I’m sure you’ve often wondered how some people seem to succeed in life with minimal effort. And to some, it seems like a constant struggle. Well, unless you’re lucky enough to be born into a billionaire family, most people spend their lives working hard just to succeed. So why do some people always seem to get rich in life while others spend a lifetime chasing after their wealth ?.

Right now, you’re probably trading time for money. Most people’s jobs involve being paid for their time at work, trading expertise in exchange for a salary. Think about all the time it takes to build a business, the time in the office, the hours to answer calls, strategic meetings, networking, chasing customers. It is exhausting and labor intensive.

Why do the poor stay “poor”

So, we all know what poverty looks like when people can’t cover their basic expenses for life. They have difficult choices just to pay their rent or their bills. They spend their lives chasing money like a rat in a cage. Instead of investing in themselves and trying to improve their situation, they are reluctant to take risks and seize an opportunity because they are worried about the future. But the truth is most people don’t feel equipped to face challenges and so can often vent their frustrations by blaming others – politicians, bad luck, and so on. The poor want wealth, but they don’t know how.

Why the middle class remains “poor”

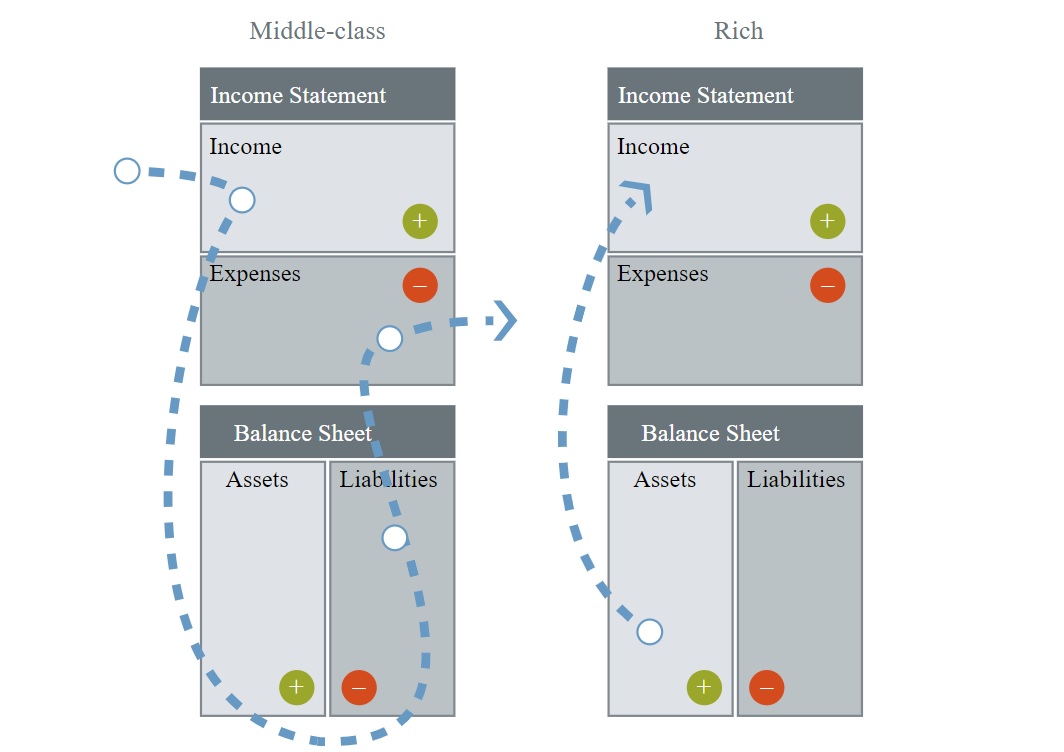

And then there’s the middle class. They have disposable income and savings. They work hard and aspire to be rich. But they often never quite reach that next financial level.

Imagine. You have a monthly income available. So you buy the latest technology, a new car or a vacation to indulge yourself. And that’s where you make a mistake that costs you the opportunity to get rich.

When things lose their value, that’s called depreciation. And that’s what drags you down. The technology will quickly become obsolete. That beautiful watch is worth less than half as soon as you walk out of the store. The car will quickly lose its value. The holiday will be a distant memory. These are not good investment choices. You are caught up in a cycle of working harder and harder just to keep things as they are.

For short-term gain, you lose the opportunity to enter the next financial bracket and become really rich. The car needs repairs. The technology needs to be replaced. You feel pressured to maintain or even outdo your lifestyle. This lifestyle costs you more and more money. When things cost you more in the future, it’s called responsibility.

So how do you get rich?

Rich people make their money work for them, while the poor work to make money. Wealthy people learn to invest wisely in assets that are going to make them appreciate and give them a positive cash flow.

Paul Getty, the world-famous billionaire, famously declared,

“The key to wealth is learning how to make money while you sleep.”

So, what is he talking about? Sounds like a fairy tale. Not at all. It’s a smart way to make money, and it’s called “passive income.”

Passive income is a smart way to make money and free up your time. It is the gain of wolf ownership, limited partnership, shares, stock or other business in which a person is not actively involved.

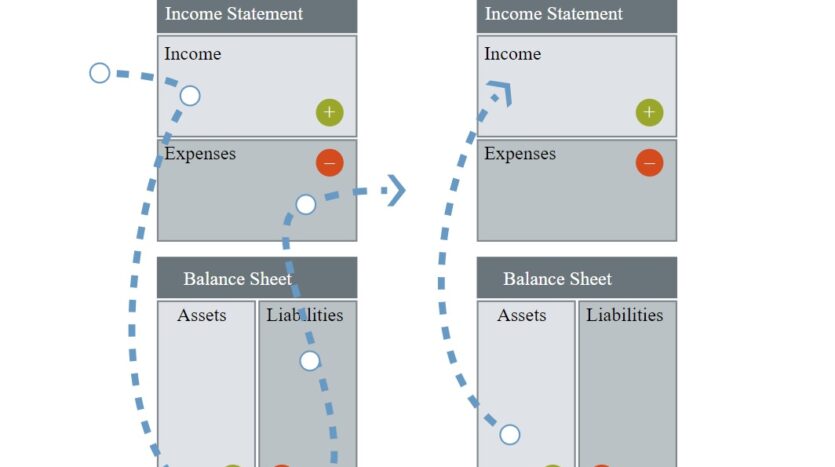

As Robert Kyoski explains in his book “Rich Dad, Poor Dad,” the biggest mistake most middle-class people make is that they continue to gain compensation by believing that these are assets.

La asset it’s something that increases in value and puts money in your pocket every month, giving you a regular cash flow.

Responsibility it’s something that takes the money out of your pocket.

Your house, for example, is not an asset but a liability by Roberts definition the plots and files you have purchased are passive also. You will pay for its maintenance, taxes, development costs, non-construction penalties. Only if you are able to sell it profitably will it become an asset or if they are paid for with your passive money. Until then, although they may increase in value over time and give you capital gains, which is not always the case, you pay for them and that classifies them into liabilities.

Conversely, rental property can be valuable if you do your due diligence correctly and are able to collect more rent than you have monthly costs. The difference between the rent and the expenses is the net operating income, and it is a cash flow that flows into your pockets every month. Therefore, it is a valuable asset.

I can tell you that cash is king. Assets do not pay bills; cash does! Robert K’s definition of an asset is not accurate from an academic point of view, but to define the types of assets to focus attention on, he is correct.

So, really, you can call yourself rich only if your assets pay off your liabilities, expenses and also generate capital for you to get more assets. Now you don’t have to work for money but your money works for you.

That’s why if you continue to collect assets that are passive, you will continue to pay for them until you die and while it seems your net worth is rising, it can’t pay for your monthly expenses or your lifestyle, and the profits are only realized when you sell. it.

The safest investment property

Partnerships can be sour. But real estate tends to rise steadily and can provide two streams of income: rent and capital growth. If the market is stagnant, you can always rent a property and continue to make money “while you sleep”.

And what kind of passive income has the least risk? Lua Farm, of course.

So the safest way is to invest in real estate. As the old saying goes, ‘Nothing is as safe as houses. With some expert help in choosing an investment property, you can double your money. How? Because you can rent the property while it is constantly increasing in value. So you literally make money while you sleep. And even better, you can invest your rental income from your assets and invest after the next investment opportunity.

This is how the rich move up and up. They make easy money rental income, see how their carefully selected property is also valued in value, and then move on to the next project. Such an investment is called ‘passive income ‘– where there is an initial cost but then the income stream does not require you to spend time enslaving it every day. It leaves you free to spend your precious time in an easy life, or look for the next opportunity,

Work Wiser NOT Harder

You can’t help it if you weren’t born with a silver spoon in your mouth. You may have a ‘comfortable’ lifestyle but wonder how you can become really rich. The lesson is that you need to actively take calculated risks. No one will offer it to you on a silver platter. You need to put in some initial time, money and research and then sit back and enjoy the results. Invest in a property that will not only be worthwhile but will also earn you rental income. You can use your assets to continue your next project.

And then you can enjoy what it really means to be rich.

Time is precious | Lua income solution

It’s not about working 50 years of your life during a few years of retirement. Have the constant stress of being tied to your desk, to the phone, juggling investments, and constantly watching the stock market returns.

Time is the only thing we can’t buyback. Passive Income is about saving time. It’s about making smart investments that work for you in the background .; quietly earning income. So you can spend your precious time earning more money if you wish. Or enjoying your life to the fullest for as long as Allah wills.

For more information on the real estate sector of the country, keep reading Feeta Blog.