proper care and maintenance for drains. So, if you have extra money for your budget, it is worth spending on professional solutions.

Conclusion

Gutters are essential as they protect any house from water damage and rain. Without a good drainage system, rainwater will collect in your roof, which can cause mold, deterioration or rot. It will weaken the shingles, fascia and ceiling. So make sure you choose the best drain system suitable for your rental property. Don’t forget to provide proper care and maintenance to extend its lifespan and better serve current and future tenants.

Watch this space for more information on that. Stay tuned to Feeta Blog for the latest updates about Architrcture, Lifestyle and Interior Design.

About Gutters: What You Need to Know

- Published in #architecture, build, building plan, Construction, gutters, home repairs, International, Real Estate, Real Estate Investments, rental property